- The BoJ’s Ueda said it was too early to say that inflation in Japan would soon reach the 2% target.

- Markets remain uncertain about the outcome of the BoJ policy meeting on March 19.

- The dollar was range-bound after falling on Friday on poor economic data.

The USD/JPI forecast is slightly bullish on Monday amid dovish comments from a senior BoJ official last Friday. Meanwhile, weak manufacturing data sent the dollar sideways after Friday’s decline.

–Are you interested in learning more about CFD brokers? Check out our detailed guide-

Bank of Japan Governor Kazuo Ueda said on Friday that he has downplayed hopes for an interest rate hike in March. He said it is too early to say that inflation in Japan will soon reach the 2% target. Therefore, the central bank will likely need more time to assess the state of inflation before reversing its monetary policy.

The most significant indicator of inflation trends in Japan is wage growth. The central bank needs evidence that wages are rising before it will consider raising interest rates. As a result, markets remain uncertain about the outcome of the March 19 policy meeting.

On the other hand, the dollar was mostly range-bound after falling on Friday due to poor economic data. The report found that US manufacturing contracted in February, pointing to a slowing economy. This fueled bets on a cut in interest rates, which was also a sign that high interest rates were slowing the economy. Therefore, the Fed may be more open to cutting rates in June.

USD/JPI Key Events Today

There are no high-impact economic releases on the USD/JPI calendar today. Because of this, the couple could wander off to the side.

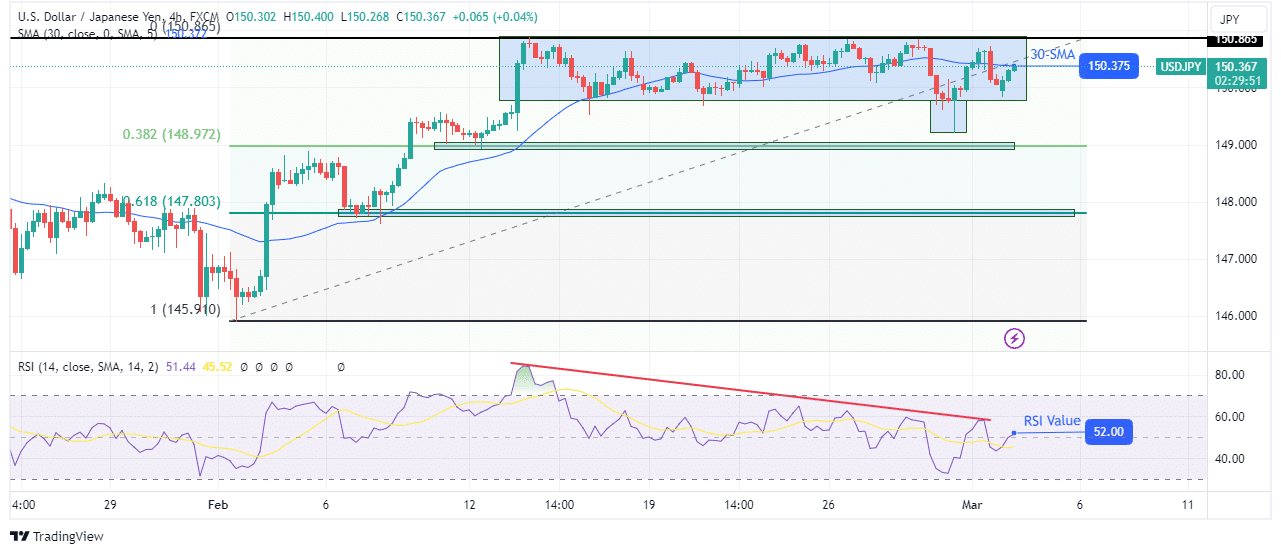

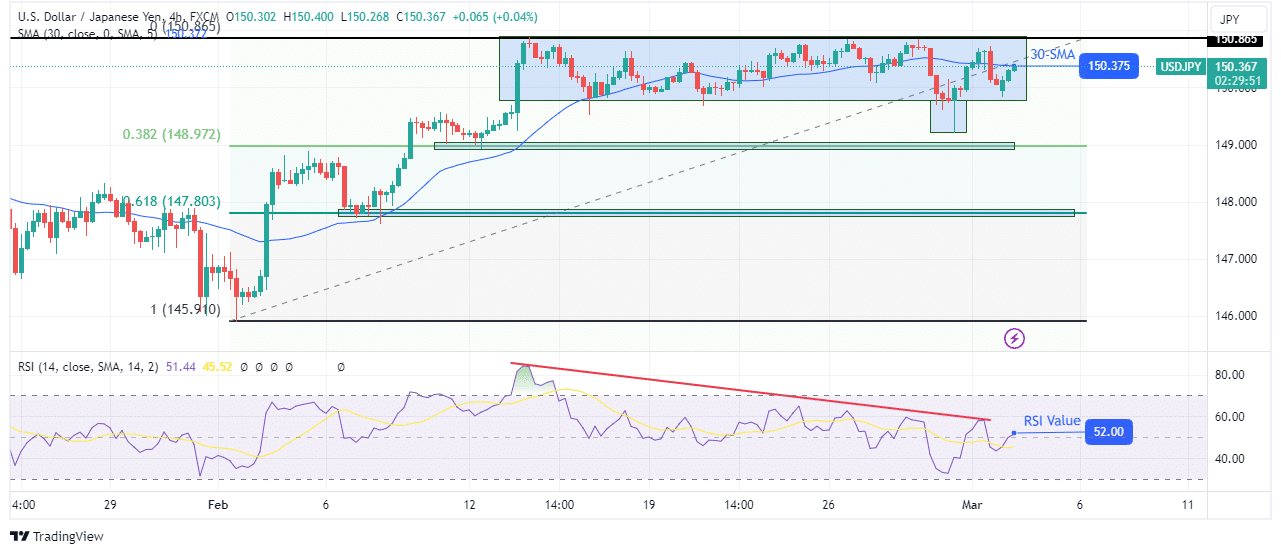

USD/JPI Technical Forecast: Consolidation below critical level of 150.86

On the technical side, the USD/JPY pair remains range-bound below the key resistance level of 150.86. At some point, the price tried to break below the range support. However, it closed within the range, making a large fuse. This is a sign that bulls are not ready to give up control.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

However, the bullish momentum has weakened. It is noticeable that the price is cutting through the SMA and RSI to the 50 mark. This shows the range of the market. Furthermore, the RSI has made a bearish divergence, indicating weaker bullish momentum. If the divergence plays out, the price will collapse to return to the previous bullish move. On the other hand, if the bulls regain momentum, the price could break above 150.86.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.