- Oil prices rose, driven by geopolitical tensions and disruptions in US oil production.

- The US dollar extended its recent gains on positive data on the US labor market.

- Economists forecast a 0.1% decline in sales in Canada.

A bearish tone emerged in the USD/CAD price analysis on Friday, boosted by a rise in oil prices amid geopolitical tensions and production disruptions in the US. The Canadian dollar recovered from a five-week low just a day earlier, riding the wave of a resurgence in oil.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Adam Button, chief currency analyst at ForexLive, noted: “The Canadian dollar needed a boost in the oil market, and finally, oil has seen a rally.

Oil rose after the International Energy Agency forecast strong global oil demand. Furthermore, there was a disruption in US crude oil production caused by cold winter weather. In addition, oil received support from a significant weekly increase in crude oil inventories.

The IEA on Thursday raised its forecast for global oil demand growth in 2024. However, its higher projection still falls short of OPEC’s expectations.

Investors await Friday’s November release of Canadian retail sales data. This is the final major economic report before the Bank of Canada’s interest rate decision next week. Economists are predicting a 0.1% drop in sales. Adam Button noted, “Friday’s retail sales report is likely to highlight the contrast between Canadian and US consumers, weighing on the currency more than anything else.”

Meanwhile, the US dollar remained strong after positive US labor market data dampened expectations of a Fed rate cut.

USD/CAD Key Events Today

- Preliminary US Consumer Sentiment Report

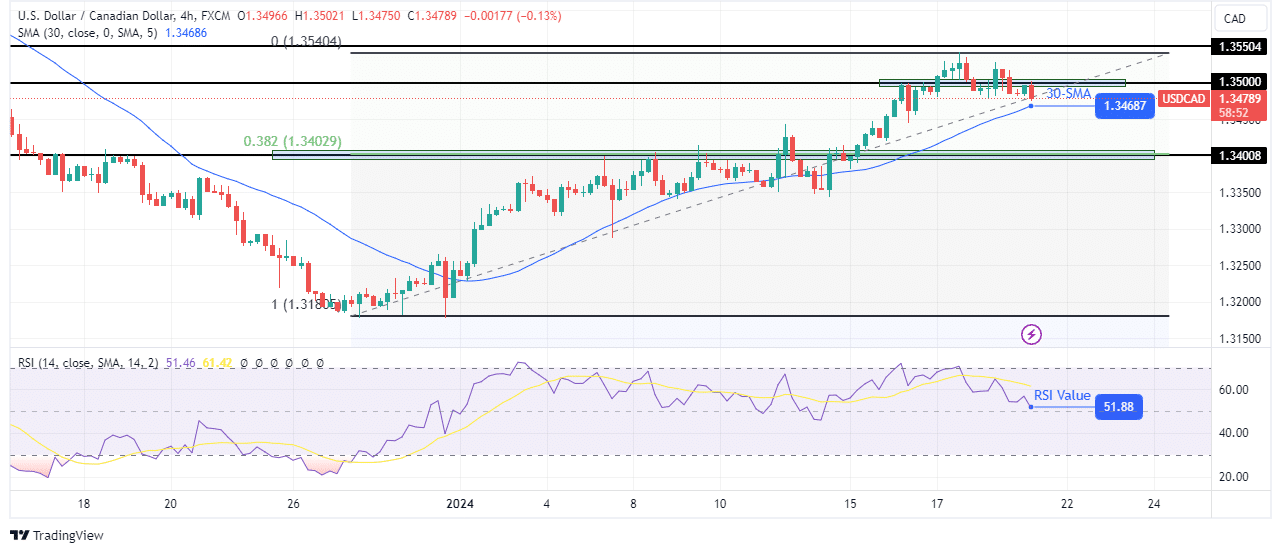

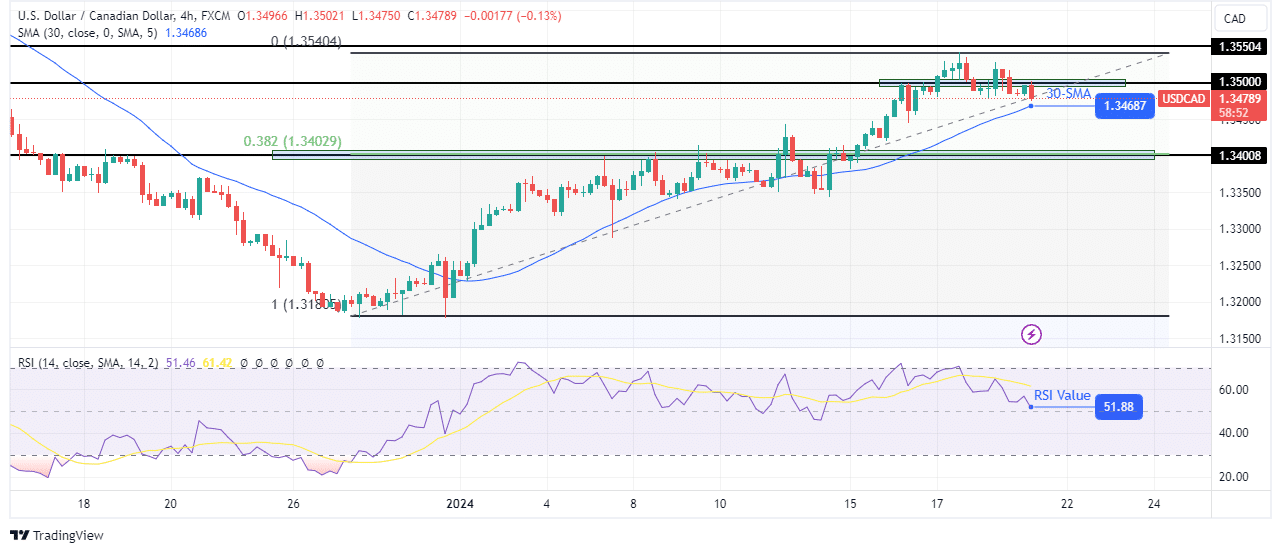

USD/CAD technical price analysis: Price is likely to return to 0.382 fib

On the technical side, the USD/CAD price is pulling back to challenge the 30-SMA support. The price encountered strong resistance at the key level of 1.3500. Initially, this led to the formation of a bearish engulfing candle, indicating that the bears are ready to take over.

Still, the bulls had some strength to push the price above 1.3500, although it was quickly rejected above this level. The bears made another candle that took hold, leading to a decline towards the 30-SMA.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

At the same time, the RSI is rapidly falling to 50, a key level. There is a good chance that the bears will continue the decline and break below the 30-SMA. After that, the price is likely to retest the support zone consisting of the 0.382 fib level and the 1.3400 support.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.