- Crude oil inventories rose more than expected last week.

- GDP data from Canada showed a stronger-than-expected expansion in the fourth quarter.

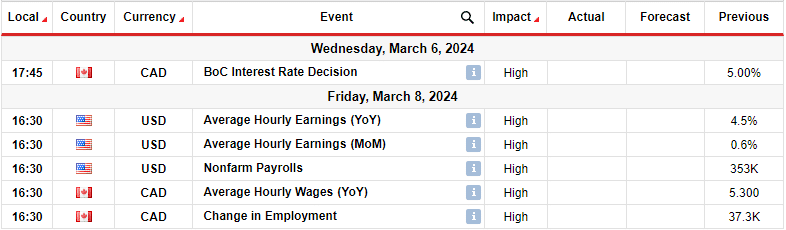

- Market participants will be watching the outcome of the Bank of Canada’s interest rate decision.

The weekly USD/CAD forecast leans bullish as the dollar regains strength just in time for the highly anticipated non-farm payrolls report.

USD/CAD Ups and Downs

USD/CAD ended the week on a bullish note as the greenback rose against the Canadian dollar. The biggest move in the week happened on Wednesday when oil prices fell. Notably, there was a larger-than-expected increase in crude oil inventories last week, leading to a drop in oil prices. As a result, the Canadian dollar weakened against the dollar.

–Are you interested in learning more about CFD brokers? Check out our detailed guide-

Other data for the week included the US PCE price index, which revealed a softening of annual inflation. In addition, GDP data from Canada showed a stronger-than-expected economic expansion in the fourth quarter.

Next week’s key events for USD/CAD

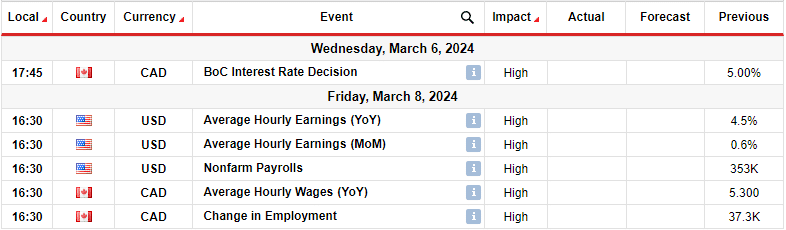

Next week, traders will focus on employment data from Canada and the US. These reports will have a significant impact on the outlook for monetary policy in the US and Canada. Furthermore, market participants will be watching the outcome of the Bank of Canada’s interest rate decision.

US and Canadian hiring numbers were higher than expected last month, indicating that the labor market in both countries remains hot. Consequently, this has made central banks in both countries cautious about cutting rates.

At this point, markets are expecting the Bank of Canada’s first rate cut in June. Similarly, they expect the Fed to start cutting rates in June. However, this could change with employment data.

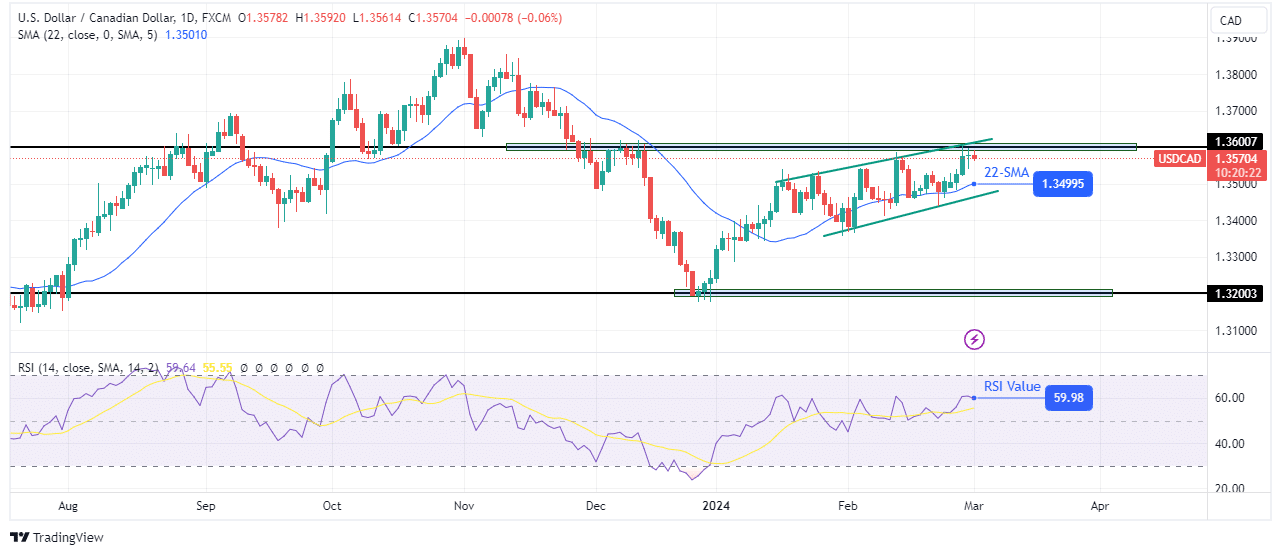

USD/CAD Weekly Technical Forecast: Bulls fade as price approaches 1.3600 resistance

On the daily chart, sentiment suddenly changed from bearish to bullish when the price found support at 1.3200 and broke above the 22-SMA. However, shortly thereafter, the bullish momentum weakened and the move became shallow. Moreover, the price continued to break the 22-SMA support line.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

The price was trading in a bullish channel that has now paused at the key resistance level of 1.3600. Meanwhile, the RSI is trading above 50, supporting bullish momentum. If the bulls regain their previous enthusiasm, the price could break above the resistance level at 1.3600. However, if the bears become strong enough to break below the channel support, the price could return to retest the 1.3200 support level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.