- The yen fell 2.5% against the dollar in the first week of the year.

- Traders are pricing in less than 140 basis points of a Fed rate cut.

- Economists predict the creation of 170,000 jobs in the US in December.

On Friday, the USD/JPI outlook was upbeat, buoyed by the dollar’s impressive weekly performance as it posted its strongest week since July. This increase comes amid diminishing expectations for imminent and significant interest rate cuts. However, there was caution in the market ahead of expected US wages data later in the day.

If you are interested in automated Forex trading, check out our detailed guide-

The strong dollar overshadowed the Japanese yen, which experienced a 2.5% decline against the dollar in the first week of the year. That’s the weakest weekly performance since August 2022.

Minutes from the December policy meeting show that policymakers are prepared to keep borrowing costs high for a longer period. Accordingly, some speculators have already trimmed their bets on an aggressive Fed rate cut this year.

Despite the Fed’s previous forecast of a 75 basis point rate cut in 2024, market expectations have eased since the start of the year. Traders are now pricing in less than 140 basis points. Moreover, the probability of a March cut decreased from 86% to 65% within a week.

However, the dollar’s recovery faces a test with the upcoming non-farm payrolls report. Economists expect 170,000 jobs to be created in December, down from 199,000 in November.

Elsewhere, data on Thursday showed that US private employers hired more workers than expected in December, pointing to continued strength in the labor market.

USD/JPI Key Events Today

- Average hourly earnings in the US

- The change in US non-farm employment

- Unemployment rate in the US

- US ISM services PMI

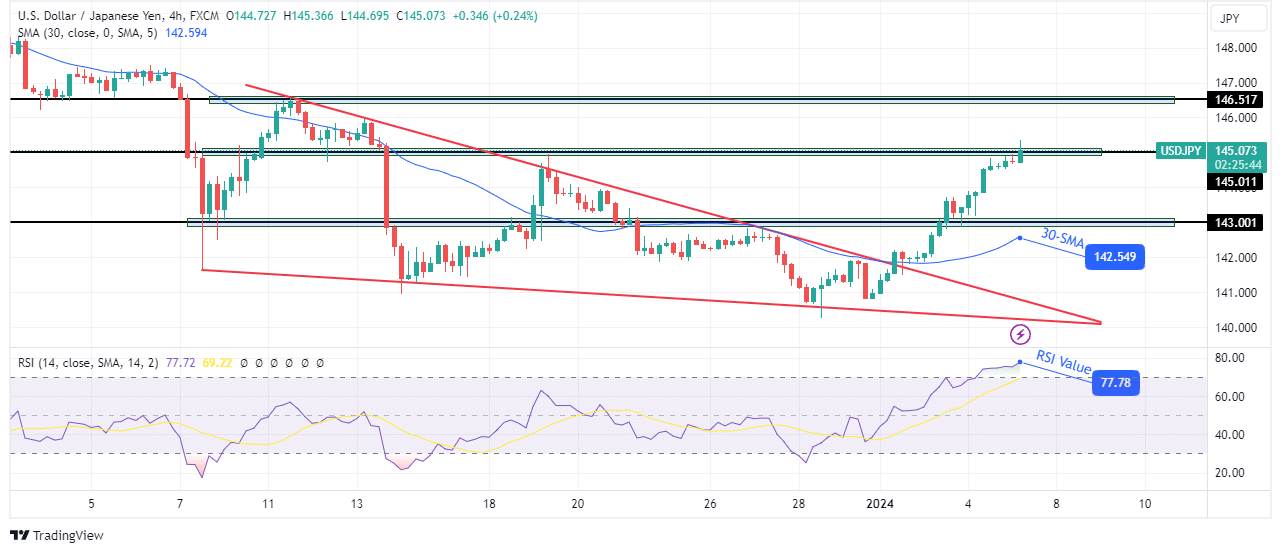

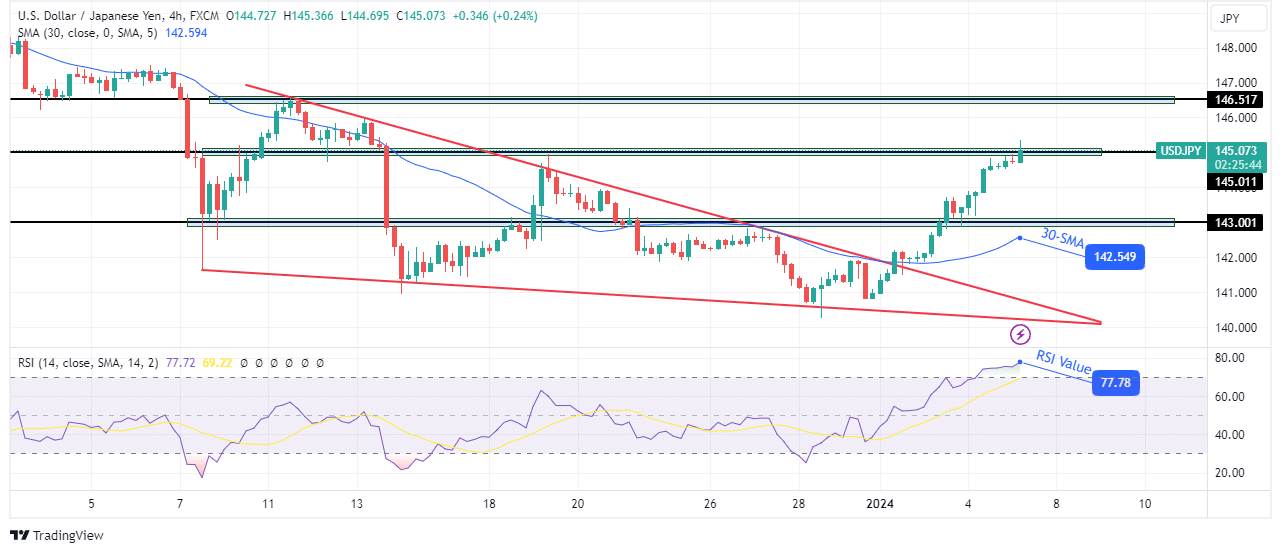

USD/JPI Technical Outlook: Bullish momentum builds after descending triangle

On the charts, the bias for USD/JPI is bullish. Cena made a steep bullish move after breaking out of the descending triangle. Furthermore, the RSI is overbought and the price has left the 30-SMA well below, showing strong momentum. With this recent move, the price broke above the key resistance level of 143.00 and rose to retest the key resistance level of 145.01.

If you are interested in guaranteed stop loss forex brokers, check out our detailed guide-

However, after such a sharp move, the bulls could be exhausted. Therefore, the price is likely to pause at 145.01 and pull back as the SMA catches up. Still, the new direction is promising, and the bulls are likely to break above 145.01 to retest the resistance at 146.51.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.