- Weekly forecast for USD / CAD indicates that there is probably a pause from Fed and BOC.

- The dollar failed against most of his peers in the middle of optimism in connection with commercial affairs.

- The data revealed that the claims of American unemployment fell by the second week.

The weekly forecast for USD / CAD indicates that traders feed for the FEDA break and Canada Bank.

UPS and Downs of USD / CAD

The USD / CAD price had a bear week, but it closed well above their orders. At the beginning of the week, the dollar collapsed against most of his peers in the middle of optimism about trade jobs. The agreement between the United States and Japan convinced investors that there could be more such contracts before the deadline. August. As a result, appetite has grown and the dollar fell.

– Did you ask for the best CFD broker? See our detailed guide-

However, until Thursday, the focus switched to monetary policy. The data revealed that the claims of American unemployment fell by the second week. As a result, the rate of fed role facilitated easier and the dollar was gathered.

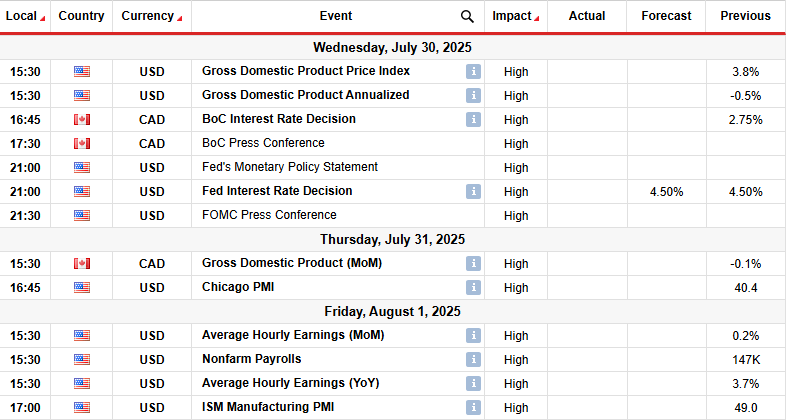

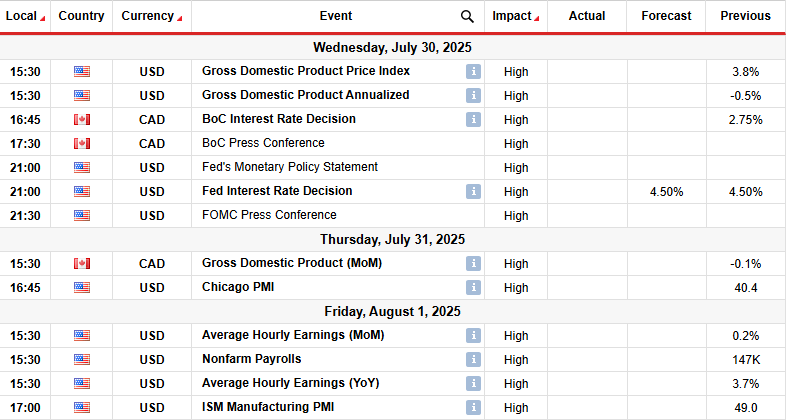

Key events next week for USD / CAD

Next week, traders will focus on major economic events, including US GDP, FOMC meeting and report on the Nefarm of Payrolls. In the meantime, Canada will free her GDP report, and the Bank of Canada will also meet next week.

The most important events will be political meetings and the US Employment Report. The Fed will probably continue to rates unchanged and maintained a cautious tone. The Canada Bank will also continue to break. Meanwhile, the NFP report will continue to shape the look for reducing the rates of Nah.

USD / CAD Sunny technique Technical forecast: triple bottom, bullish-divergence signal reversion

On the technical page, the USD / CAD price is broken above the 22-SMA suggests that the bulls are in lead. At the same time, the RSI violated over 50, suggesting stronger swing. However, the price remains in a narrow range near the level of support from 1,3575.

-If you are interested in the guaranteed forex brokers to stop stopping, check our detailed guide-

In a larger scale, USD / CAD trades a corrective move after falling near the support level of 1,3575. Initially, the price of the lower highway and lower, until it reaches the level of support. Here, bears couldn’t be broken below despite three attempts. As a result, the price made a triple bottom.

Moreover, the RSI made a little divergence, which indicates a weaker bear momentum. This suggests that the 1.3575 level can mark the bottom for the trend. Moreover, the bulls could soon be discontinued from a consolidation consolidation in order to resume 1,4000 levels of resistance to keys.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.