- Investors believe that the Japanese authorities have intervened to support the yen.

- The interest rate gap between Japan and the US remains wide.

- The core US PCE price index remained at 0.3% compared to the previous month.

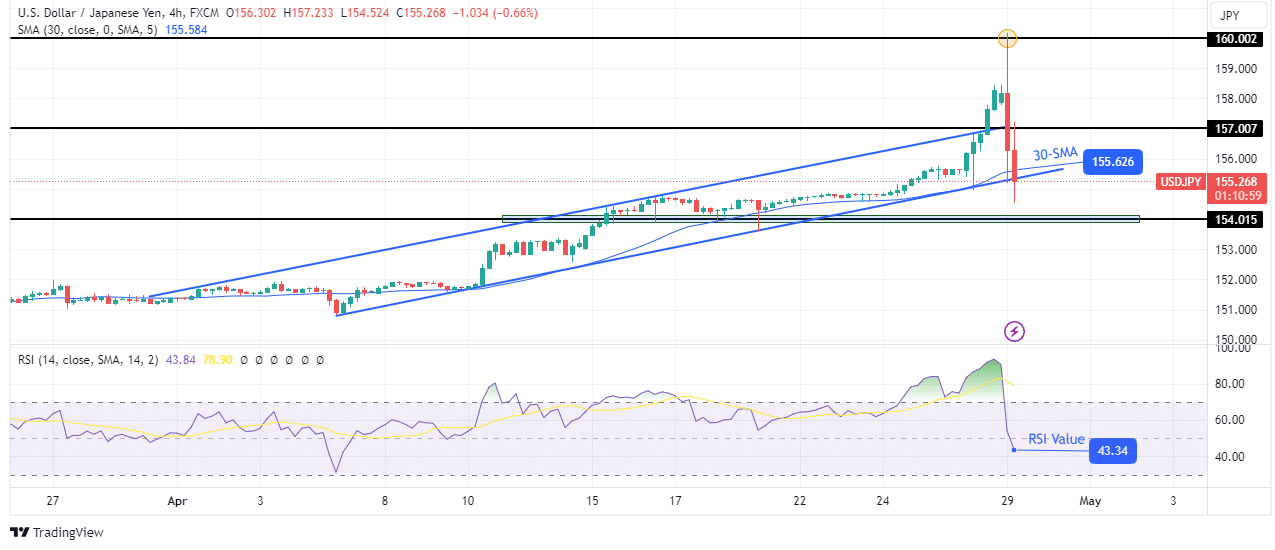

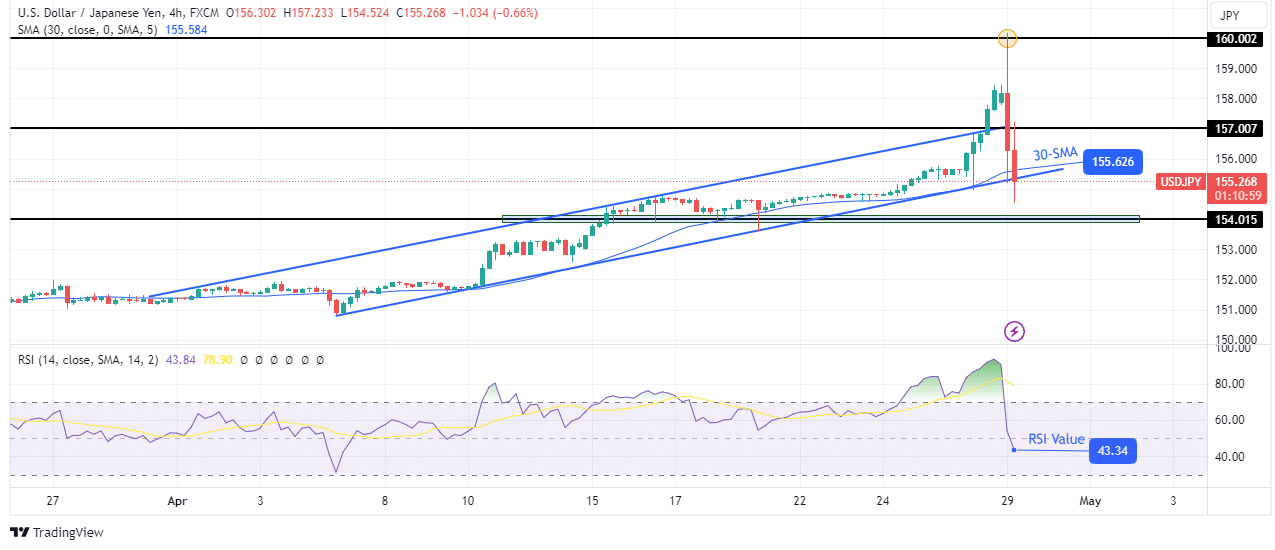

The USD/JPI forecast turned bearish as markets fell from a massive 160.00 amid fears of an intervention. The pair pulled back sharply after breaching the $160.00 level as the yen received a big boost early in the session. Investors believe that the Japanese authorities have intervened by buying yen and selling dollars.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

The recent sharp drop to $160 came after the Bank of Japan’s policy meeting on Friday. The central bank kept interest rates on hold and gave little information about future rate hikes. As a result, investors were disappointed. The hiking cycle in the BoJ is likely to be slow and gradual.

Therefore, the interest rate gap between Japan and the US will remain wide. This gap is the reason for the yen’s recent weakness. Notably, the currency has lost nearly 11% against the dollar in 2024. Although the BoJ raised rates for the first time last month, they signaled a less aggressive policy than expected.

Meanwhile, economic data has remained strong in the US and inflation is stubborn. The latest inflation report was the core PCE price index, which was up 0.3% from the previous month. Although it was in line with expectations, it showed that the fall in inflation has stalled. As investors prepare for the Fed’s meeting this week, they expect policymakers to continue delaying cuts until data show inflation easing.

USD/JPI Key Events Today

Investors are not expecting big impact economic news from Japan or the US today. Therefore, the couple may continue to respond to a possible intervention.

USD/JPI Technical Forecast: A sudden surge in bearish momentum threatens the uptrend

On the technical side, the price of USD/JPI broke above its bullish channel before falling sharply. A break above the channel indicated that the bulls are ready to start a steeper trend. However, the bears rejected such a move by reversing direction at the key psychological level of 160.00.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Despite the increased volatility, the price remained above the channel support. However, it broke below the 30-SMA and the RSI below 50. This indicates a change in sentiment that could soon see the trend reverse. Moreover, the bears could retest the support level of 154.01.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.