- Oil prices fell on demand concerns after China’s disappointing pledge to improve its weak economy.

- Traders are preparing for the Bank of Canada’s monetary policy decision.

- There is a 64% chance the Fed will cut rates starting in June.

The USD/CAD outlook signals optimism as the Canadian dollar weakens amid falling oil prices. Additionally, investors remained cautious ahead of the Bank of Canada’s monetary policy meeting.

–Are you interested in learning more about CFD brokers? Check out our detailed guide-

Oil prices fell on demand concerns after China’s pledge to improve its weak economy failed to impress investors. China is the largest consumer of oil. So a bad economy hurts demand for oil, causing prices to fall. Meanwhile, falling oil prices hurt the Canadian dollar, as Canada is a net oil exporter.

At the same time, traders are preparing for the Bank of Canada’s monetary policy decision on Wednesday. Markets expect the central bank to keep rates at 5%. However, they will focus on statements made at the meeting regarding future policy decisions. Traders will be especially on the lookout for clues about the timing of a rate cut in Canada. The BoC could start cutting rates in April or June.

Meanwhile, investors are also expecting more insight into the timing of US interest rate cuts when Powell testifies before Congress on Wednesday. There is currently a 64% chance that the Fed will cut rates starting in June. In addition, markets now expect a total rate cut of 75 basis points this year. This is in line with Fed forecasts, which show a significant drop in interest rate cut expectations.

USD/CAD Key Events Today

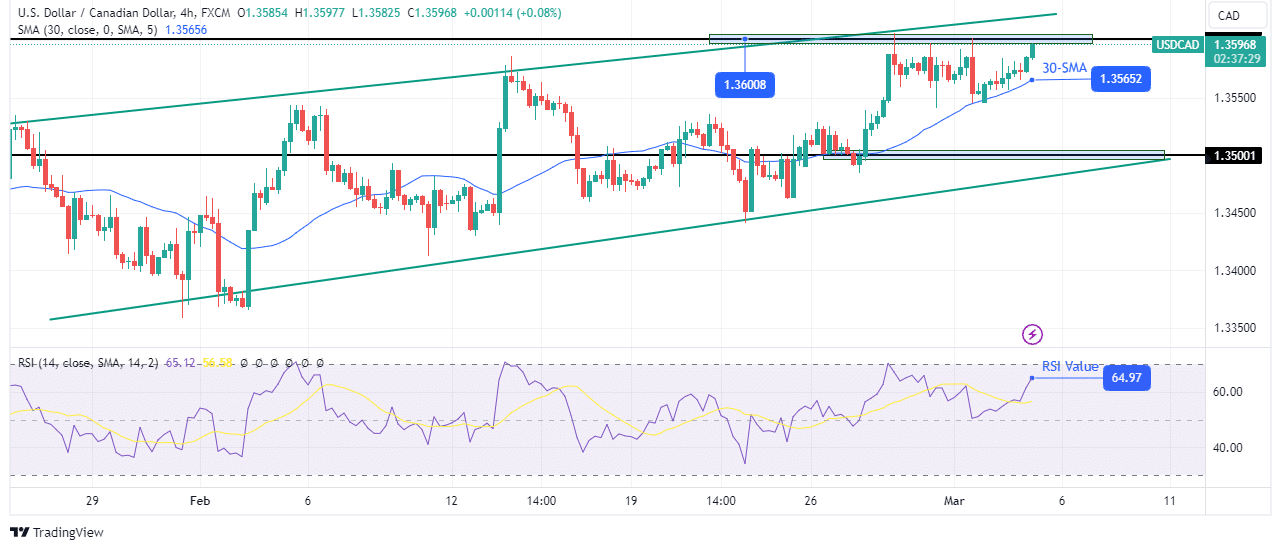

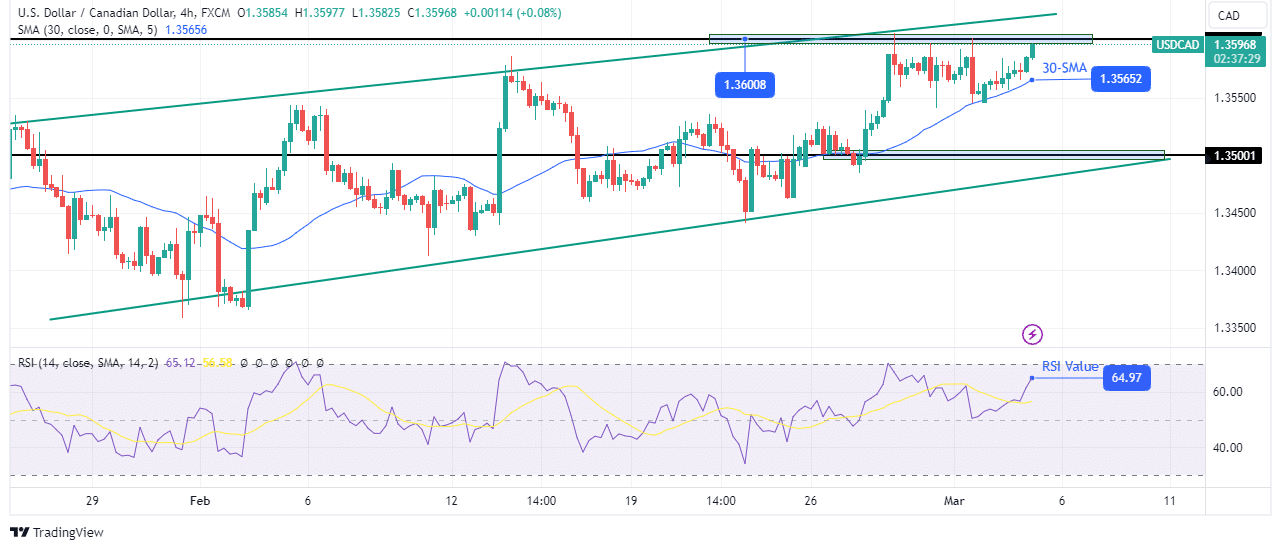

USD/CAD Technical Outlook: Bulls have hit a wall at the key 1.3600 level

On the technical side, USD/CAD is climbing after respecting the 30-SMA support line. The bullish bias is strong, as the price has maintained its position above the SMA and RSI above 50. Furthermore, the price is currently trading in a bullish channel. Because of this, it creates bigger highs and lows on a larger scale.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

At this point, the price is approaching the resistance of the channel. However, the bulls encountered solid resistance at the key 1.3600 level. However, after finding support at the 30-SMA, the price is rising with renewed strength. Therefore, there is a good chance that it will make a new high above 1.3600.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.