- Last week, the dollar lost about 1.3% against the yen.

- The news revealed a strong chance of a 50 bps Fed rate cut.

- The Bank of Japan will meet on Friday.

The USD/JPI forecast points to a further decline in the dollar due to rising expectations of a Fed rate cut. At the same time, the yen was on top as investors awaited the Bank of Japan’s policy meeting.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

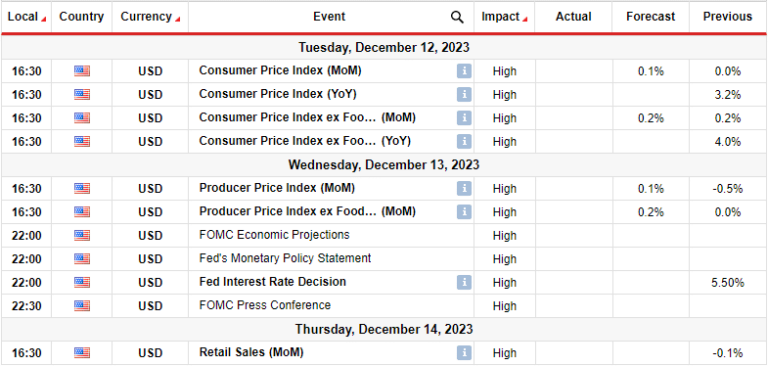

The dollar lost about 1.3% against the yen last week after reports that the Fed may consider a more significant rate cut at this week’s meeting. Initially, markets were confident that policymakers would vote for a 25 basis point cut. Inflation was slightly higher than expected, and the labor market was not in such a dire state. Therefore, the US central bank could afford to start cutting rates slowly.

However, this outlook changed on Friday when news outlets revealed the high chances of a 50 basis point rate cut. Accordingly, investors have moved to value higher odds of such an outcome, weighing on the dollar. By Monday, investors had priced in 59% of a 50 basis point rate cut. At the same time, total reductions in 2024 increased to 125 basis points.

The Fed is poised to cut rates on Wednesday. However, traders are still betting on a rate cut of 25 to 50 bps. Therefore, whatever size the central bank chooses, it is likely to increase market volatility.

On the other hand, the Bank of Japan is scheduled to meet on Friday this week. While the BoJ could keep rates unchanged, the message could be hawkish. Recent remarks by policymakers have shown they are willing to keep raising interest rates.

USD/JPI Key Events Today

With a holiday in Japan and no key events in the US, the price could extend last week’s move.

USD/JPI Technical Forecast: Bullish RSI Divergence Fails

On the technical side, the USD/JPY price made a new downtrend low after breaking below the 141.01 support level. This strengthened the bearish bias as the price fell well below the 30-SMA with the RSI in the oversold region.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Previously, the price paused at the level of 141.01. Here the RSI indicated a bullish divergence, signaling a reversal. However, when the bulls took over, they failed to break the 30-SMA, a sign that the bears remain in the lead. This downtrend could soon reach the support level of 139.02.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money