- Investors are now awaiting a decision from the BoJ on Tuesday to clarify the bank’s rate outlook.

- The dollar fell amid signs of a potential Fed rate cut next year.

- There was uncertainty as to when the BoJ might gradually end its negative interest rate policy.

Monday’s USD/JPI forecast indicated a downtrend, spurred by the start of the Bank of Japan’s (BOJ) two-day monetary policy meeting. Traders eagerly awaited the central bank’s decision, speculating on a potential withdrawal of its ultra-loose policy settings.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Moreover, the currency extended weakness from the previous week after signaling a potential rate cut next year at the Federal Reserve’s policy meeting. Accordingly, the yen strengthened nearly 2% last week as the dollar fell.

Furthermore, the Japanese currency has seen volatility in recent weeks amid uncertainty over when the BoJ might gradually end its negative interest rate policy. Notably, Governor Kazuo Ueda’s comments triggered a significant rally in the yen earlier this month. However, it was later reversed after news reports suggested the policy change might not happen as early as December. Investors are now awaiting a decision from the BoJ on Tuesday to clarify the bank’s rate outlook.

The pair was supported by aggressive rate hikes from the Fed and expectations of sustained higher rates in 2022 and 2023. However, recent comments from the Fed showed the dollar index posted a significant 1.3% decline last week.

Frank Dikmier, global chief investment officer for fixed income at Allianz Global Investors, commented: “The Fed has officially opened the door to the next cycle of interest rate cuts.”

USD/JPI Key Events Today

Investors will await the results of the BoJ policy meeting as there are no high-impact events scheduled for today.

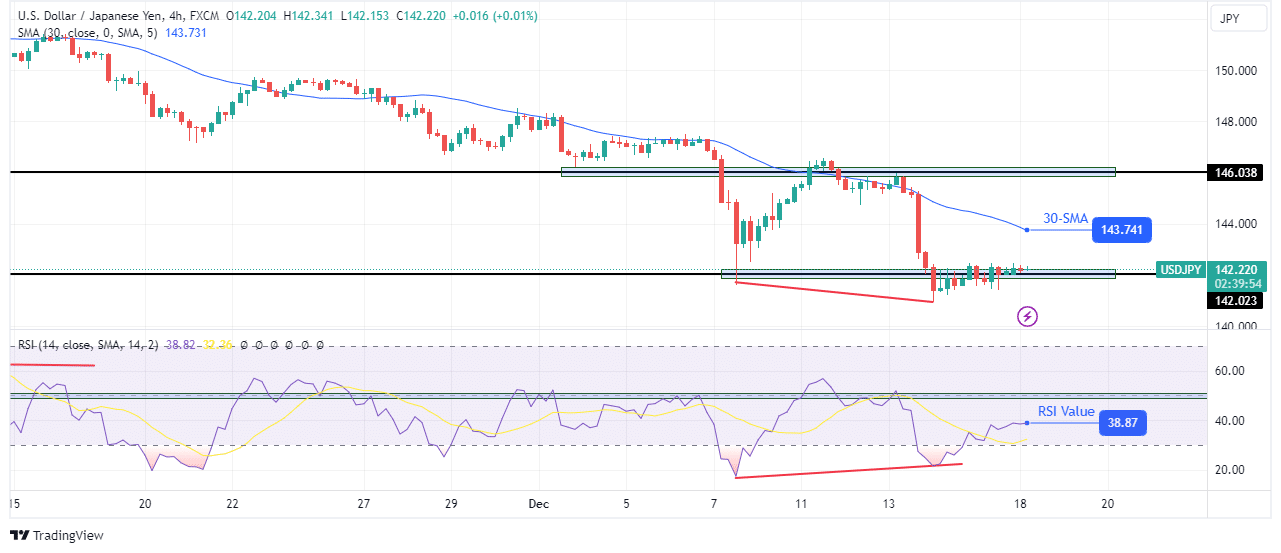

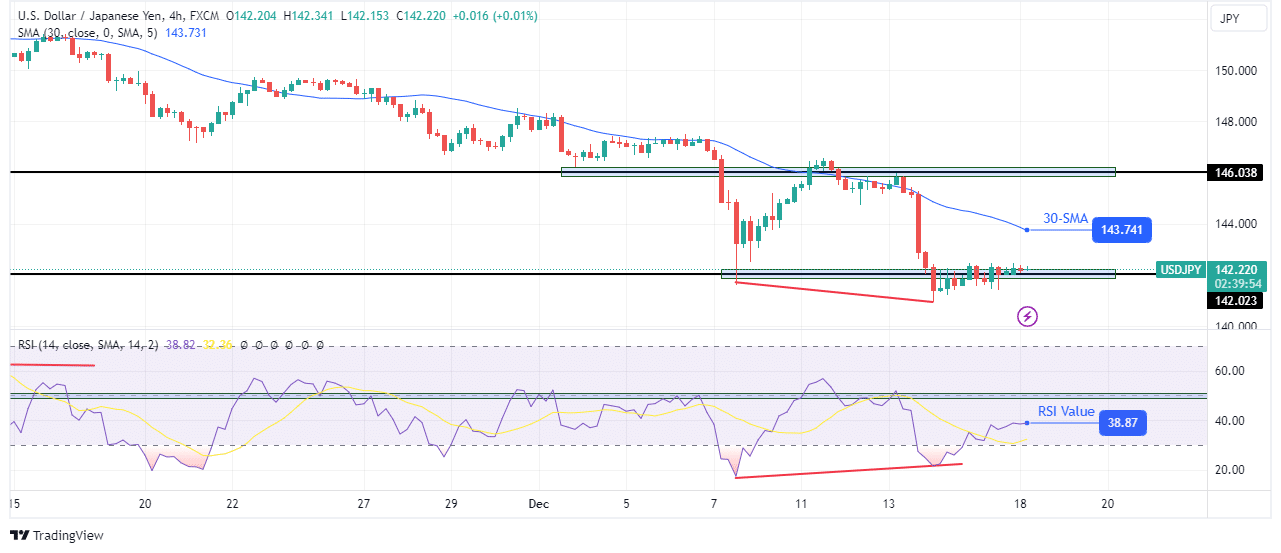

USD/JPI Technical Forecast: 142.02 support remains firm, decline breathtaking

On the technical side, the decline in USD/JPI has been halted near the key support level of 142.02. However, the bearish bias remains strong as the price is well below the 30-SMA and the RSI is below the 50 mark. The recent decline started at the key level of 146.03, where the price respected the 30-SMA resistance.

–Are you interested in learning more about forex tools? Check out our detailed guide-

However, the bears are showing some vulnerability as the RSI made a bullish divergence. Therefore, it shows that the bearish momentum has weakened, which could allow the bulls to trigger a pullback or reversal. The downtrend could continue without a pullback if the bears regain strength. However, in the event of a pullback, the price is likely to stall at the 30-SMA before the downtrend resumes.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.