- Data on Tuesday showed upbeat US retail sales, pointing to resilience.

- Inflation in Canada eased more than expected, fueling bets for a July rate cut.

- The Bank of Canada is likely to cut rates next week.

The weekly USD/CAD forecast paints a strong bullish picture as the Canadian dollar falls sharply on bad data and an impending BoC rate cut.

USD/CAD Ups and Downs

The USD/CAD pair had a bullish week as the US dollar rallied against a weak Canadian dollar. Although the dollar was weak in the broader market, the loonie was weaker. Data on Tuesday showed upbeat US retail sales, pointing to resilience. Meanwhile, inflation eased more than expected in Canada, fueling bets on a July rate cut.

–Are you interested in learning more about Forex indicators? Check out our detailed guide-

To make matters worse, Canada reported poor sales on Friday, well below expectations. It clearly showed that the economy is falling apart due to high rates. Accordingly, the Bank of Canada has every reason to reduce borrowing costs.

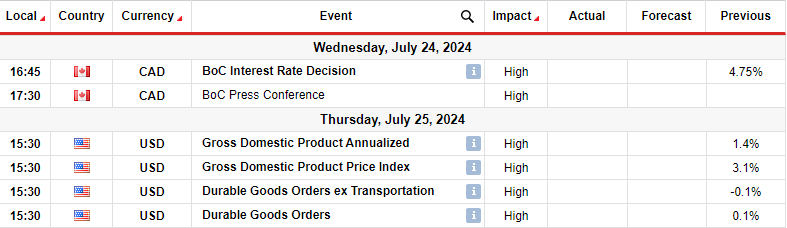

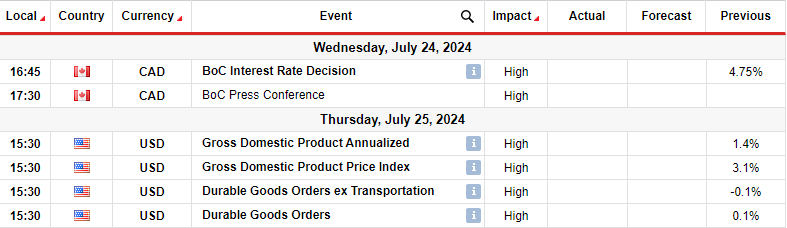

Next week’s key events for USD/CAD

Investors will focus on the Bank of Canada’s policy meeting next week. Meanwhile, US GDP and durable goods reports will be released.

The Bank of Canada is likely to cut rates next week after inflation eased further in June. Chances of a cut in July rose sharply after this week’s data showed inflation in Canada rose 2.7 percent less than expected. This followed a 2.9% jump in May. At the same time, economists expect that the central bank will reduce it two more times in 2024.

Meanwhile, US GDP data will show the state of the economy. However, unless there is a major surprise, this may not change the outlook for a cut in September.

USD/CAD Weekly Technical Forecast: Bulls charge a range resistance level

On the technical side, the USD/CAD price is trading above the 22-SMA, with the RSI rising above 50, indicating that the bulls are in control. However, the price traded sideways, crossing the SMA. So, bears and bulls are equally aligned, and the market has no clear direction.

–Are you interested in learning more about the best Bitcoin exchanges? Check out our detailed guide-

It is noticeable that the price remained in the range between support at 1.3600 and resistance at 1.3750. Therefore, the price must break out of this area to start trending. With the bulls in charge, the price could challenge range resistance. A break above would allow the price to return to the key level of 1.3900. However, if the price fails to break above, it could continue to consolidate.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.