- The Canadian dollar weakened as Canadian inflation eased in May.

- Some Fed policymakers have called for a rate hike if inflation continues to beat forecasts.

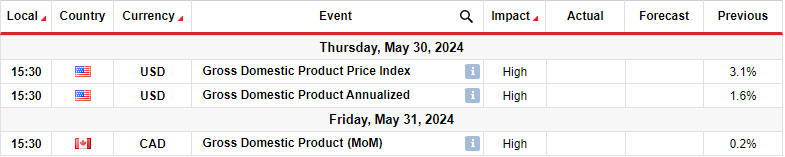

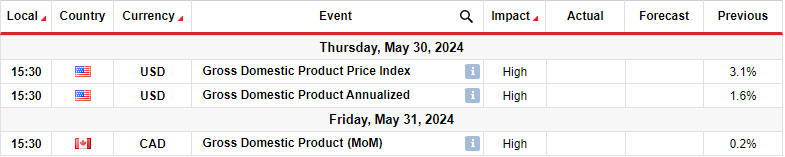

- Next week, the US and Canada will release their GDP reports.

The weekly USD/CAD forecast shows bullish sentiment as the policy outlook gap between the Fed and the Canadian dollar widens.

USD/CAD Ups and Downs

The USD/CAD pair had a bullish week as the dollar strengthened on upbeat data and Fed minutes. Meanwhile, the Canadian dollar weakened as Canadian inflation eased in May.

–Are you interested in learning more about forex tools? Check out our detailed guide-

Minutes from the FOMC meeting released on Wednesday showed that policymakers are willing to keep policy tight for a long time to tame stubborn inflation. In addition, some policymakers have called for rate hikes if inflation continues to beat forecasts. Accordingly, investors have reduced expectations for a rate cut in September.

Furthermore, the US released PMI data showing better-than-expected business activity in the manufacturing and services sectors. Meanwhile, data from Canada showed cooling inflation, raising bets for a June rate cut by the Bank of Canada.

Next week’s key events for USD/CAD

Next week, the US and Canada will release their gross domestic product reports, which will show the state of their economies. These reports will significantly define the gap in political perspectives between the US and Canada.

A higher-than-expected number in the US would point to a strong economy, which would likely lower Fed rate cut expectations.

Meanwhile, the GDP report is more likely to reveal a slowdown in Canada, which would put pressure on the BoC to cut rates and widen the gap in the policy outlook.

USD/CAD Weekly Technical Forecast: Bears Retest Bullish Trendline

On the technical side, the USD/CAD price is in a bullish trend that has stalled after reaching the key resistance level of 1.3800. After reaching this level, the price entered a period of consolidation, crossing the 22-SMA. Moreover, the price traded with the nearest support at 1.3600 and the nearest resistance at 1.3800.

–Are you interested in learning more about the best cryptocurrency exchange? Check out our detailed guide-

However, for the most part, the price has maintained its position above the bullish trend line. Furthermore, he has consistently made more highs and lows. Currently, the price is trading near the trend line, which has acted as support several times. Therefore, the price could bounce off this trend line to retest the resistance at 1.3800. A break above this level would make a higher high for the continuation of the uptrend.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.