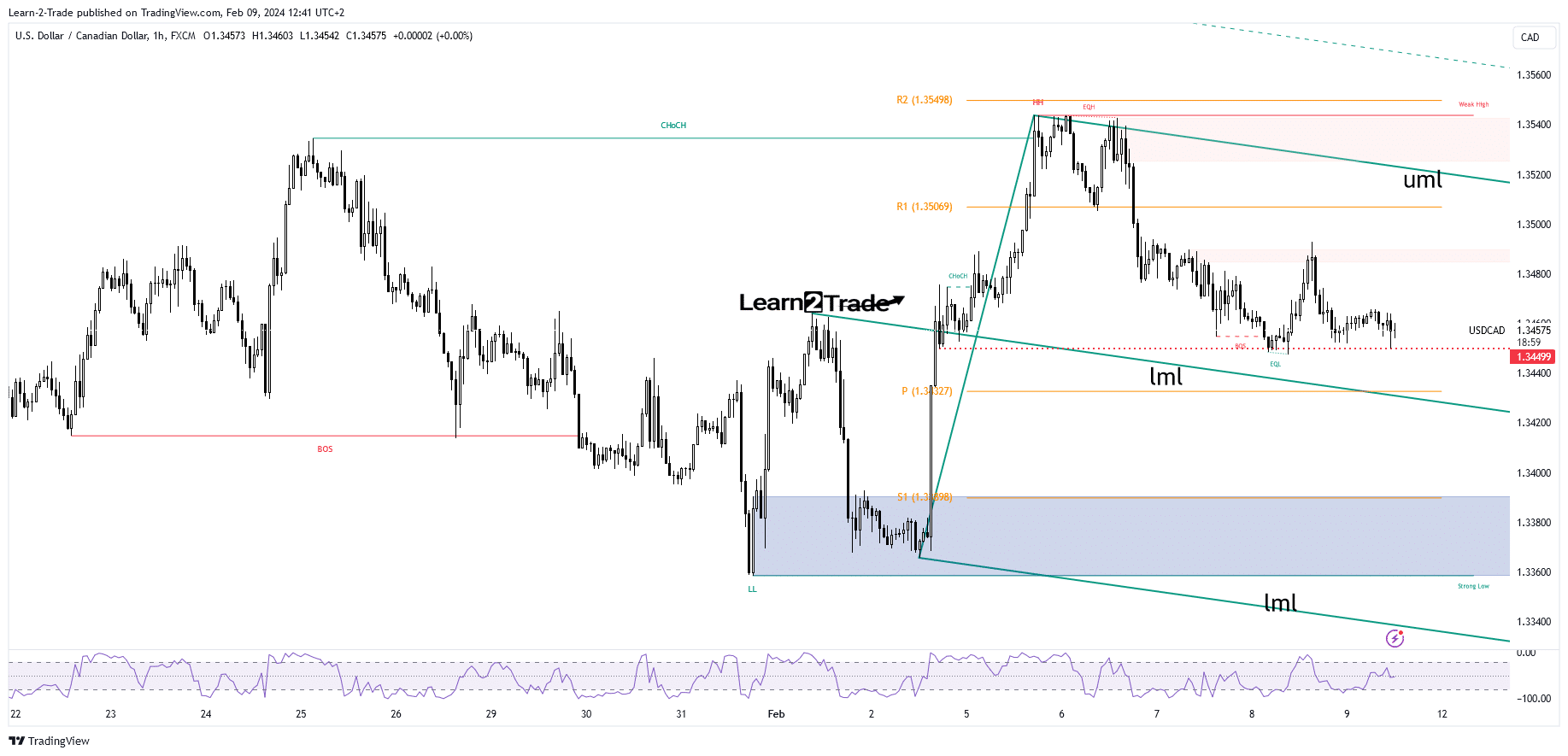

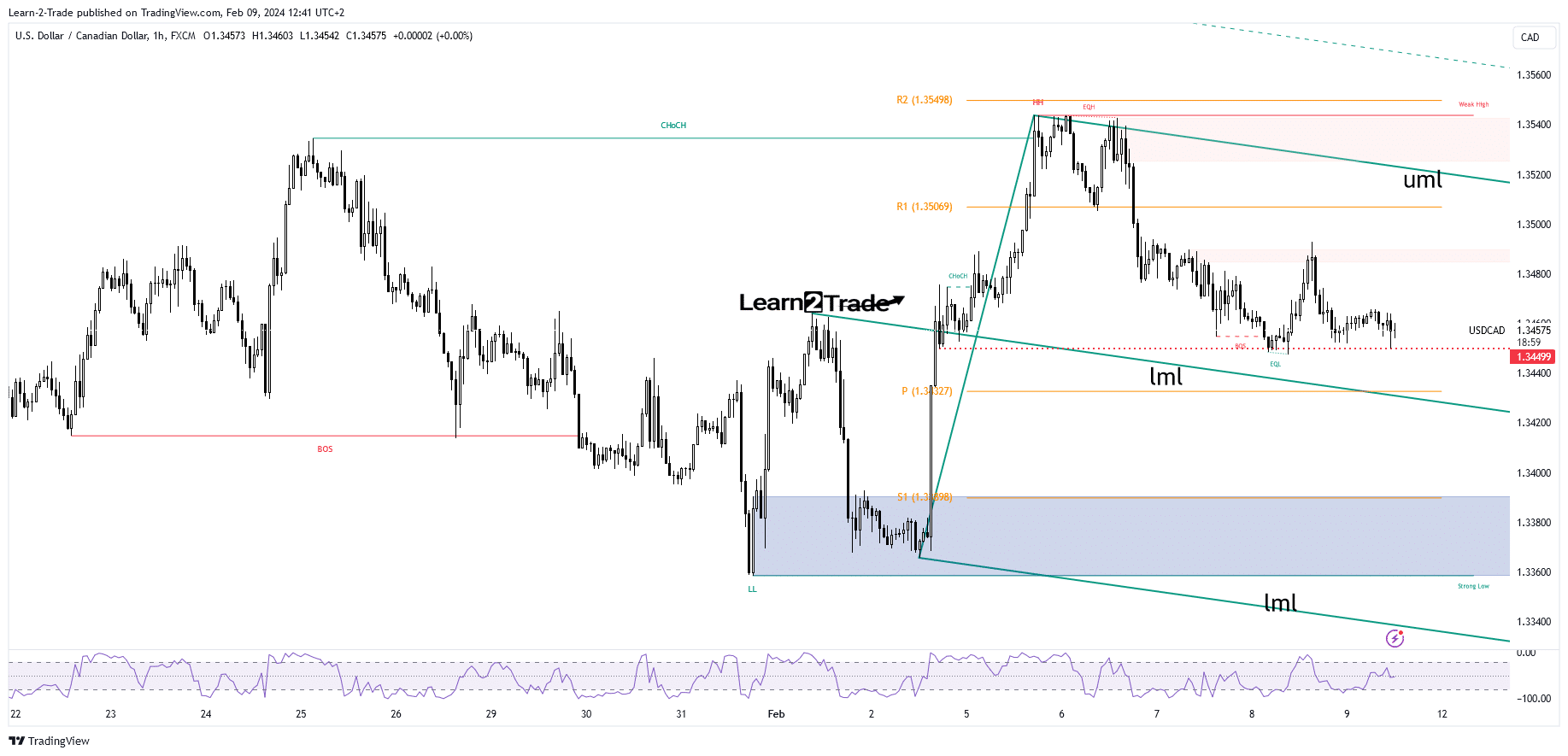

- The middle line could attract the USD/CAD pair.

- Canadian data should have a big impact today.

- Removing the middle line triggers a bigger drop.

The USD/CAD price lost strength on Friday amid a weaker dollar. The pair is trading at 1.3459 at the time of writing. The price has been corrected after strong growth.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

The dollar depreciated in the short term even though the ISM Services PMI fell to 53.4 points from 52.0 points on Monday.

Yesterday US jobless claims came in at 218,000 last week versus expectations of 221,000 compared to 227,000 in the previous reporting period. However, the dollar remains under pressure.

Today, Canadian economic data could be decisive. The change in employment is expected to 16.0 thousand in January, compared to 0.1 thousand in December, while the unemployment rate could jump from 5.8 percent in December to 5.8 percent in January.

Bad economic data may help the USD/CAD pair develop new bullish momentum. On the contrary, positive data helps CAD pull the pair towards new lows.

USD/CAD Price Technical Analysis: Corrective Downside

From a technical point of view, the USD/CAD price turned to the downside after failing to reach the weekly R2 of 1.3549. It fell well below R1 (1.3506), but static support at 1.3449 stopped the sell-off. Removing this negative obstacle activates more declines.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

The middle line (ml) and pivot point 1.3432 represent potential downside targets. Price confirmed the descending forks after testing and retesting the upper middle line (uml). So, the middle line could attract the price. A larger move down should be triggered after a valid break below this dynamic support. On the other hand, a failure to reach can herald a new leg higher.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money