- Data showed that inflation in Canada remained stable in November.

- The probability of a BoC cut next month fell to 16.0% from 21.4%.

- Raphael Bostic reiterated on Tuesday that he expects two Fed rate cuts in the second half of the year.

USD/CAD price analysis revealed bearish sentiment on Wednesday as investors adjusted their expectations, deviating from an expected rate cut by the Bank of Canada in the coming months. This change in expectations came after domestic data revealed that inflation in Canada held steady in November.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Meanwhile, analysts had expected a decline to 2.9%. Therefore, they were surprised because the annual inflation rate in Canada was 3.1%. Moreover, measures of core inflation, CPI-median and CPI-trim, maintained their levels at 3.4% and 3.5%, respectively.

As a result, money markets are now pointing to a reduced 40% chance of BoC easing in March, down from 50% before the data release. At the same time, the probability of a cut next month fell to 16.0% from 21.4%. Despite these adjustments, markets still expect the central bank to begin easing, possibly in April.

Additionally, a 1.3% rise in the price of oil on concerns about supply disruptions contributed to the Canadian dollar’s rise.

Meanwhile, the US dollar held steady on Wednesday as traders weighed the likelihood of the US Federal Reserve starting to cut interest rates. Rafael Bostick, president of the Atlanta Federal Reserve, reiterated Tuesday that he expects two interest rate cuts in the second half of the year. However, he emphasized that there is no “urgency” for such actions at the moment.

USD/CAD Key Events Today

- US CB Consumer Confidence Report

USD/CAD Technical Price Analysis: New Lows Signal Market Exhaustion

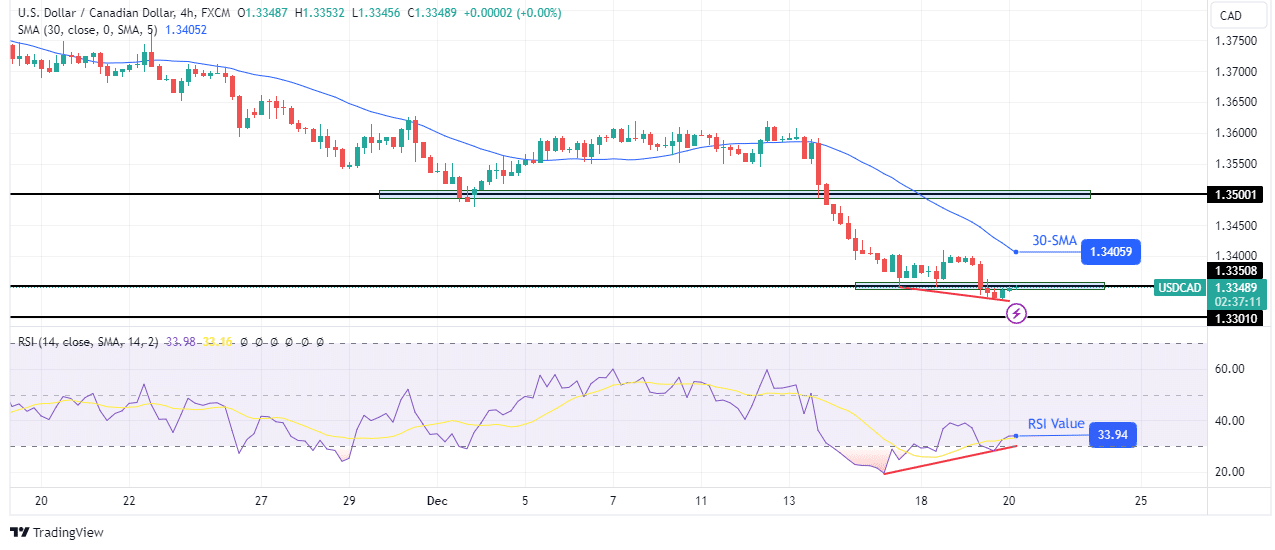

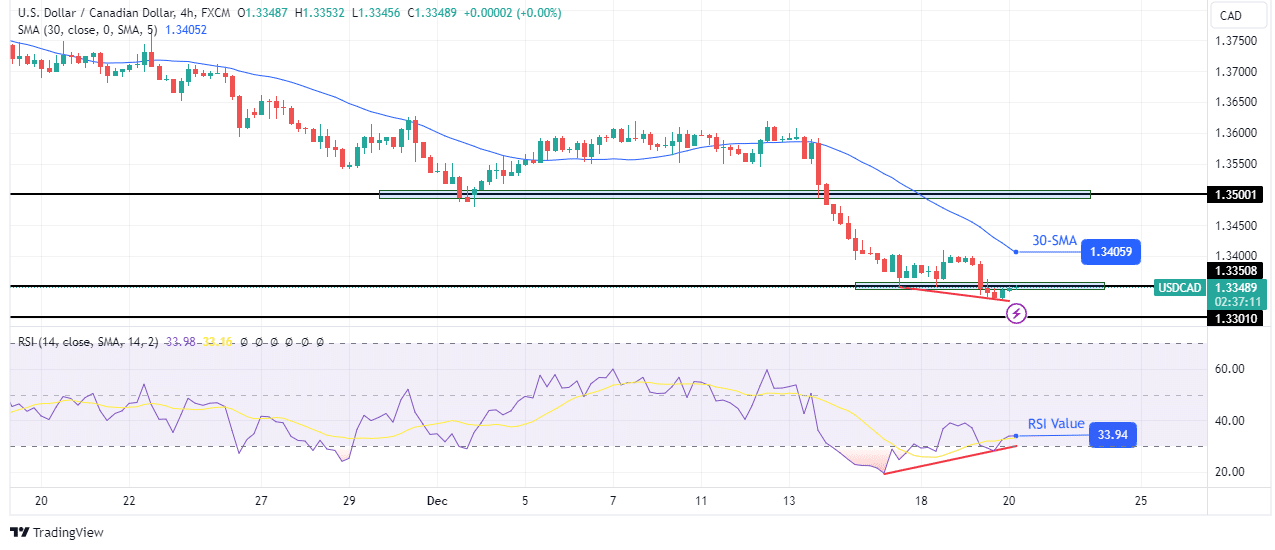

On the charts, USD/CAD made a new low below the 1.3301 level, showing that the downtrend has progressed. The price is well below the 30-SMA, further supporting the bears. However, although the RSI is below 50, showing solid bearish momentum, it has made a bullish divergence. This means that the new low is weaker and the bears are exhausted.

–Are you interested in learning more about forex tools? Check out our detailed guide-

Therefore, the bulls could get an opportunity to follow the recent decline. However, since the pullback could come in the middle of a downtrend, it is likely to stop at the 30-SMA resistance. The trend can only be reversed if the bulls are strong enough to break above the SMA.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.