- There is a 39% chance the BoJ will hike on Tuesday.

- The Fed will meet on Wednesday and likely keep rates on hold.

- There is a 57% chance that the Fed will cut interest rates in June.

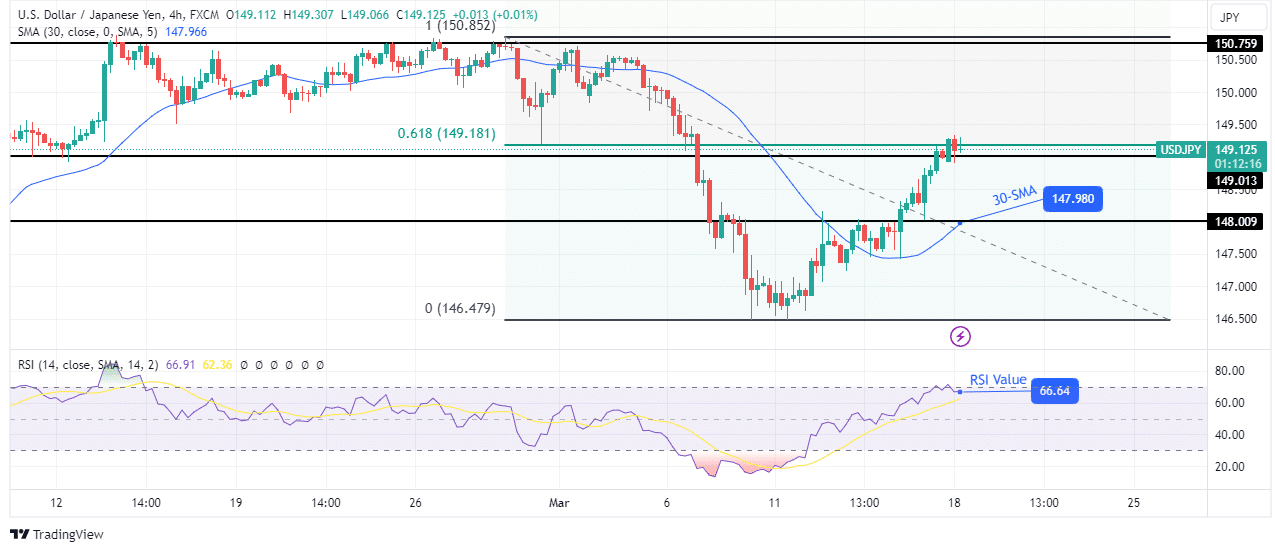

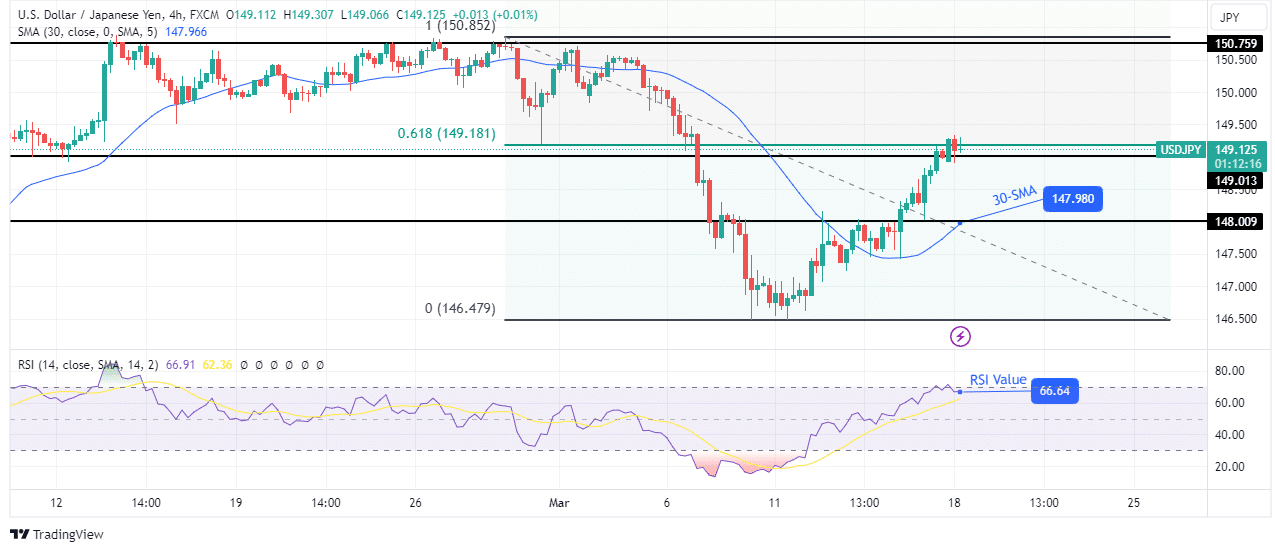

The USD/JPI forecast shows mild upside potential, with the currency steady ahead of central bank meetings in Japan and the US. While the Fed is likely to hold its current rates, all eyes are on the Bank of Japan, with a 39 percent chance of a hike on Tuesday.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

Notably, the dollar strengthened last week on upbeat economic data that weakened the case for the Fed’s rate cut in June. This led to a fall in the yen that extended into this week. When last week began, markets were hopeful that the Fed would cut rates after Powell’s dovish testimony to Congress. However, data during the week revealed higher-than-expected consumer and producer prices, sending rate-cut bets tumbling.

That’s why investors will focus on economic projections and a press conference when the Fed meets on Wednesday. Policymakers may sound less dovish after surprising inflation reports. If that’s the case, the June cut bets will fall further. There is currently a 57% chance that the Fed will cut interest rates in June.

Meanwhile, the outlook for a rate hike in Japan improved on Friday. Companies in Japan have agreed to big wage increases that are likely to pave the way for higher interest rates. The Bank of Japan will meet on Tuesday and there is a chance they will raise rates.

USD/JPI Key Events Today

The pair is likely to consolidate ahead of central bank meetings as there are no key economic announcements today.

USD/JPI Technical Forecast: Price faces strong resistance at 0.618 Fib

On the technical side, the USD/JPI price is trading in a strong resistance zone consisting of key levels of 0.618 Fib and 149.01. Furthermore, the bullish bias is strong, with the price well above the 30-SMA and the RSI near the overbought region.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

However, the price could reverse at a strong resistance zone after such a steep move. However, a pullback would likely retest the 30-SMA support before the bullish move continues higher. If the price breaks above the 0.618 Fib, it could climb to the resistance level of 150.75. On the other hand, the bears could return if the price falls below the 30-SMA.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.