- The Bank of Japan made a significant policy shift when it raised interest rates.

- Market participants shifted their focus to the possible pace and size of future BoJ hikes.

- The dollar ended last week higher as US data revealed a resilient economy.

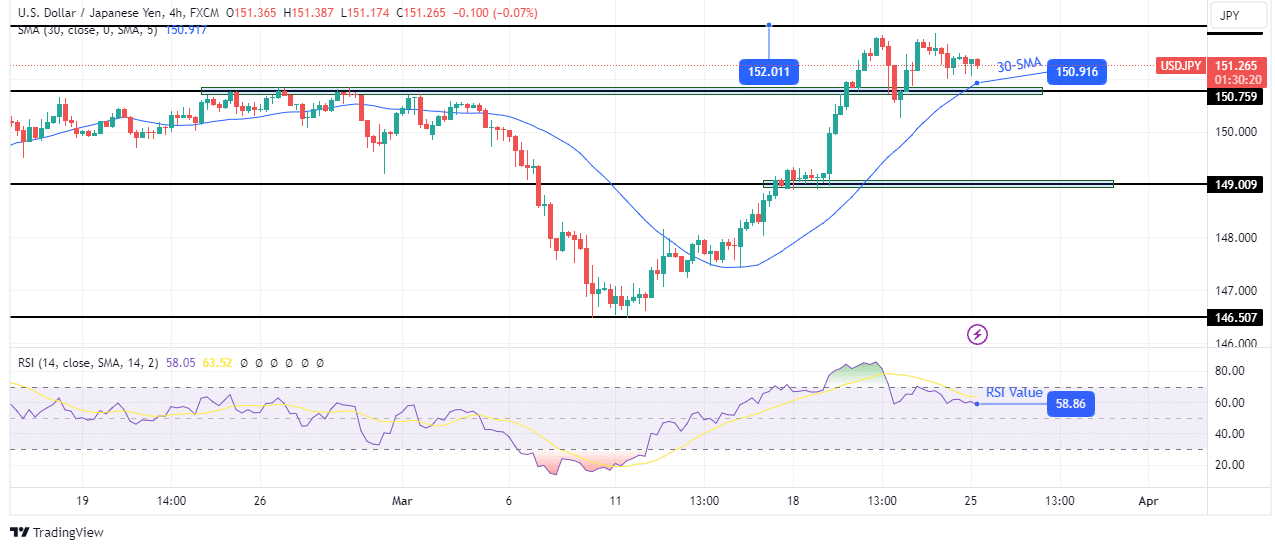

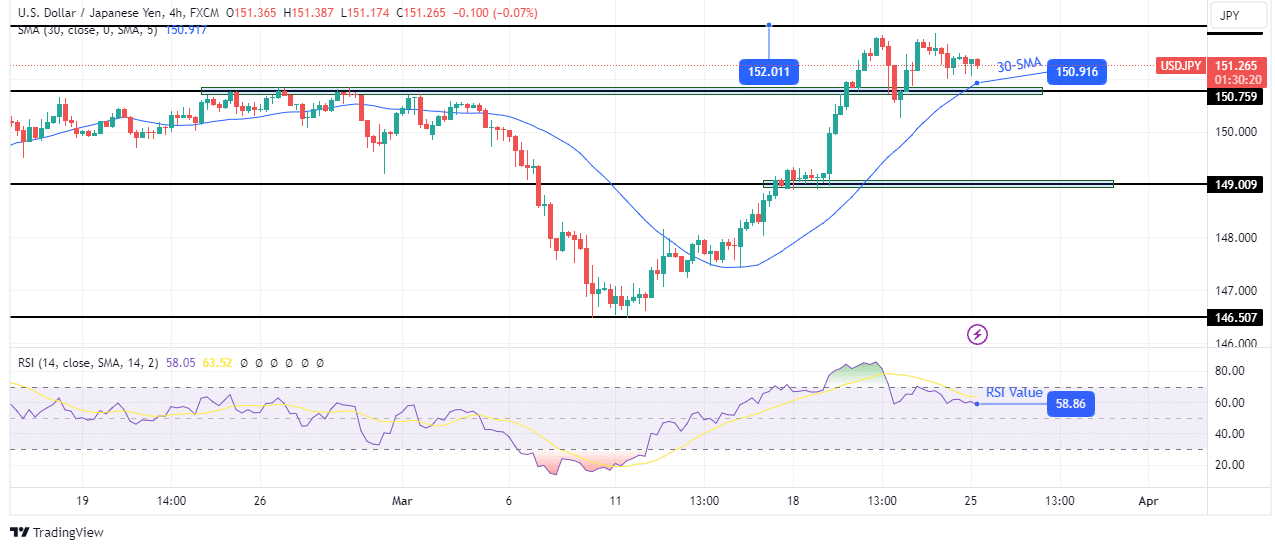

Monday’s USD/JPI forecast is leaning towards bullish territory, with the dollar showing resistance against a softening yen. Even so, the recent rally has been stalled by caution over a potential intervention to strengthen the yen.

-Are you interested in learning about the best AI trading forex brokers? Click here for details –

Last week, the Bank of Japan made a significant policy shift when it raised interest rates. As a result, interest rates moved from negative to positive territory. Ideally, such a move should strengthen the yen. However, markets have already priced in the move. For months, investors have been speculating about the coming policy change, the strengthening of the yen. So it was no surprise when the central bank finally raised rates.

Furthermore, market participants shifted their focus to the likely pace and size of future rate hikes, which was disappointing. Although Japan has started its hiking cycle, markets expect it to be slow and gradual. Consequently, the rate gap between Japan and the US will remain large for some time to come. For this reason, the yen has lost ground, leading to warnings of a possible intervention.

Japanese authorities have warned that the current move is based on speculation rather than evidence. Therefore, there is a high chance of intervention if the yen weakens above the $152.00 mark.

Meanwhile, the dollar rallied on Friday, closing the week with gains as US data revealed a resilient economy. Consequently, there is doubt as to whether the Fed will implement the first rate cut in June.

USD/JPI Key Events Today

The pair could go astray as there are no high-impact events scheduled for today.

USD/JPI Technical Forecast: Bullish growth stops above the 150.75 barrier

On the technical side, the price of USD/JPI paused its rally after breaking the key resistance level of 150.75. The bullish momentum reached its maximum level when the RSI became overbought, allowing the price to stop and pull back. The price pulled back to retest at 150.75 and is yet to make a new high.

-Are you interested in learning more about forex indicators? Click here for details –

However, the bullish bias remains strong as the price is trading above the 30-SMA and the RSI is above 50. Therefore, the price is likely to make a new swing when the 30-SMA catches up. This would retest the 152.01 resistance level, breaking above or bouncing lower.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.