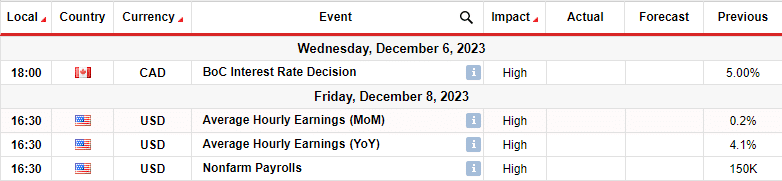

- US economic data supports the view that the Fed will start cutting rates soon.

- Canada reported stronger-than-expected employment growth.

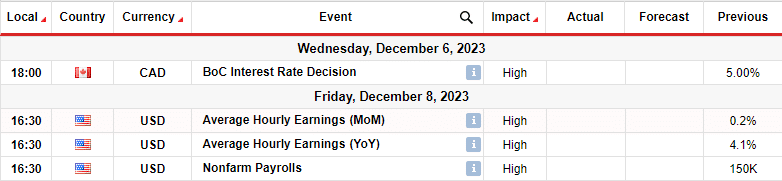

- The BoC is likely to keep its main benchmark rate at 5.0% next week.

The weekly USD/CAD forecast predicts a bearish trajectory, with recent US data signaling a potential conclusion to a Fed rate hike. This narrative suggests a likely extension of dollar weakness.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

USD/CAD Ups and Downs

The Loonie had a bearish week characterized by dollar weakness and Canadian dollar strength. The dollar fell last week as economic data supported the view that the Fed will start cutting rates soon.

Notably, US jobless claims rose last week, indicating weaker demand in the labor market. At the same time, the core PCE price index showed a drop in inflation, supporting the Fed pivot. Moreover, the dollar fell as investors took note of Fed Chairman Jerome Powell’s commitment to a “cautious” approach to interest rates.

Meanwhile, employment data from Canada showed a higher-than-expected figure that supported the Canadian dollar on Friday. Still, the BOC is likely to leave rates unchanged next week.

Next week’s key events for USD/CAD

Next week, the Bank of Canada will hold its monetary policy meeting, where investors expect interest rates to remain on hold. In a recent speech, BoC Governor Tiff Macklem suggested that interest rates may be sufficiently restrictive, given the disappearance of excess demand and expected weak growth.

This led to the widespread conclusion that the central bank had stopped raising rates. The BoC will keep its main benchmark rate at 5.0% until at least the end of March, in line with expectations for the US Federal Reserve.

Another big report next week is US non-farm payrolls. The latest jobs report showed an easing in the labor market and supported expectations of a rate cut by the Fed. Another such report could lead to a dovish Fed.

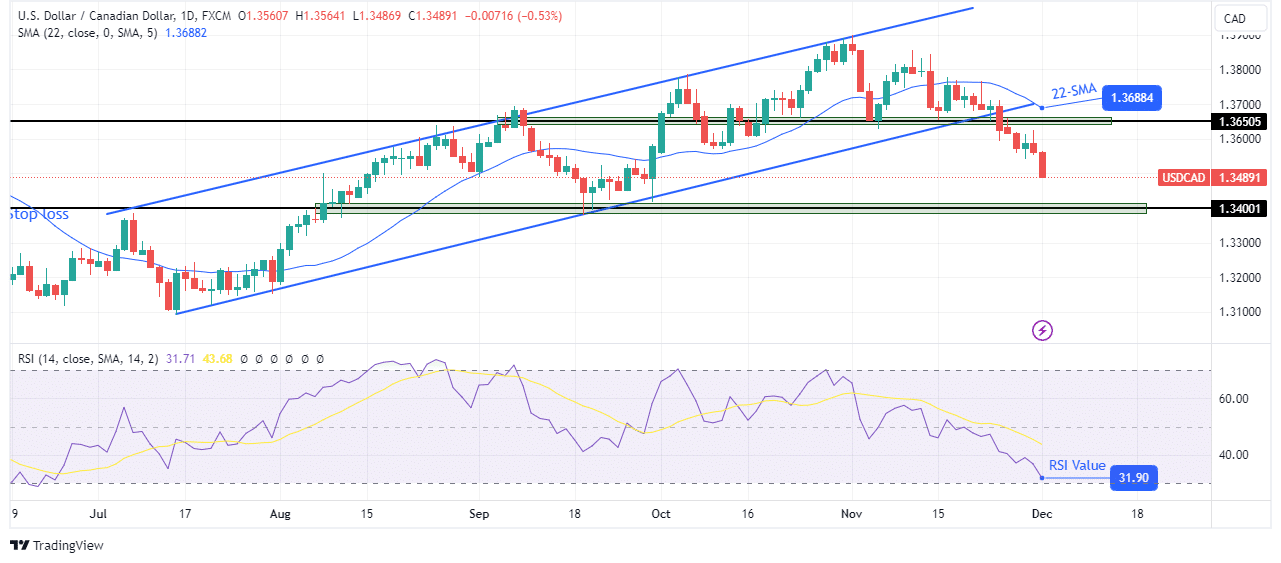

USD/CAD Weekly Technical Forecast: Bullish Channel Cracks Under Pressure

On the charts, USD/CAD has broken out of its bullish channel, signaling a change in direction. The bulls were stronger than the bears in the channel and continued to push the price above the 22-SMA.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

At the same time, the RSI was mostly trading above 50, supporting the bullish momentum. However, this all changed with the channel support breach. The bears are now in control, and the RSI has dipped into bearish territory.

Furthermore, the price pushed well below the 22-SMA, supporting the bears. Next week, the price is likely to fall to the 1.3400 support level. However, it could pull back to retest the recently broken key level of 1.3650 before continuing lower.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.