- Fed policymakers played down expectations for a June rate cut.

- The US NFP report showed strong demand in the labor market.

- Canada released a dismal employment report.

A closer look at the weekly USD/CAD forecast reveals hints of a bullish trend as the political outlook between the US and Canada diverges.

USD/CAD Ups and Downs

USD/CAD had a bullish week where bets on a Fed tapering in June fell while bets on a BoC tapering in June rose. The week was volatile for the dollar, which fell as the US reported a slowdown in services activity. However, it ended higher after hawkish remarks from the Fed and an upbeat jobs report. Fed policymakers played down expectations for a June cut, saying inflation had stalled. Moreover, the US NFP report showed strong demand in the labor market, which led to a decline in rate cut bets.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

On the other hand, Canada released a dismal employment report, with employment shrinking and unemployment rising. This showed a weaker economy which could put pressure on the BoC to start cutting interest rates.

Next week’s key events for USD/CAD

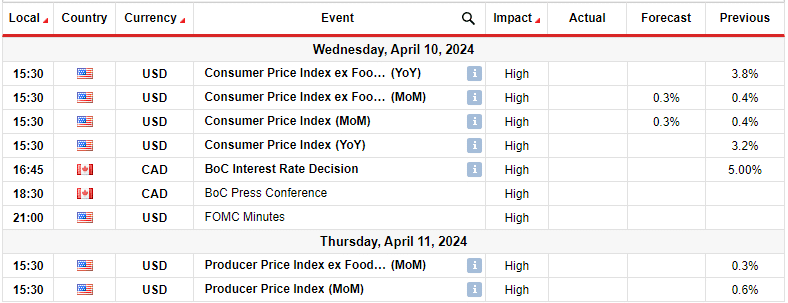

Next week, investors will focus on US consumer and producer inflation data. Moreover, the Bank of Canada will decide on monetary policy.

Investors will be interested to see if inflation beats forecasts again. In that case, rate cut bets may fall further after the jobs report, allowing the USD/CAD pair to rally. On the other hand, if inflation falls, bets on a rate cut will increase.

Meanwhile, markets expect the Bank of Canada to keep rates at 5% on Wednesday. It will also focus on rate reduction messaging. For now, futures point to the first reduction in June.

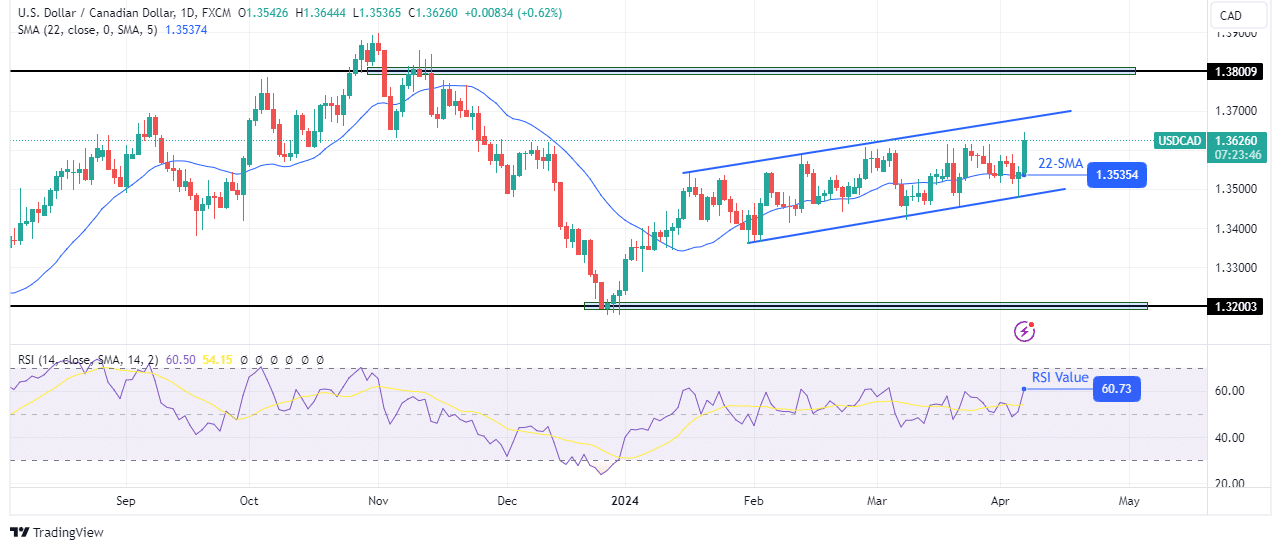

USD/CAD Weekly Technical Forecast: Bulls maintain control despite weak momentum

On the technical side, USD/CAD is bullish as the price has risen well above the 22-SMA. At the same time, the price is trading within a bullish channel. Meanwhile, the RSI was in solid sideways movement in bullish territory. This is a sign that the momentum is weak, even though the bulls are in the lead.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

The price is likely to start a stronger trend when it breaks out of the bullish channel. A break above the channel resistance would lead to a retest of the key resistance level of 1.3800. Moreover, it would allow the price to rise.

On the other hand, if the price falls below the channel support in the coming week, the trend will reverse.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.