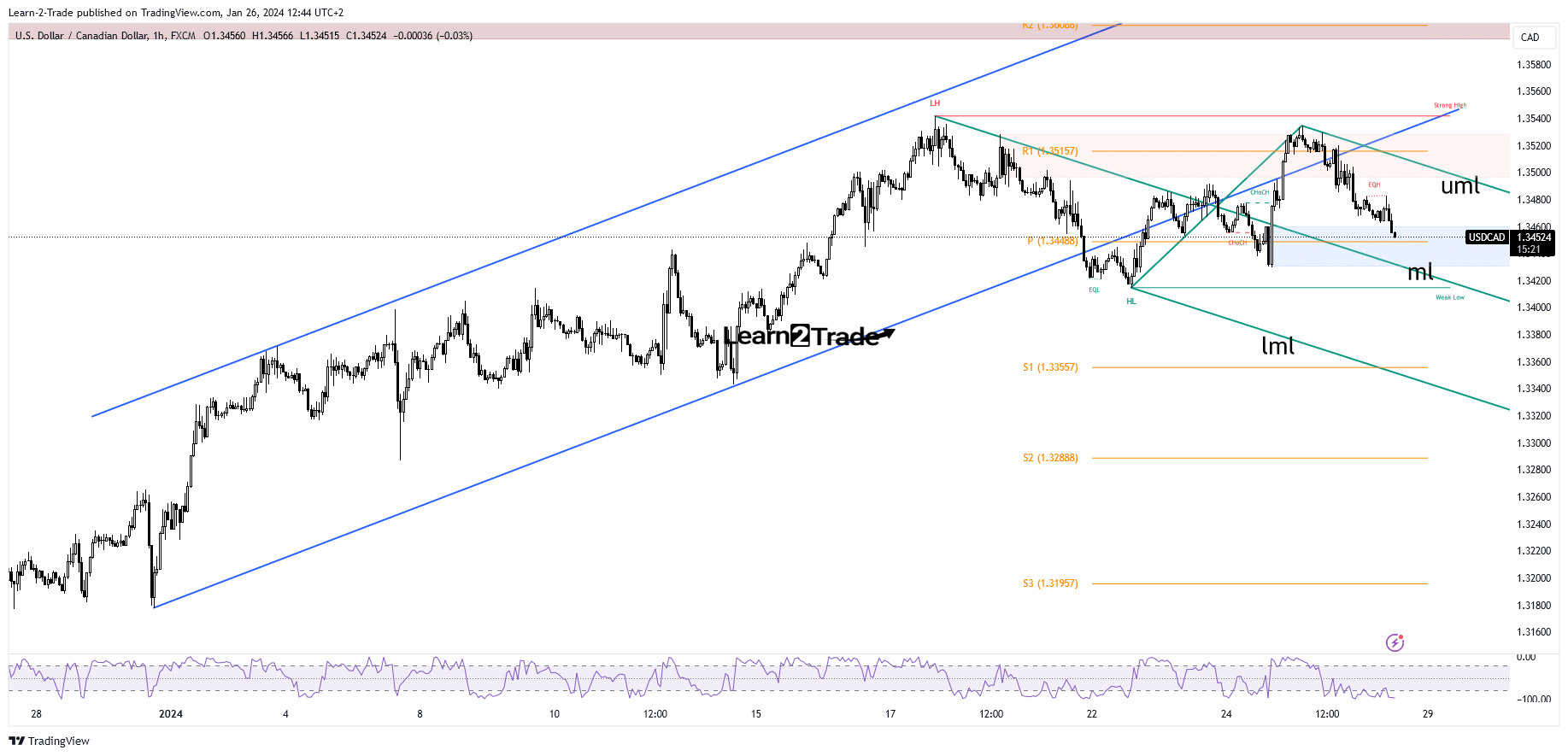

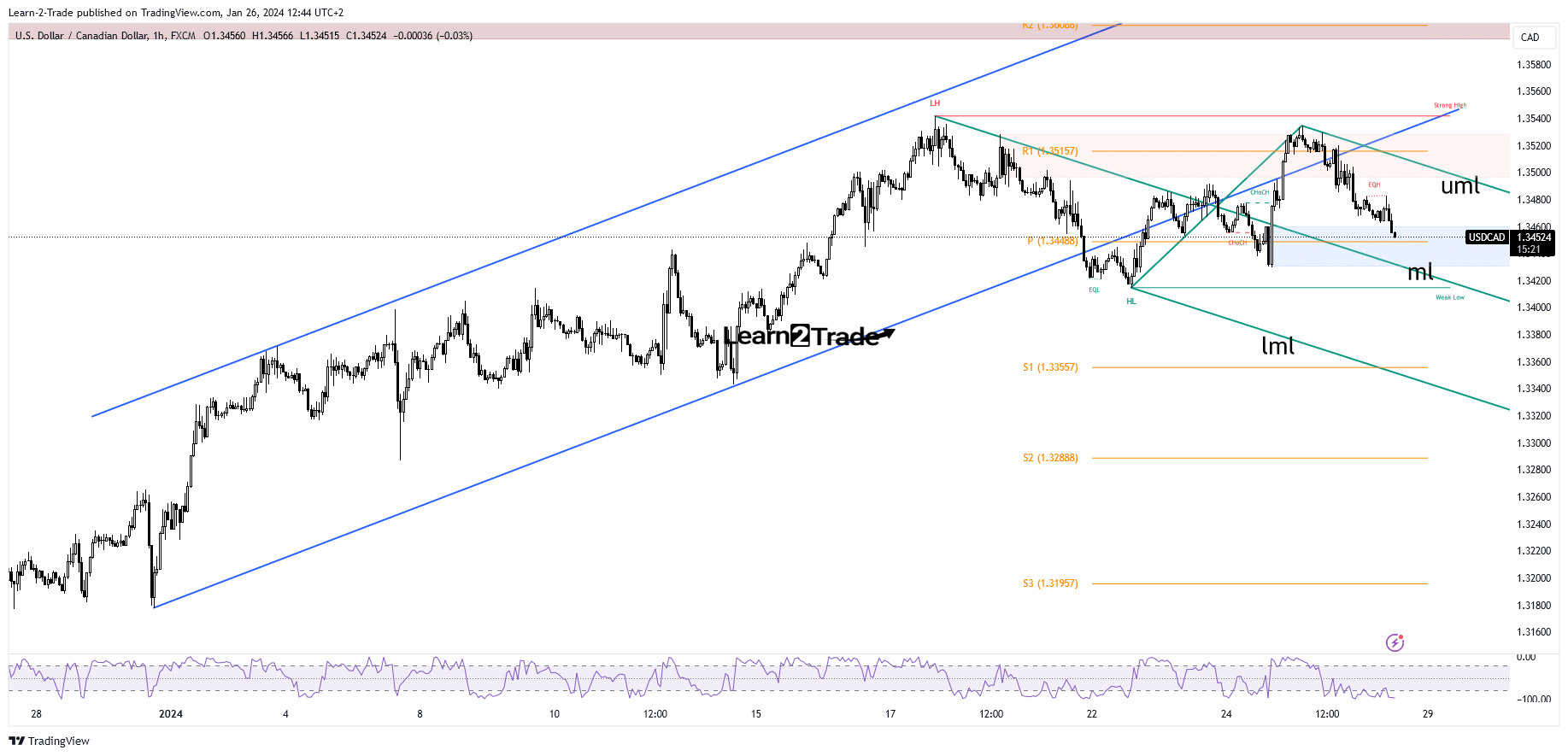

- The middle line could attract the USD/CAD pair.

- US economic data should be decisive today.

- Removing the middle line activates more declines.

USD/CAD is trading in the red at 1.3450 at the time of writing. The pair appears determined to hit new lows as the US dollar weakens.

The price jumped higher after the BOC as the Canadian central bank developed a dovish tone. On the other hand, the American manufacturing and service sectors confirmed the expansion.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

The Canadian dollar retook the lead yesterday, although the US released mixed data, while the ECB kept its monetary policy on hold.

US advance GDP, new home sales and core durable goods orders are better than expected. At the same time, jobless claims, forward GDP price index, durable goods orders, trade balance and preliminary wholesale inventories all disappointed.

Today, US economic numbers should get the markets moving again. The core price index PCE may announce a growth of 0.2% compared to a growth of 0.1% in the previous reporting period.

Pending home sales are expected to increase by 2.1%, surpassing the 0.0% increase during the last reporting period.

Furthermore, data on personal consumption and personal income will also be published. Positive economic data should help the dollar dominate the currency market. On the contrary, the Greenback could lose significant ground against its rivals.

Technical Analysis of USD/CAD Price: Selling Bias

From a technical point of view, the USD/CAD pair has broken out of a significant ascending channel pattern, indicating a potential corrective phase. The price tried to move back above the broken uptrend line, but failed to stabilize beyond this dynamic obstacle, confirming the exhausted buyers.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

A retest of the upper middle line (uml) confirmed that I had drawn descending pitchforks. Therefore, the price could be attracted by the middle line (ml), which acts like a magnet. The removal of this dynamic support opens the door for a significant downward movement. However, after the current sell-off, we cannot rule out a temporary recovery as the rate triggers a demand zone.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.