- The dollar recovered after US economic data pointed to a strong economy.

- Data on Thursday showed a drop in initial jobless claims from last week.

- Inflation in Canada fell more than expected in February.

Friday’s USD/CAD price analysis points north as the dollar gains on positive US data. Meanwhile, the Canadian dollar is weaker following comments from the BoC deputy governor regarding encouraging February inflation numbers.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

The dollar recovered on Thursday and Friday after US economic data pointed to a strong economy. Accordingly, short-term Treasury yields, which reflect interest rate expectations, rose. Notably, Thursday’s data revealed a drop in initial jobless claims from last week. The drop in claims for unemployment benefits shows that the unemployment rate has fallen, indicating a tight labor market.

Meanwhile, other data revealed a jump in US pre-owned home sales in February. It is a sign that demand has increased in the real estate market, which drives the economy. However, despite this economic resilience, the prospect of a rate cut was maintained after Powell argued that inflation was on a downward trend.

On the other hand, inflation in Canada fell more than expected in February, according to data released on Tuesday. This is a sign that the Bank of Canada is slowly achieving its goal of lowering inflation. As a result, bets on a rate cut rose, weakening the Canadian dollar.

Furthermore, Bank of Canada Deputy Governor Tony Gravel noted the drop in inflation, saying it was encouraging. This indicates a belief that inflation is falling, supporting a dovish stance.

The loonie was also weaker as oil prices fell on the prospect of a ceasefire in the Gaza war. Such an outcome would reduce supply concerns, making oil cheaper.

USD/CAD Key Events Today

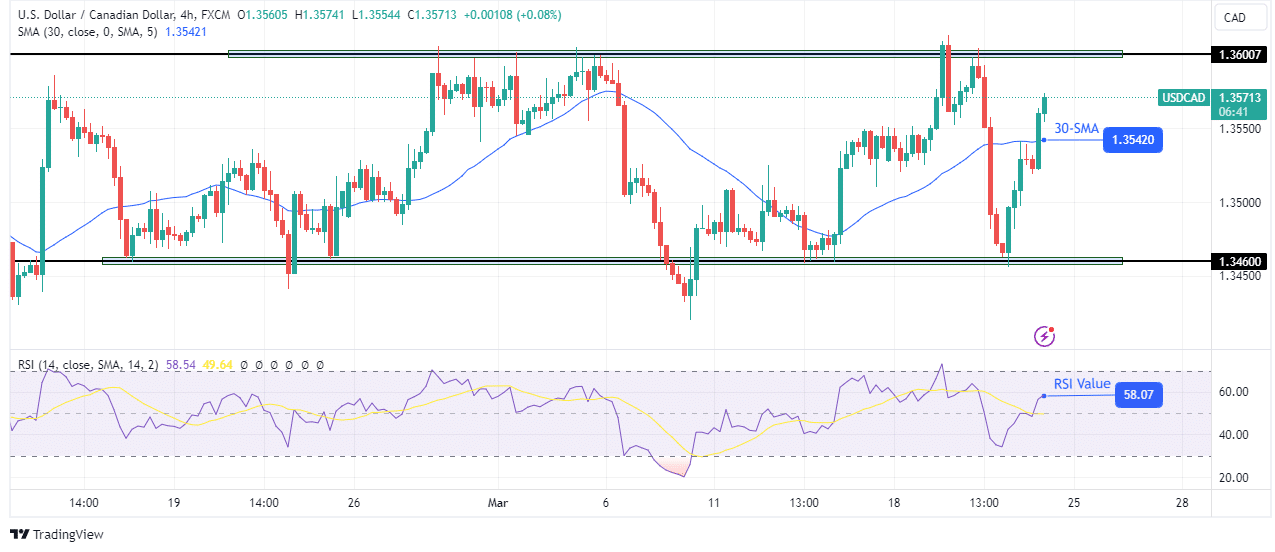

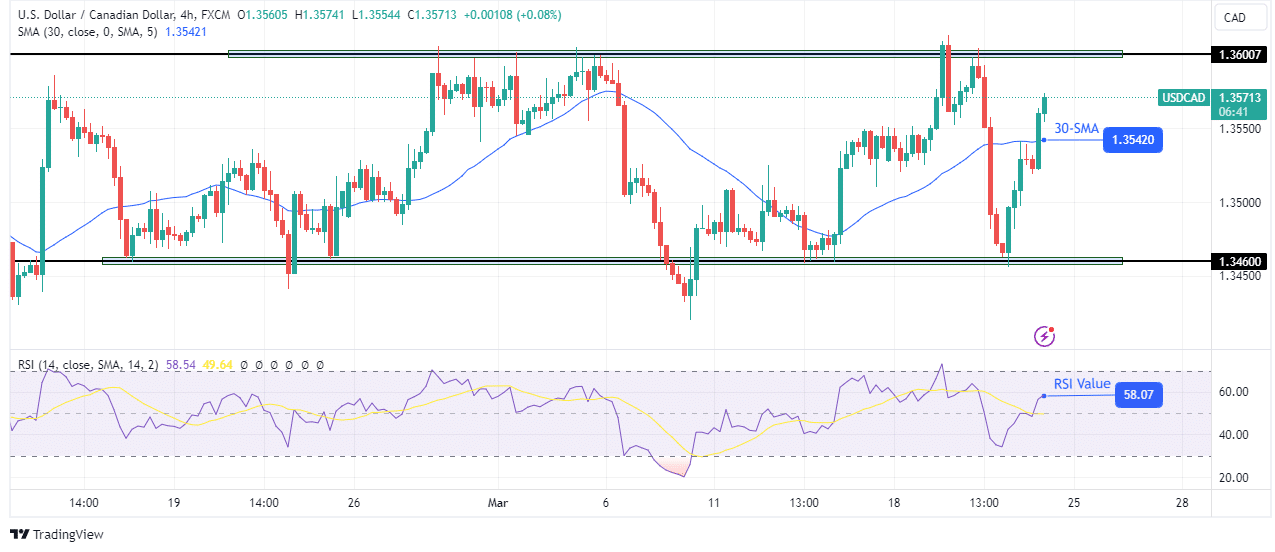

USD/CAD Technical Price Analysis: Struggle between 1.3460 and 1.3600 levels

On the charts, USD/CAD is trapped in a range between the support level at 1.3460 and the resistance level at 1.3600. Accordingly, the price continues to cut through the 30-SMA while the RSI cuts through the key 50 mark.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

However, within the range, the bias is bullish as the price is above the 30-SMA with the RSI above 50. The bullish move came after the price retested the range support and failed to break below. The move is likely to reach range resistance at 1.3600 soon, where it could pause, reverse or break above. A break above would signal the start of a bullish trend.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.