- The weekly forecast for USD / CAD shows the increased dollar demand.

- American inflation revealed lower pricing pressures, increasing the chances of reducing the rate in September.

- The Canadian dollar fell as oil prices fell.

The weekly forecast for USD / CAD shows the increased demand for dolago in the middle of mitigating global trade tensions.

UPS and Downs of USD / CAD

SALL USD / CAD Had a biliary week as the dollar was strengthened and the Canadian dollar weakened. The dollar is strengthened despite economic data falls while investors remained optimistic about the recent trademark between the United States and China.

–Are you interested in more about purchasing NFT tokens? See our detailed guide-

Inflation data discovered lower pricing pressures, increasing chances of reducing the rate in the weather in September. Meanwhile, retail sales came in a little above the assessment. However, the sale has declined significantly since the previous month.

On the other hand, the Canadian dollar has fallen as oil prices fell. The oil is inclined after Trump announced a probable nuclear contract with Iran, increasing concern.

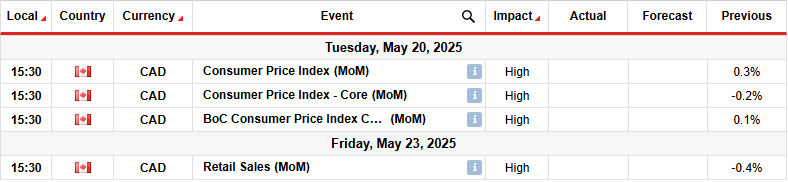

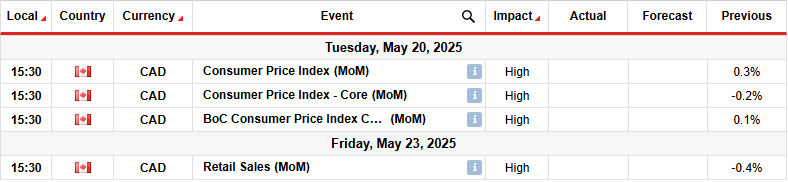

Key events next week for USD / CAD

Next week Canada will let large reports that show the state of inflation and consumer consumer. In the previous reading, inflation increased by 0.3%. The larger than the expected figure will reduce the expectations for Canadian Rating Canada in June in June. Kimodori Kimod will decide to continue the break they started in April. However, a soft figure will increase the costs of reducing the course. Currently, retailers prices a little more than 50% chance of cuting 4. June.

The retail sale report will show consumer consumption, shape and prospects for reducing the disease of the hi.

USD / CAD Sunday technique Technical forecast: Bigs target 1,4100 resistance after download

On the technical side, the USD / CAD price violated above the 22nd, signaling a bit of sentiment. At the same time, RSI trades above 50 years, proposes solid prayers’ momentum. Earlier, the price quickly declined until the level of support from 1,3801 was approached. Here, the price growth slowed, and the candlesticks became smaller.

–Are you interested in learning more about Forex Robots? See our detailed guide-

Moreover, such as the price of edges below, the RSI also examined, indicating the breakingness. This was a clear sign that the bears were exhausted. However, the bulls still need to push the price higher for confirmation of a new direction. The break over 1,4100 would strengthen the bias of the bakery. Moreover, it will allow to slow down to slow and cause higher levels of resistance. However, if this does not happen, the bears can be returned for the price to be pressed below the SMA and continued the previous decline.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.