- A weekly forecast for USD / CAD shows a slowdown in the American economy.

- The American economy added 177,000 jobs in April, above an estimate of 138,000.

- The Canadian economy is unexpectedly agreed by 0.2%.

A weekly forecast for USD / CAD shows a slowdown in the American economy that could push the fed rate in June.

UPS and Downs of USD / CAD

The price of USD / CAD had a bearing week because most American economic reports indicated economic slowdown. However, the dollar briefly jumped on Friday after the work affairs report.

– Did you look for forex robots? See our detailed guide-

Over the week, American data pointed out weakness, with free-job receivables, and private employment of all missing forecasts. However, the economy added 177,000 jobs in April, above an estimate of 138,000. However, it was slower than a previous read of 185,000.

Meanwhile, the Canadian economy unexpectedly contracted by 0.2%, increasing pressure on the Canada bank to continue its harmonized cycle.

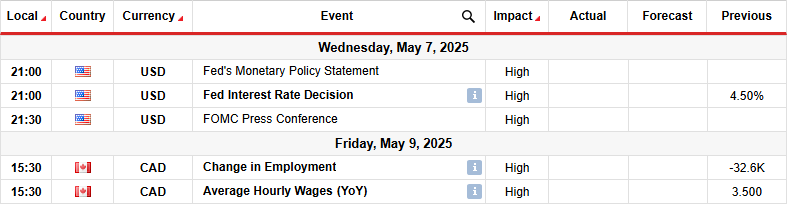

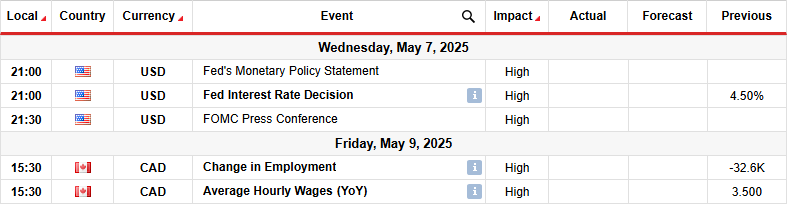

Key events next week for USD / CAD

Next week market participants will focus on FOMC’s policy meeting. Meanwhile, Canada will free her crucial monthly employment report. The Fed will probably keep interest rates unchanged while policy makers await more evidence of economic deterioration. Data on Friday, they discovered that the labor market remains stronger than expected. However, traders in June are increasingly cost of a bone incision.

Meanwhile, the Employment Report of Canada will show the state of its labor market, shape the look for Cars Can Canada.

Fewer Technical Forecast USD / CAD: Bears lose swing near the channel support

On the technical page, USD / CAD price price lasts below 22-SMA with RSI under 50 years, indicating bear bias. From its peak at the top of the chart, the price made lower top and lower. At the same time, he respected a solid resistant and support line, creating a bear channel.

– Did you ask for the best CFD broker? See our detailed guide-

Currently bears cause the level of support from 1,3800. However, the price of the price shows that the decline weakened near the channel support. The bodies for candles are smaller. At the same time, RSI made a bakery parting, suggesting how fading momentum.

If the bullocks are returned, the price is likely to be beaten above SMA to reset the resistance to the channel and level 1,4200. The fall will continue until the price remains on the channel. The next goal will be at the 1.3400 level. On the other hand, the interruption of the bull channel will signal aid to the shift in feeling.

Looking for forex trading now? Invest in Ethorro!

67% of retail orders lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.