- Trump’s victory changed the outlook for the economy and inflation.

- US inflation data revealed that price pressures rose as expected.

- US sales jumped more than expected.

The weekly USD/CAD forecast remains bullish, with the US dollar hitting a one-year high on Trump’s policy proposals.

USD/CAD Ups and Downs

Ludi had a bullish week as the dollar surged to a one-year high against its peers on Trump’s optimism. Market participants continued to absorb the recent US election, which boosted the US dollar. Trump’s victory changed the outlook for the economy and inflation. Experts believe that the economy will grow rapidly and inflation will rise. This is why the Fed could pause interest rate cuts.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

Meanwhile, inflation data revealed that price pressures rose as expected. However, bets on a rate cut fell sharply after Powell said there was no rush to lower borrowing costs. Other data showed sales jumped more than expected, pointing to strong consumer spending.

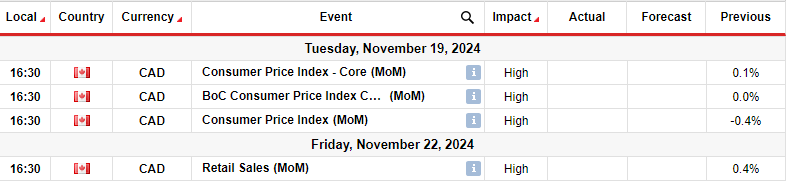

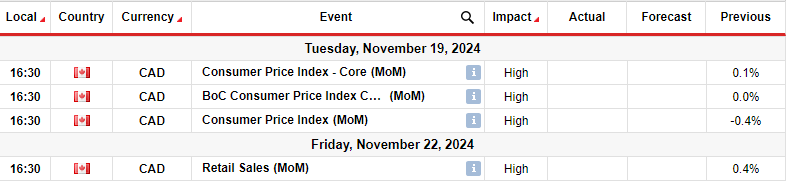

Next week’s key events for USD/CAD

Next week, Canada will release key inflation and retail sales data that will shape the outlook for a Bank of Canada rate cut. Inflation in Canada has eased significantly and is now at 1.6%, within the central bank’s target. As a result, the Bank of Canada is more focused on preserving growth, which has deteriorated.

Still, low inflation is also putting pressure on policymakers to reduce borrowing costs. Market participants are already pricing in a more aggressive BoC rate cut. Because of this, the cooler-than-expected numbers will weigh on the Canadian dollar.

Meanwhile, the retail sales report will show the health of consumers and the economy as a whole, further shaping the outlook for rate cuts.

USD/CAD Weekly Technical Forecast: Bearish RSI Divergence

From the technical side, USD/CAD the price made a new high after respecting the 22-SMA as support. The price is trading well above the SMA, indicating a solid bullish bias. At the same time, the RSI is trading in an overbought region, indicating strong bullish momentum.

–Are you interested in learning more about leveraged brokers? Check out our detailed guide-

The price recently broke above the resistance level of 1.3951 and rose to make a new high near the key level of 1.4101. However, while the price made a higher high, the RSI made a lower one, indicating weaker bullish momentum. Therefore, next week, USD/CAD could pull back next week to retest the 1.3951 support or the 22-SMA line. However, the bullish trend will continue if the price stays above the SMA.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money