- Accelerated data on consumer confidence from the US caused the dollar to rise.

- Canadian GDP fell from 0.2% to 0.0% on a monthly basis.

- Markets are predicting a 60% chance of a rate cut in Canada on Wednesday.

The weekly USD/CAD forecast shows more downside potential as there is a good chance the Bank of Canada will cut rates next week, well ahead of the Fed.

USD/CAD Ups and Downs

USD/CAD fluctuated throughout the week, but ended lower following poor US inflation data. As the week began, upbeat US consumer confidence data sent the dollar higher against the Canadian dollar. However, the trend changed when US data on Thursday revealed GDP fell from 1.6% to 1.3% in Q1.

–Are you interested in learning more about tips for Forex traders? Check out our detailed guide-

Similarly, Canada’s GDP fell from 0.2% to 0.0% on a monthly basis. Therefore, the Bank of Canada is under more pressure to cut rates next week. The main catalyst this week was the US core PCE index, which revealed an unexpected drop in inflation from 0.3 to 0.2%. This raised bets that the Fed would cut rates in September.

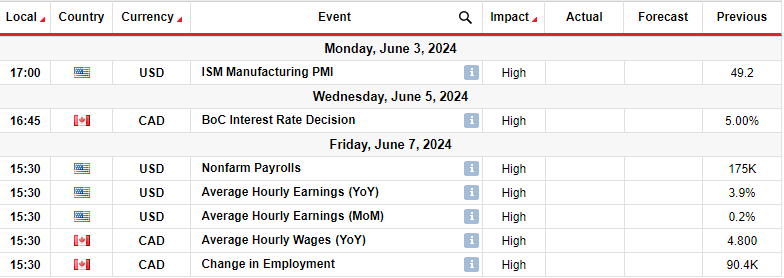

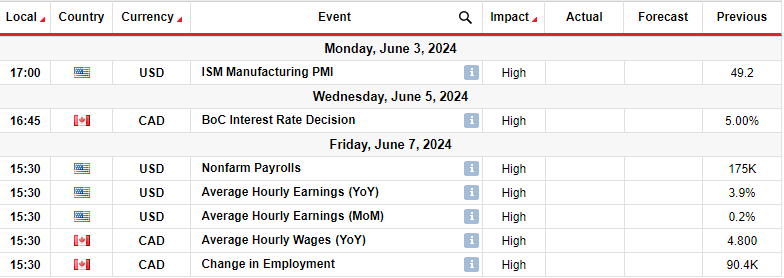

Next week’s key events for USD/CAD

Next week, investors will focus on the Bank of Canada’s policy meeting and employment data from Canada. At the same time, the US will release PMI data and a non-farm payrolls report. The BoC’s policy meeting comes after much speculation about the central bank’s rate-cutting cycle. Markets are pricing in a 60% chance of a rate cut in Canada this coming Wednesday.

Meanwhile, the NFP report will give more clues about the prospects for a rate cut in the US as it shows the state of the labor market.

USD/CAD Weekly Technical Forecast: Bears approaching solid support at 1.3601

On the technical side, the USD/CAD price has broken below its bullish trend line and is approaching the 1.3601 support level. This comes after the bullish trend rose to the 1.3803 resistance level.

–Are you interested in learning more about forex brokers? Check out our detailed guide-

Although sentiment turned bearish, the move lower was volatile, indicating that it could be a corrective move. If so, the price is likely to bounce from 1.3601 to retest the resistance level at 1.3803.

A break above this resistance would make a higher high, confirming the continuation of the bullish trend. However, if the bears make a stronger move in the coming week, the price could break below 1.3601 to retest the 1.3400 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.