- Powell noted that inflation is on a downward trend.

- US consumer inflation data showed a larger-than-expected reduction in price pressures.

- US wholesale inflation data came in higher than expected.

The weekly USD/CAD forecast is bearish as softening US inflation increased the likelihood of a September Fed tapering.

USD/CAD Ups and Downs

The USD/CAD pair had a mildly bearish week but closed well above its lows. During the week, investors focused on Powell’s testimony and US inflation data. Although Powell was cautious, he noted that inflation is on the decline.

–Are you interested in learning more about Forex brokers? Check out our detailed guide-

After his speech, data on consumer inflation showed a larger-than-expected reduction in price pressures. This led to a rise in Fed rate cut expectations, which weighed heavily on the dollar. However, as the week ended, US wholesale inflation data came in higher than expected, allowing for a slight recovery in the dollar.

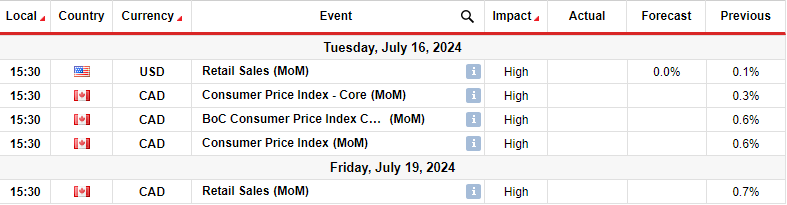

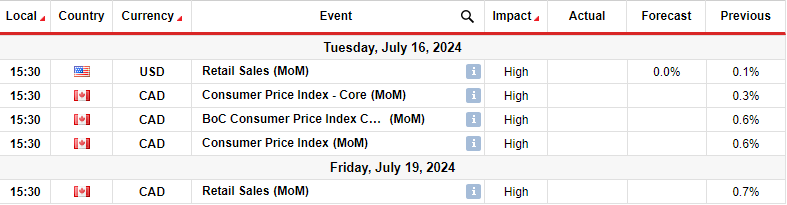

Next week’s key events for USD/CAD

Next week, the US will release only the retail sales report. Meanwhile, Canada will release data on inflation and retail sales. The US retail sales report will complement recent reports that have shaped the Fed’s rate cut outlook. This week, the probability of a September cut rose to 93% after the consumer inflation report. Consequently, if retail sales ease, there will be more certainty about a rate cut in September.

Meanwhile, Canada’s inflation report will weigh on BoC rate cut bets. Last month, inflation in Canada unexpectedly accelerated, sending bets for a July cut down. If inflation picks up again, Canada’s central bank may not cut in July. However, if it gives way, the chances of a cut will increase.

USD/CAD Weekly Technical Forecast: Bears face support at 1.3601

On the technical side, the USD/CAD price is challenging the key support level of 1.3601. The bias is bearish as price is trading below the 22-SMA with the RSI below 50 in bearish territory. However, after the previous bullish move, the price is caught in a sideways move between support at 1.3601 and resistance at 1.3800.

–Are you interested in learning more about Crypto Signals Telegram Groups? Check out our detailed guide-

This consolidation could be a break in a previous bull trend or the start of a reversal. Price must break below the 0.382 Fib retracement level and 1.3601 support to confirm a reversal. On the flip side, if this is just a pause, support at 1.3601 could remain firm, allowing bulls to retest and possibly break above 1.3800.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.