- The dollar rose 1% this month, recovering from a 2% decline in December.

- The Canadian dollar fell to its lowest level in nearly four weeks on Tuesday.

- Data from Canada revealed a narrowing of the trade surplus to C$1.6 billion in November.

USD/CAD price analysis on Wednesday painted a bullish picture as the greenback held its ground in a cautious trading environment ahead of key US inflation data. Anticipating these inflation numbers adds an extra layer of anxiety, as they may affect the direction of Federal Reserve policy.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Notably, the dollar rose 1% this month, recovering from a 2% decline in December, as traders reassess expectations about the timing and extent of Fed rate cuts.

Meanwhile, the Canadian dollar weakened against the US dollar and hit a near four-week low on Tuesday.

Aaron Hurd, senior portfolio manager at State Street Global Advisors, noted that the impact of monetary policy is more apparent in Canada than in the U.S., creating a consistent backdrop that favors a weaker Canadian dollar.

Moreover, the BoC stated that the slowdown in the domestic economy signals the effectiveness of its monetary policy. Accordingly, money markets are anticipating a rate cut in April.

Elsewhere, Statistics Canada reported a narrowing of the trade surplus to C$1.6 billion in November, down from C$3.2 billion in October. The decline in exports, led by precious metals, is the first in five months. In addition, separate data shows the value of Canadian building permits fell 3.9 percent from October to November.

USD/CAD Key Events Today

The pair is likely to consolidate as Canada and the US will not release any significant reports today.

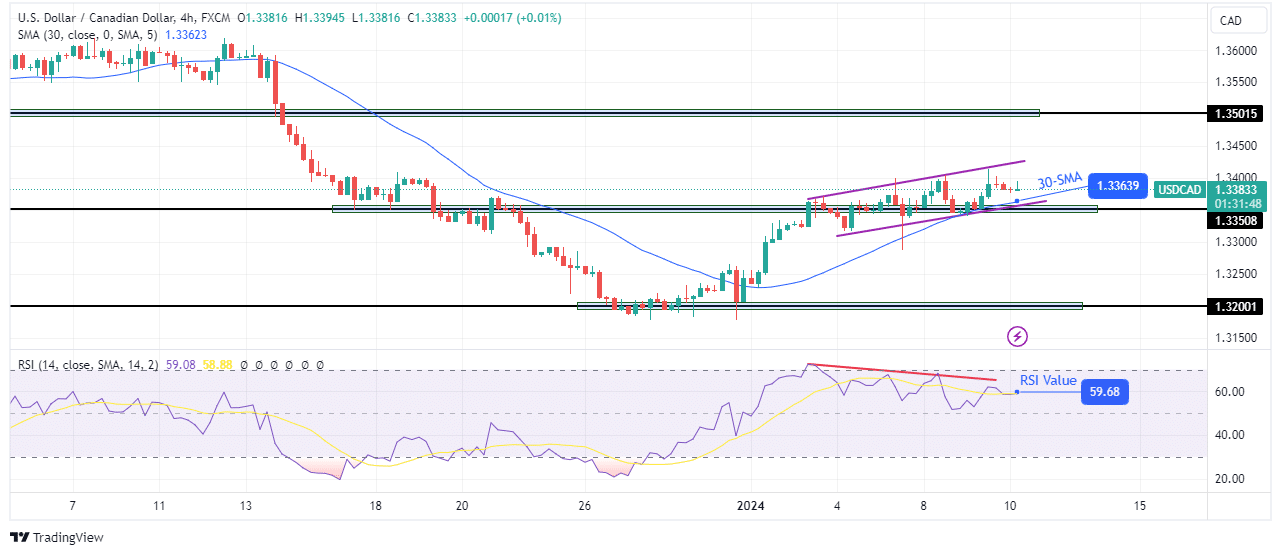

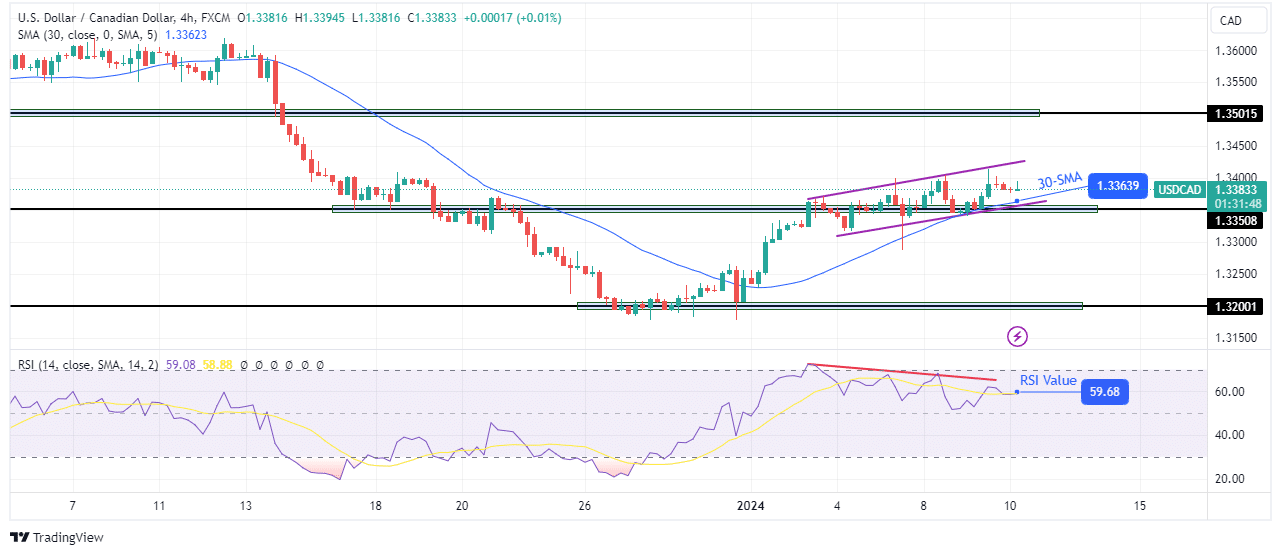

USD/CAD Technical Price Analysis: Bulls are forming a shallow channel near 1.3350

On the technical side, USD/CAD is trading in a shallow, bullish channel, staying close to the key 1.3350 level. Therefore, although the bias is bullish, the momentum is fading. The price is above the 30-SMA, but not swinging far above it, which is a sign that the bulls are weak. Finally, supporting the view that the bullish momentum is fading is the RSI, which has made a bearish divergence.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

Accordingly, there is a good chance that the price will soon break out of the support of the bullish channel and the 30-SMA. Moreover, such a reversal would allow the price to break below the key level of 1.3350 and retest the key support level of 1.3200.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money