- Japan’s conditions are aligned for the Bank of Japan to start raising interest rates.

- Policy makers expect significant wage increases in Japan.

- The probability of a Fed rate cut in June has risen above 70%.

The USD/JPI forecast reveals bearish sentiment on Monday, as markets gain confidence that the BoJ could reverse its policy this month. As a result, the yen is gaining against the dollar. At the same time, there is more confidence that the Fed will cut rates in June, weakening the dollar.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

In particular, conditions in Japan are aligned for the Bank of Japan to start raising interest rates. First, the economy is doing much better than expected. Moreover, it avoided recession in the fourth quarter. Second, policymakers expect significant wage increases when wage negotiations conclude on Wednesday. Rising wages put money in consumers’ pockets, fueling consumption and inflation. Accordingly, there is an increasing chance that the BoJ will hike on March 19.

On the other hand, the dollar weakened on Friday after the US jobs report revealed cracks in the labor market. Although US employment rose in February, the unemployment rate beat forecasts, implying weaker demand. Accordingly, the probability of a rate cut in June rose above 70%.

As the BoJ prepares to raise interest rates, the Fed is gaining more confidence that inflation is on a downward trend. Therefore, rates are likely to start falling in the US. Again, the BoJ is playing on the opposite side of the field. This difference in policy has been the main cause of the yen’s recent weakness. However, the current policy divergence could allow the yen to regain most of its lost value.

USD/JPI Key Events Today

It could be a slow day for the pair as the calendar lacks major economic events that could cause volatility.

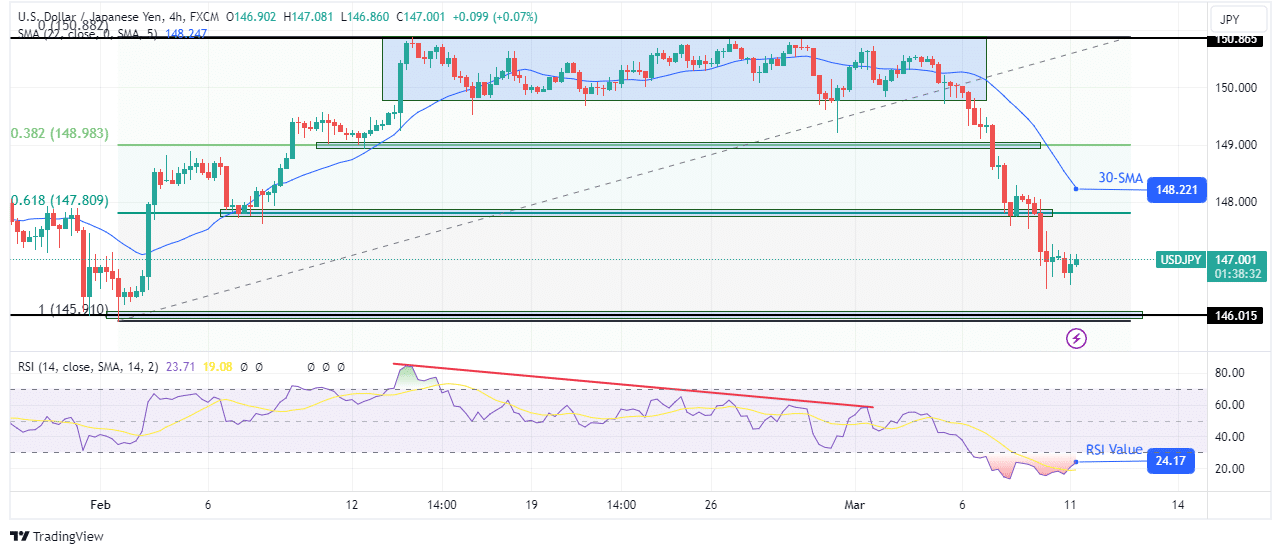

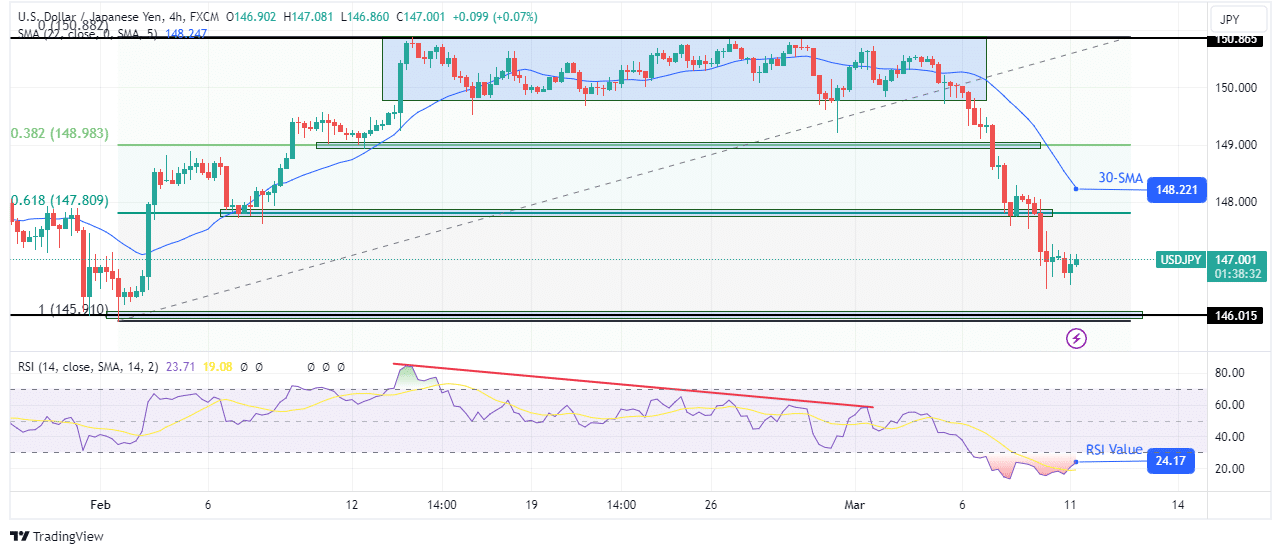

USD/JPI Technical Forecast: Price poised for 100% retracement of previous trend

On the technical side, the USD/JPI price has reached its first and second targets. Therefore, the price could soon return to 100% of the previous uptrend. The price is currently in a steep downtrend, breaking below major support levels without pause.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

The decline is so strong that the price did not pull back even once to retest the 30-SMA resistance. Furthermore, the RSI has entered the oversold region, indicating solid bearish momentum. Therefore, the price could soon reach the key support level of 146.01, which represents a 100% retracement of the previous trend.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money