- The yen lost 1.4% against the dollar in June.

- The Bank of Japan has refrained from raising interest rates further due to weak economic demand.

- Investors are gearing up for Friday’s US PCE price index report.

The USD/JPI forecast reveals increasing bullish momentum as the yen moves near $160.00, raising concerns about a possible intervention. Meanwhile, the dollar was steady as investors braced for more U.S. inflation data this week.

–Are you interested in learning more about the next cryptocurrency to explode? Check out our detailed guide-

The yen lost 1.4% against the dollar in June. This decline mainly stemmed from the Bank of Japan’s policy meeting. At the June meeting, the central bank did not reduce bond purchases. At the same time, the currency remained weak due to the interest rate gap between Japan and the US. Accordingly, it is trading near $160.00, which is the line in the sand for the Japanese authorities. This level led to interventions in April and May.

In particular, the Bank of Japan has refrained from raising interest rates further due to weak economic spending, which has kept inflation low. On the other hand, the Federal Reserve has delayed its rate cut. Moreover, it could be reduced only once this year in December. This means that a large rate gap between Japan and the US remains, increasing demand for the dollar at the expense of the yen.

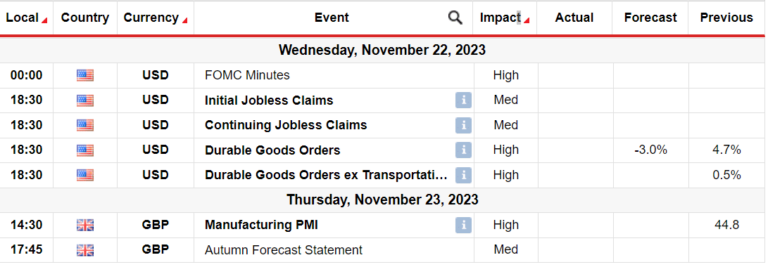

Meanwhile, the US dollar was steady after Friday’s data showed stronger-than-expected expansion in the manufacturing and services sectors. Investors are now gearing up for Friday’s PCE price index report, which will provide more clues about the Fed’s policy outlook.

USD/JPI Key Events Today

Neither the US nor Japan will release any high impact report today. Therefore, trading can be thin.

USD/JPI Technical Forecast: Bulls face a solid resistance zone

On the technical side, the price of USD/JPI rose to the 1,618 Fib extension level. Furthermore, the bullish bias is strong as the price is well above the 30-SMA with the RSI in the overbought region.

–Are you interested in learning more about forex tools? Check out our detailed guide-

However, this bullish move has reached a solid resistance zone consisting of the 1,618 Fib and the 160.01 level. Therefore, there is a good chance that the bears will appear and push the price lower. Such an outcome could lead to a retest of the 30-SMA or bullish trend line. However, if the bulls remain strong, the price will break through this zone, looking for new highs.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.