- Financial markets were calm ahead of US consumer price index data.

- Oil prices rose, but investors remain wary of US inflation data.

- Speculators cut bearish bets on the Canadian dollar.

Heading into Tuesday’s market trip, the USD/CAD outlook turned lower, led by a rally in the Canadian dollar amid rising oil prices. Moreover, investor sentiment was shaped by expectations that the Fed would keep interest rates steady on Wednesday.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

Financial markets were calm ahead of the release of US consumer price index data on Tuesday and the Fed meeting on Wednesday. Both events will shape investor confidence in interest rate cuts next year.

The US Federal Reserve is likely to keep rates unchanged on Wednesday. However, the Fed’s November minutes revealed lingering concerns among policymakers about stubborn inflation. So there is room for additional tightening if needed.

Darren Richardson of the Richardson International Currency Exchange noted, “Economists expect the Fed to hold rates steady and begin cutting interest rates in early to mid-2024. Moreover, lower interest rates tend to encourage risk appetite and weaken the USD.”

Given Canada’s significant role as a producer of commodities, particularly oil, the Canadian dollar is sensitive to changes in risk appetite.

Meanwhile, oil prices rose on Tuesday. However, investors remained cautious ahead of key interest rate decisions and the release of inflation data. Moreover, concerns about excess supply and slowing demand growth continued to limit potential gains.

Elsewhere, data from the U.S. Commodity Futures Trading Commission on Friday showed that speculators trimmed bearish bets on the Canadian dollar.

USD/CAD Key Events Today

- Core US consumer price index m/m

- Consumer Price Index in the USA m/m

- US Consumer Price Index y/y

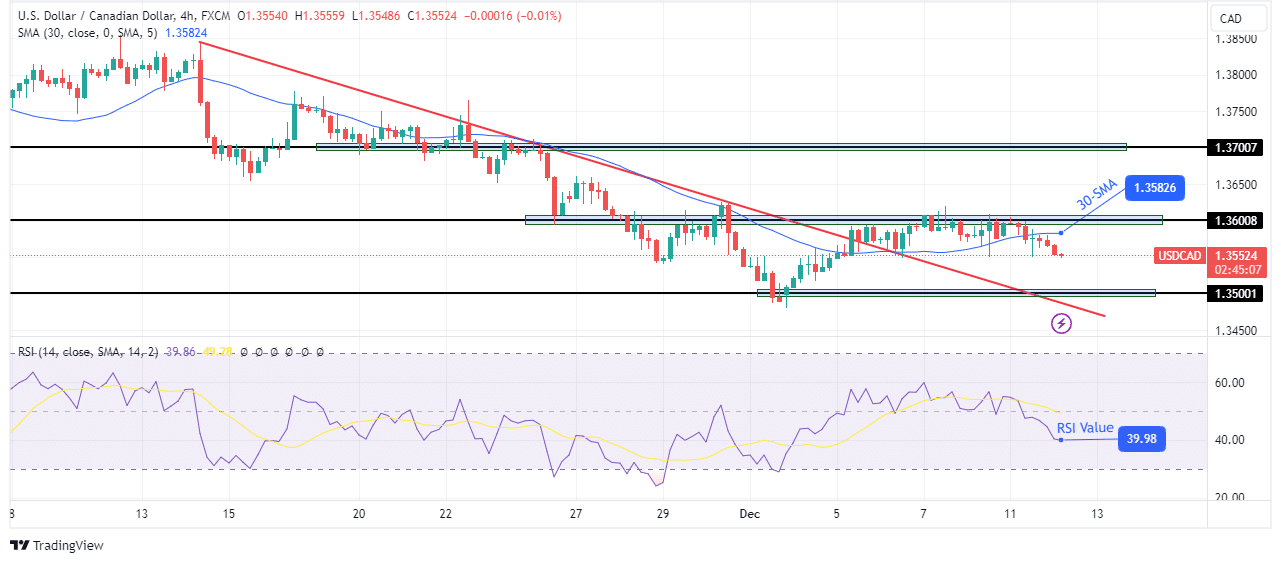

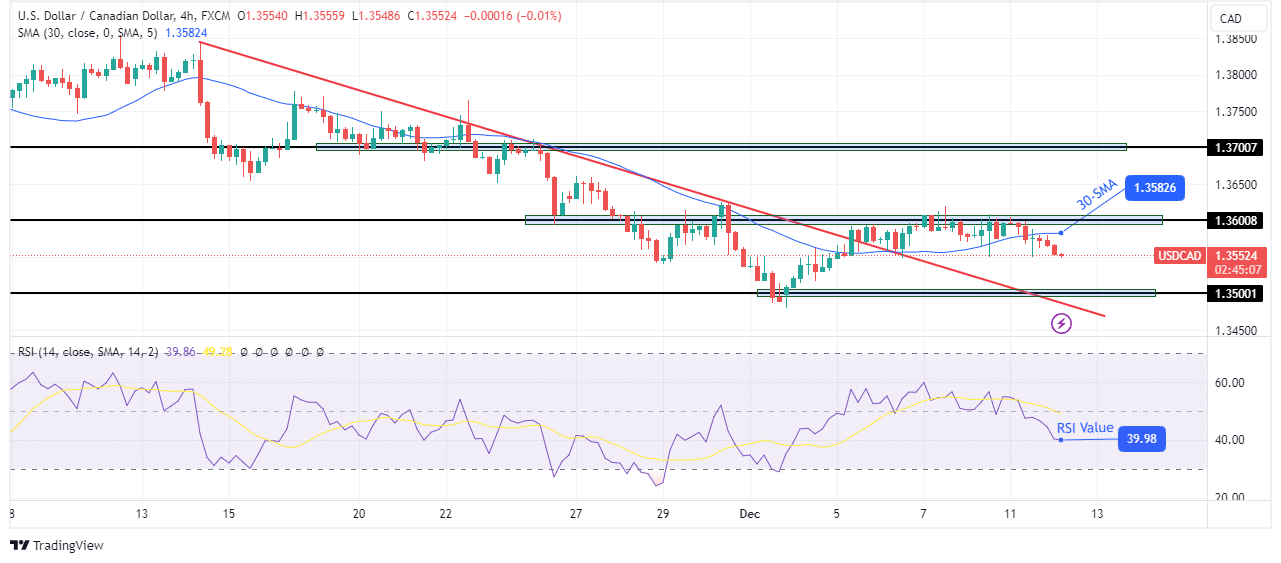

USD/CAD Technical Outlook: Price breaks trendline resistance as bears weaken

The pair is trading above its resistance trend line, a sign that the bears have weakened, allowing the bulls to take the lead. However, despite the break above the trend line, the bulls have yet to find their footing. The bullish move stalled at the key resistance level of 1.3600. The Bulls tried a lot to break above this level, but failed.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

Consequently, the price broke below the 30-SMA and the RSI returned to bearish territory. Price could retest the trend line and make a double bottom before the bulls take over. However, the bearish trend will continue if the price breaks below the 1.3500 support.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.