- The monthly US employment report showed an increase in the unemployment rate to 4.1%.

- The Canadian labor market weakened sharply, and the economy lost jobs in June.

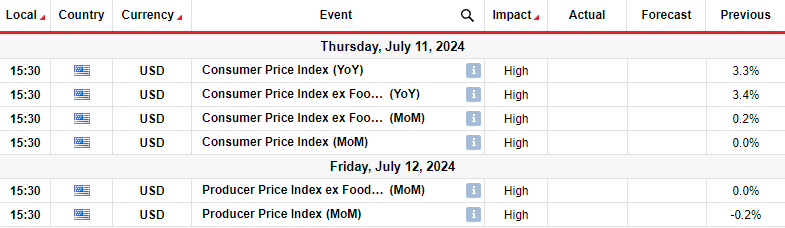

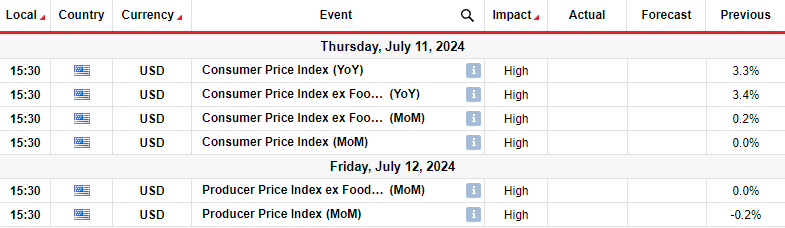

- Next week, investors will focus only on US inflation data.

The weekly USD/CAD forecast is bearish as the greenback falls amid a string of bad reports and a dovish Powell.

USD/CAD Ups and Downs

The USD/CAD pair had a bearish week as the dollar weakened due to poor economic data. At the same time, Powell’s slightly dovish speech weighed on the currency.

–Are you interested in learning more about Bitcoin price prediction? Check out our detailed guide-

US data shows a drop in job vacancies, higher initial jobless claims and a weaker service sector. Moreover, the monthly employment report showed an increase in the unemployment rate to 4.1%. Easing the labor market will allow the Fed to start reducing borrowing costs.

Moreover, when Powell spoke, he acknowledged the recent decline in inflation. He said it would pave the way for rate cuts. Meanwhile, the Canadian labor market weakened sharply, and the economy shed jobs in June. At the same time, the unemployment rate rose to 6.4%.

Next week’s key events for USD/CAD

Next week, investors will focus only on US inflation data. Reports on consumer and wholesale inflation will show the state of price pressures in the country. Last month, consumer inflation decreased to 3.3%. Moreover, the Fed’s preferred measure of inflation fell to 2.6% in May, a sign that the 2% target is within reach.

If next week’s reports continue this downward trend, expectations for a rate cut by the Fed will increase. This would weaken the dollar against the lunatic. On the other hand, if inflation beats forecasts, the dollar will strengthen as the Fed is likely to continue to delay tapering.

USD/CAD Weekly Technical Forecast: Bears Challenge Range Support

On the technical side, the USD/CAD price is bearish as it is trading below the 22-SMA with RSI below 50. However, there is no clear direction in the market as the price has mostly traded sideways, with support at 1.3601 and resistance. at 1.3800. The previous bullish trend failed to break above the resistance at 1.3800 and entered a period of consolidation.

–Are you interested in learning more about crypto robots? Check out our detailed guide-

Bears are now testing the support level of 1.3601. If the bears break below this level next week, the price is likely to retest the key support of 1.3400. However, if the bears fail to continue lower, USD/CAD will continue to consolidate.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.