- Fed policymakers said there was no urgency to start cutting interest rates.

- The probability of a March cut fell to 18.5%.

- Uchida was less hawkish when he said the BoJ would not raise rates aggressively.

Thursday’s USD/JPI forecast was upgraded with a bullish tone as the greenback strengthened following slightly hawkish comments from Fed policymakers. At the same time, the yen found itself on shaky ground as the BoJ’s deputy governor dismissed the likelihood of a quick rate hike.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

Fed policymakers continued to dial back interest rate cut expectations, saying there was no urgency to begin cutting rates. Moreover, when the Fed begins to ease monetary policy, there will be no need to do so quickly.

Accordingly, rate cut bets continued to decline. The latest data shows that the probability of a March cut has fallen to 18.5%. Meanwhile, there is a 60% chance the Fed will cut rates by 25 basis points in May.

On the other hand, views on monetary policy in Japan are different. While traders expect a cut in the US, they expect rates to rise in Japan. However, BoJ Deputy Governor Shinichi Uchida was less hawkish when he said he would not raise rates aggressively.

Still, this is a big departure from the dovish tone of the central bank. There is more hope in the market that Japan will move away from negative interest rates. Moreover, the central bank will begin to ease its massive stimulus.

Furthermore, Uchida said the conditions for exiting negative interest rates are being adjusted. Companies in Japan are raising wages and prices in the service sector. As a result, markets expect the BoJ to start raising interest rates in March or April.

USD/JPI Key Events Today

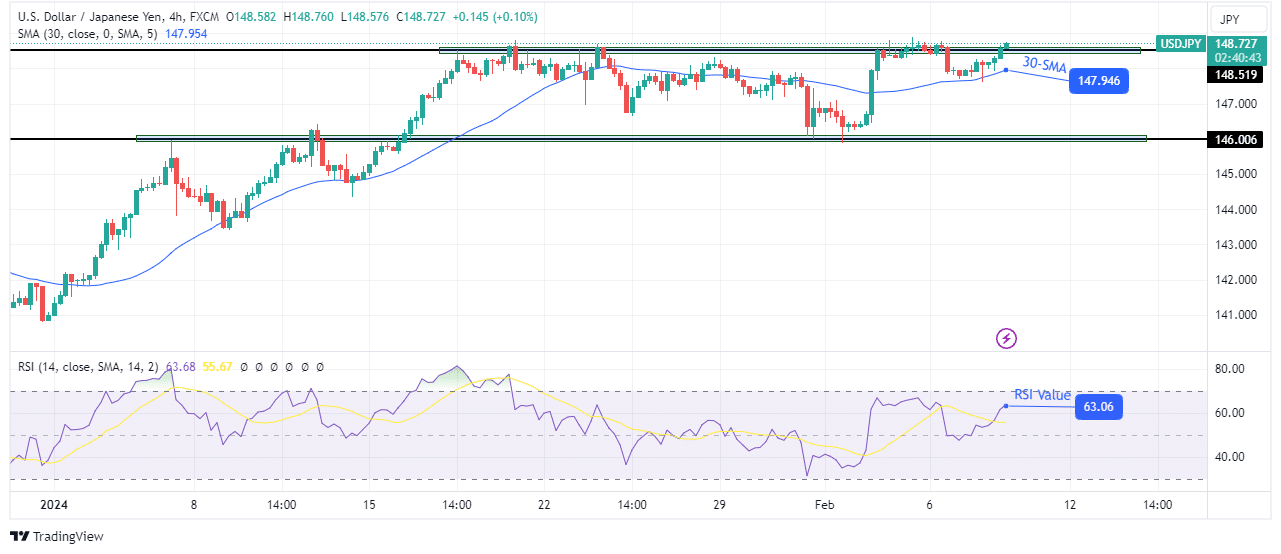

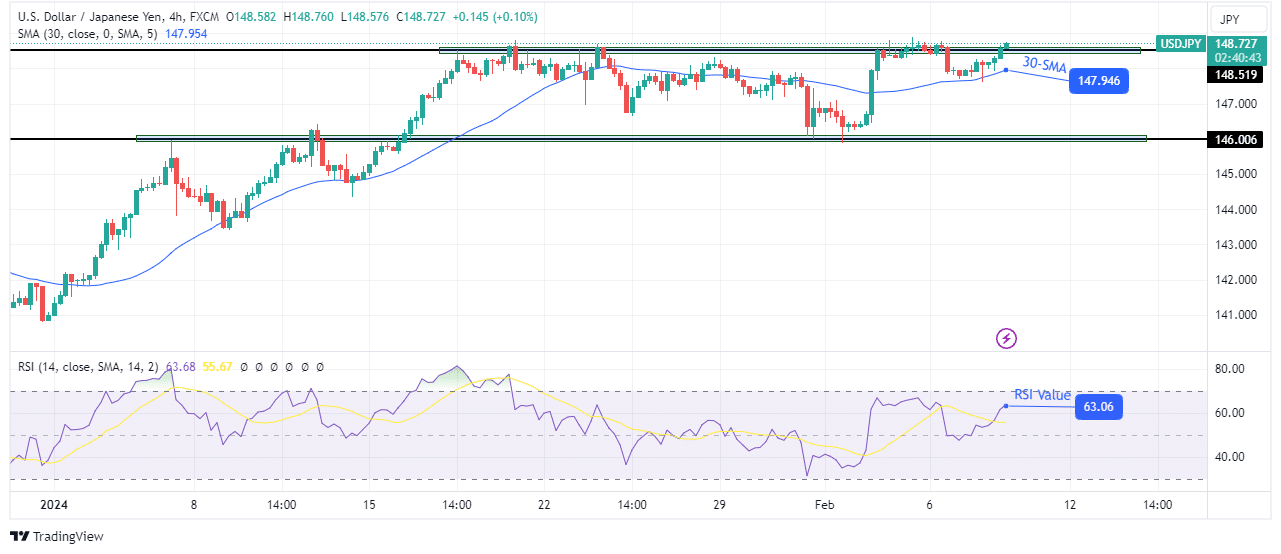

USD/JPI Technical Forecast: Bulls are poised to break the 148.51 barrier

On the technical side, USD/JPI is on the verge of pushing above the 148.51 resistance level. Initially, this level caused a pause in the bullish move, allowing the bears to take control. However, the rally was short-lived as the price found solid support at the key 146.00 level.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

At this level, the bulls came back stronger, pushing the price above the 30-SMA to retest resistance at 148.51. The first attempt failed, prompting a retest of the 30-SMA support. However, the bullish bias remained strong as the price remained above the SMA. At the same time, the RSI remained above 50 in bullish territory.

Therefore, there is a good chance that the price will break above the 148.51 resistance this time.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money