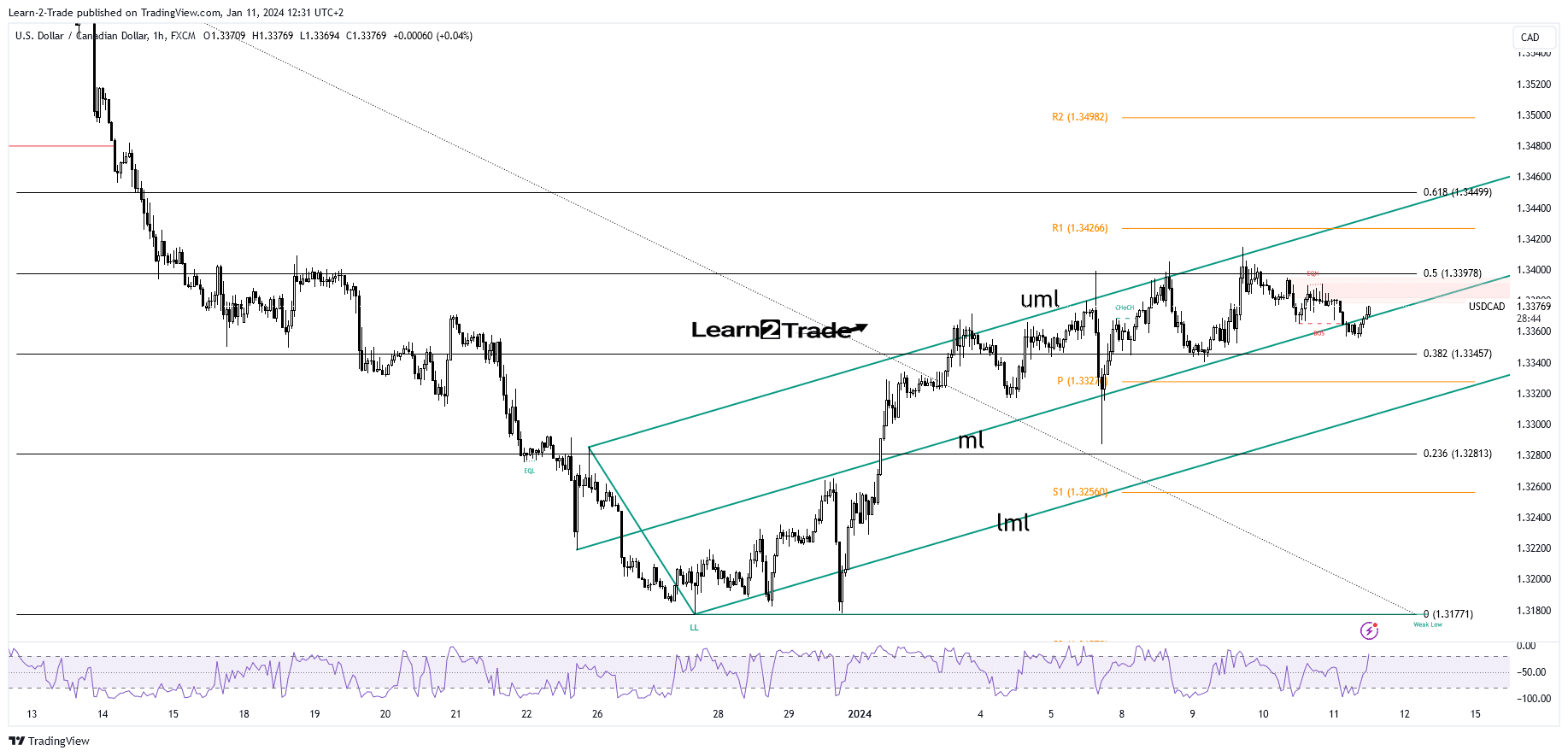

- The bias remains bullish as long as it is above the median line (ml).

- Higher inflation should boost the dollar.

- A new higher high activates further growth.

USD/CAD is trading in the green at 1.3374 at the time of writing. The couple is struggling to stay longer despite temporary setbacks. The US dollar fell slightly in the short term.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Tuesday’s US data was better than expected, while yesterday’s final wholesale inventories were in line with expectations.

Today, US inflation numbers should have a big impact. Volatility should be high, leading to consolidation amid uncertainty. The Fed is expected to cut rates by 75 basis points over the course of the year as inflation eases.

However, the consumer price index m/m is expected to register a growth of 0.2% in December against a growth of 0.1% in November; Annual CPI could come in at 3.2% above 3.1% in the previous reporting period, and Core CPI could post a 0.3% increase for the second month in a row. Higher inflation should force the Federal Reserve to maintain its monetary policy. This scenario could lift the dollar.

In addition, data on unemployment claims will be published. The US will release PPI and core PPI data tomorrow, so volatility could remain high.

Technical Analysis of the USD/CAD Price: Retesting the Midline

The USD/CAD price found strong resistance at the upper middle line of the ascending villa (uml). It also failed to clear the 50% retracement level (1.3397).

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

It now fell below the midline (ml), but failed to stay below it, signaling already exhausted sellers.

The bias remains bullish as long as it is above this dynamic support. The current pullback could represent a flag pattern. This could herald a sequel to the upside. However, only the new higher high activates a larger gain ahead.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money