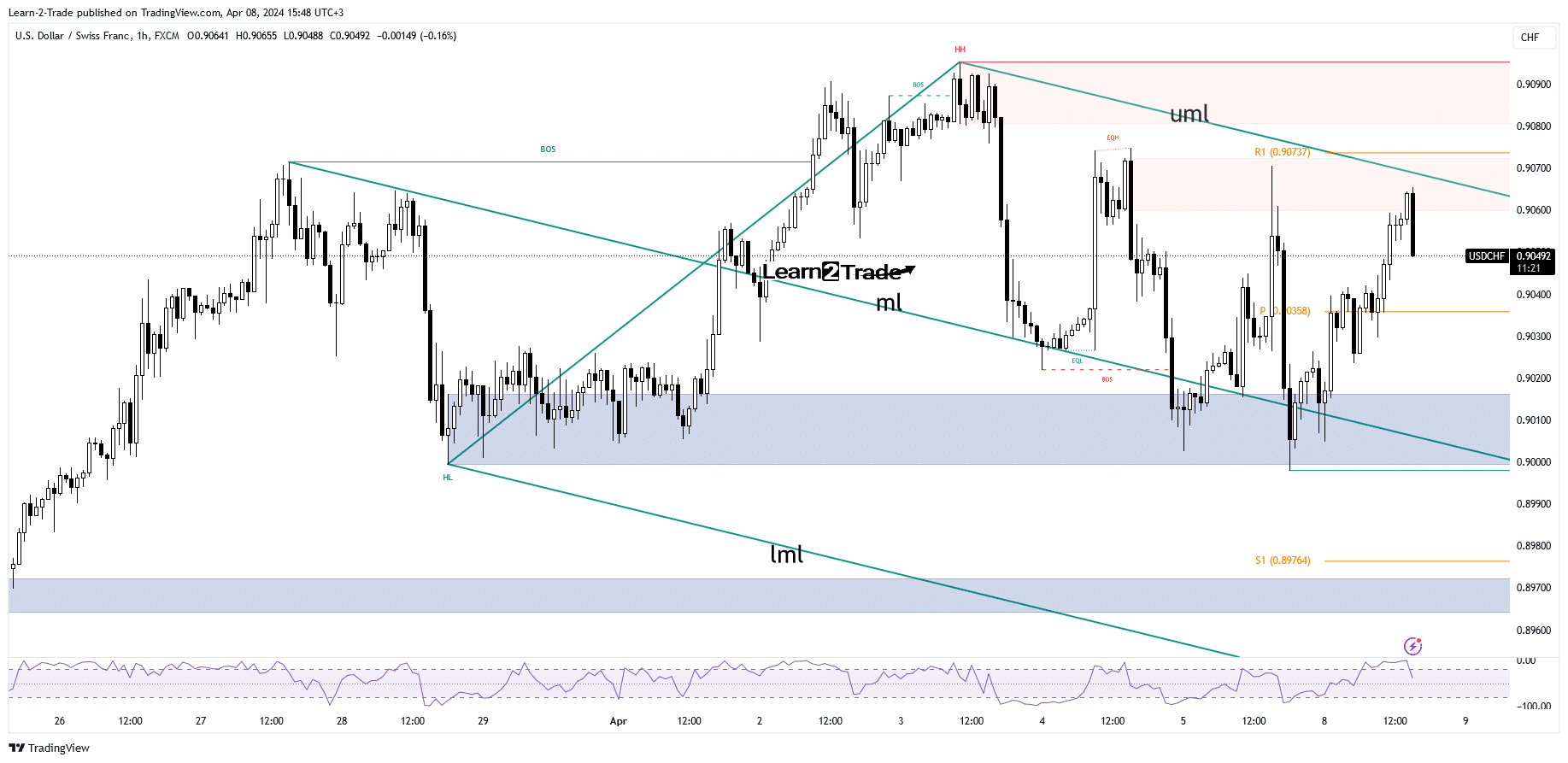

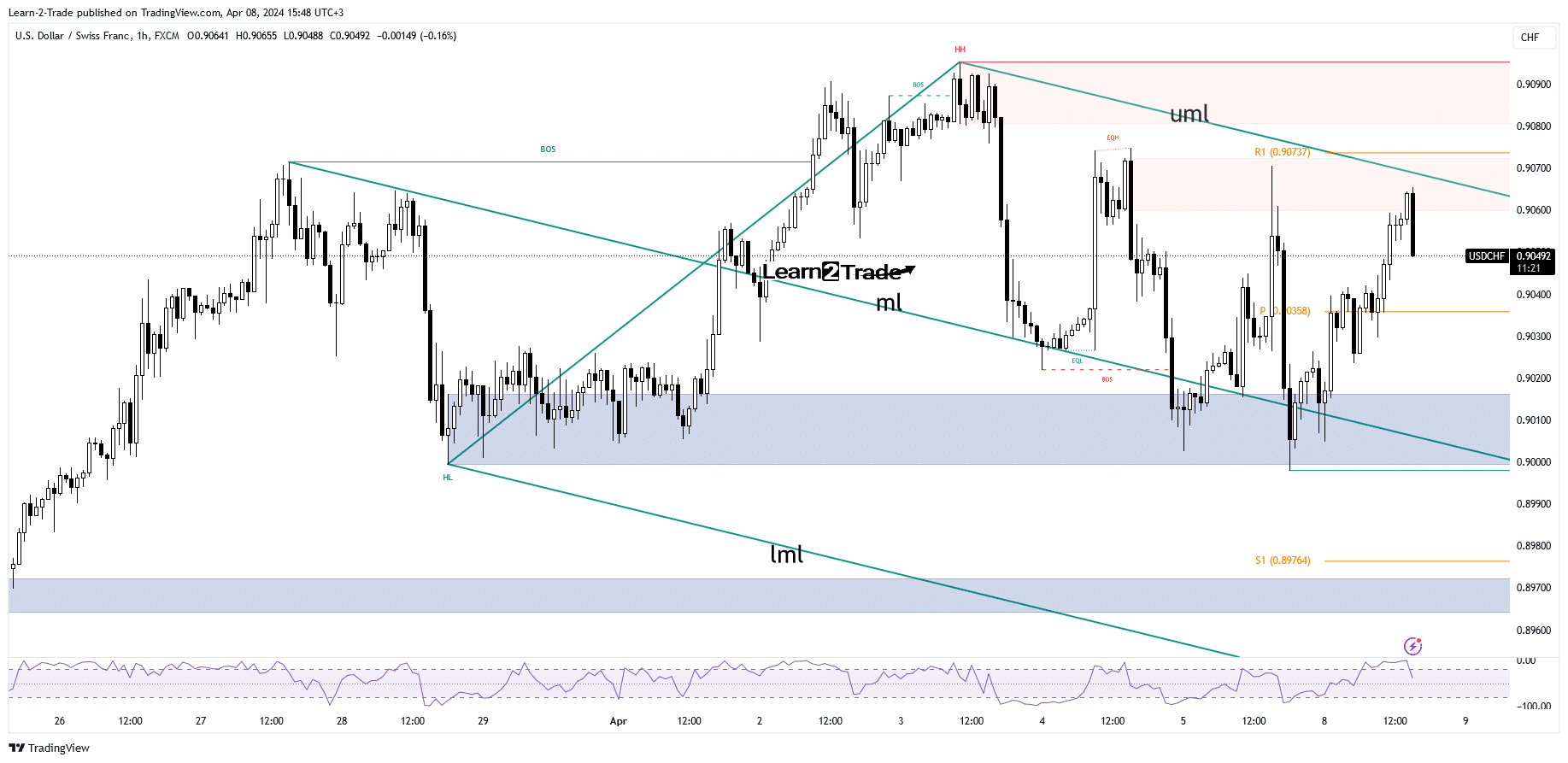

- The USD/CHF pair appears to be overbought after failing to hit the upper middle line.

- Fundamentals could change the mood on Wednesday.

- The failure to take out the 0.9 psychological level heralded exhausted sellers.

USD/CHF rallied slightly on Monday, trading near 0.9050, from Friday’s low of 0.8998. The pair climbed to 0.9065 today. However, buyers could be exhausted after the rally.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

The dollar got a helping hand from the US economy on Friday. Nonfarm payrolls totaled 303,000, compared to 212,000 expected and 270,000 in the previous reporting period. The unemployment rate unexpectedly fell from 3.9% to 3.8%, while average hourly earnings rose 0.3%, in line with expectations.

Today, the unemployment rate in Switzerland jumped from 2.2% to 2.3%, even if traders expected the rate to remain at 2.2%. The US will release the NFIB Small Business Index and RCM/TIPP Economic Optimism tomorrow, but they won’t affect the markets much.

Fundamentals should have a big impact on Wednesday when the US releases inflation data.

The consumer price index is expected to register a 0.3% increase in March, following a 0.4% increase in February, the CPI could post a 3.4% increase from 3.2% in the previous month, while core CPI could register a growth of 0.3%, after a growth of 0.4% in February. Higher-than-expected inflation should boost the US dollar as Fed rate cut speculation could fade.

Technical analysis of USD/CHF price: bullish momentum

Technically, the currency pair rallied after failing to break the psychological level of 0.9000. It only registered a false breakout below this downward barrier. Now it has turned upside down.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

Also, its failure to stay below the median line (ml) revealed exhausted sellers. It should now hit the upper middle line (uml), representing dynamic resistance.

However, sellers retook the lead, retreating from the day’s highs. Failure to hit the upper middle line indicated an overbought situation. However, being near dynamic resistance can herald an imminent breakout and continuation.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.