- Economic data revealed that Canada’s January Ivey PMI rose to its highest point in 9 months.

- According to Macklem, Canada needs high interest rates longer to bring down inflation.

- Oil prices rose due to recent efforts to reduce tensions in the Middle East.

USD/CAD price analysis reveals a bearish outlook as the Canadian dollar sits high, supported by rising oil prices. Meanwhile, the US dollar is on shaky ground as Treasury yields fall from their recent highs.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

The pair declined from the previous session due to several factors that supported the Canadian dollar. These factors included upbeat data from Canada, rising oil prices and hawkish remarks from Bank of Canada Governor Macklem.

Notably, economic data revealed that Canada’s January Ivey PMI rose to its highest point in 9 months. The increase occurred as economic activity expanded rapidly. Consequently, investors pulled back on bets on a BoC rate cut.

Furthermore, BoC Governor Macklem’s speech on Tuesday showed that the central bank is in no rush to cut interest rates. According to him, Canada needed high interest rates longer to lower inflation. In addition, he noted that the Canadian economy is vulnerable to oil price volatility due to tensions in the Middle East. This could have a significant impact on inflation in the country.

Meanwhile, oil prices rose due to recent efforts to reduce tensions in the Middle East. Investors are watching closely and waiting to see the outcome of diplomatic efforts to end the war in Gaza.

USD/CAD Key Events Today

Investors will continue to monitor developments in the Middle East as there will be no major economic announcements today.

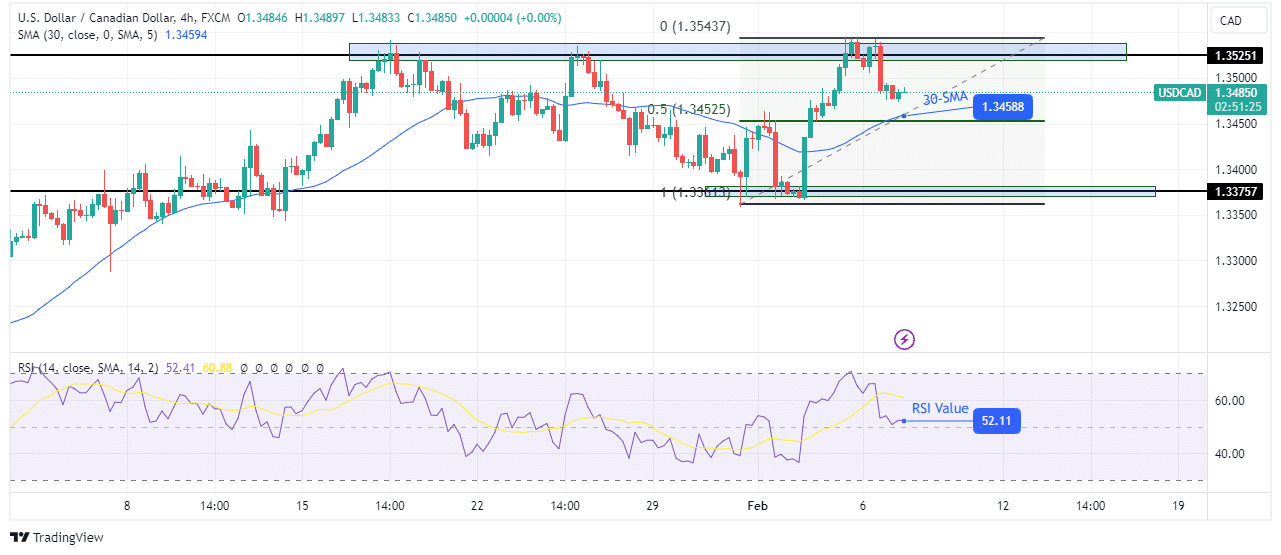

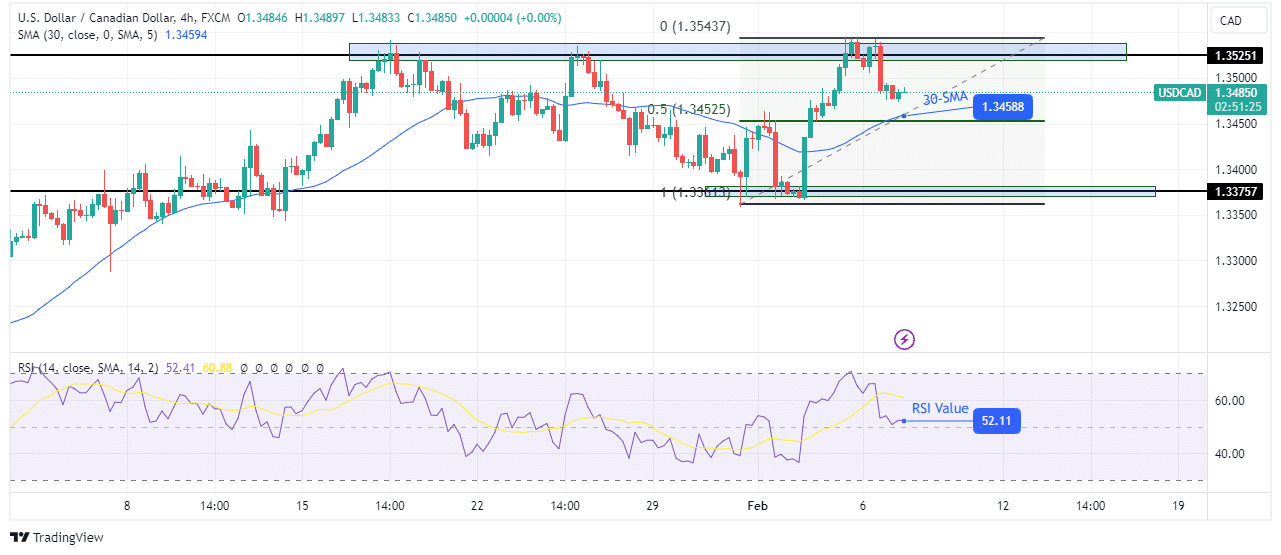

USD/CAD Technical Price Analysis: Pullback from 1.3525 barrier

On the technical side, USD/CAD pulled back sharply after trying to break above the key resistance level at 1.3525. However, the bullish bias remains strong as the pullback is above the 30-SMA. Additionally, the RSI is in bullish territory. Therefore, the decline could stop at the nearest support level.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

Currently, the price is heading towards a solid support zone consisting of the 30-SMA and the 0.5 Fib retracement level. At this point, the bulls are probably waiting to make another high swing. However, there is a chance that resistance at 1.3525 will remain firm. In that case, the price could return to the 1.3375 support.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money