- Several policymakers cited reasons for not rushing to cut interest rates.

- Oil prices rose on signs that tensions in the Middle East are likely to continue.

- Canada’s economy posted a surprise deficit in January as exports fell and imports rose.

The outlook for USD/CAD was mildly bullish on Thursday as the US dollar strengthened after policymakers continued to discount interest rate cut expectations. Fed policymakers recently said they would prefer to hold off on rate cuts until they are confident that inflation will reach the 2% target.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

On Wednesday, several policymakers gave reasons for not rushing to cut interest rates. Moreover, the resilience of the US economy has shown that there is still a need for high interest rates.

Meanwhile, the Canadian dollar was also steady, holding close to recent highs on rising oil prices. Oil prices rose on signs that tensions in the Middle East are likely to continue. In particular, Israel rejected Hama’s appeal to end the war. The Canadian dollar will continue to strengthen as long as oil prices rise.

Elsewhere, data on Wednesday revealed that Canada’s economy posted a surprise deficit in January as exports fell and imports rose. This was the first monthly deficit since July.

Meanwhile, minutes from the Bank of Canada’s policy meeting released on Wednesday showed policymakers were concerned that inflation remained persistent. Therefore, the bank is likely to refrain from cutting interest rates. Furthermore, the BoC is concerned about shelter inflation. If Canada’s housing market recovers more than expected in 2024, it could keep overall inflation high.

USD/CAD Key Events Today

- First jobless claims in the US.

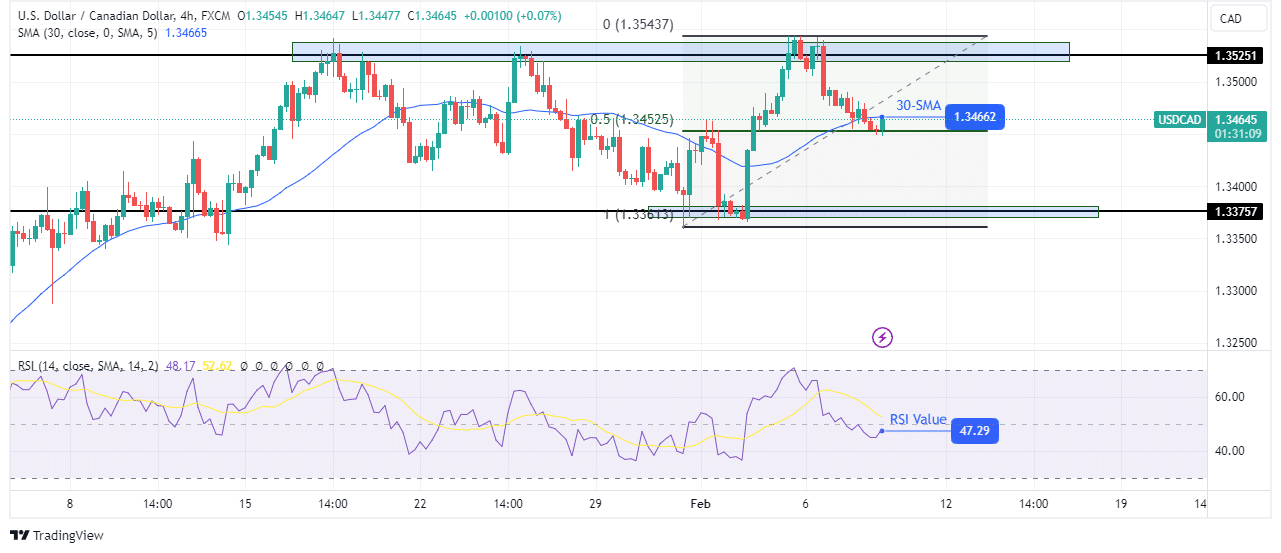

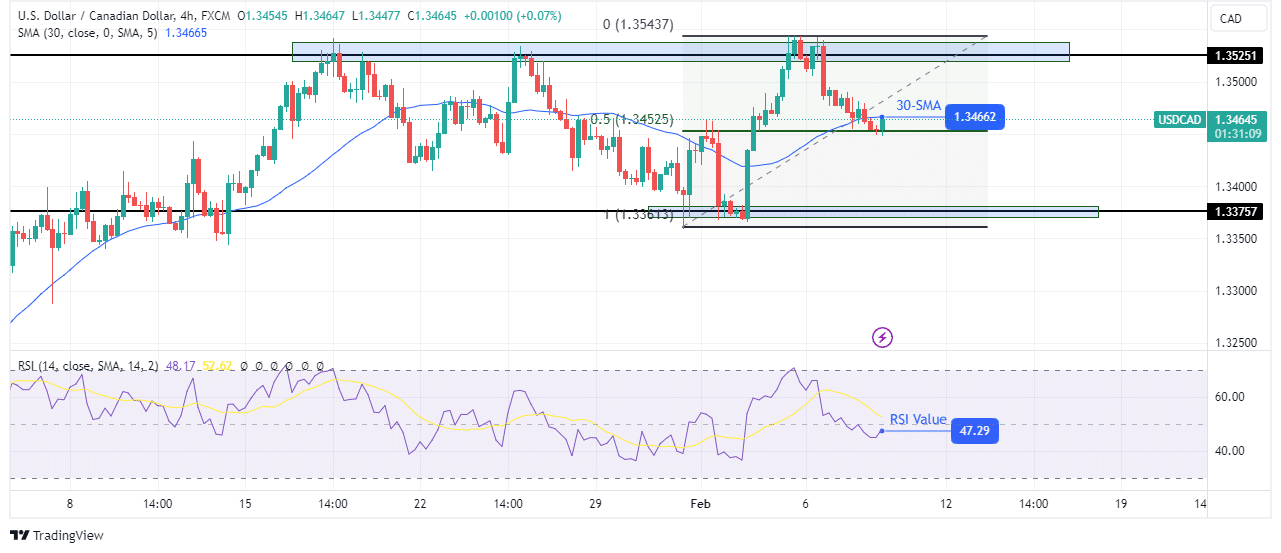

USD/CAD Technical Outlook: Decline takes a breather at 0.5 fib retracement

On the charts, the USD/CAD price has fallen below the 30-SMA, indicating a possible shift in sentiment to bears. At the same time, the RSI is now trading in bearish territory below 50. However, the decline has been halted at the 0.5 Fib retracement level, a key support and resistance level.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

Consequently, bulls have emerged at this level and could push the price back above the SMA. If this happens, the price is likely to rise to retest the 1.3525 resistance level. A break above this level would make a higher high and start a bullish trend. On the other hand, if the price breaks below the fib level, it is likely to continue falling towards the 1.3375 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money