- The USD/JPI pair rose well above the $152 level.

- Haven demand for the dollar increased after Iran attacked Israel over the weekend.

- Investors are now watching the $155 level for possible intervention.

The USD/JPI outlook is strongly bullish as the greenback rises after expectations of a Fed rate cut ease and safe-haven demand rises. Investors continued to reduce bets on a rate cut after last week’s inflation report. At the same time, Middle East tensions have increased demand for the safe-haven dollar.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

The USD/JPI pair rose well above the $152 level, raising concerns that the Japanese authorities will intervene. The rally began when investors realized the Fed would delay cutting interest rates until September. Last week’s CPI report significantly boosted the dollar and Treasury yields. As a result, the yen weakened.

Namely, Japanese Finance Minister Shunichi Suzuki said that they are ready to act to stop the further fall of the yen. Accordingly, investors are now watching the $155 level as a line in the sand.

Moreover, sales data will show whether US consumer spending has increased. Another positive report is likely to boost the USD/JPI pair.

Meanwhile, safe-haven demand for the dollar rose after Iran attacked Israel over the weekend. This could mean an escalation of the war in Iran, which has caused concern in the market. In times of geopolitical uncertainty, investors scramble for safety in safe-haven assets. However, the Iranian attack on Israel caused less damage. Moreover, Iran said it had concluded the matter with Israel.

USD/JPI Key Events Today

- Basic US retail

- Empire State Manufacturing Index

- retail in the US

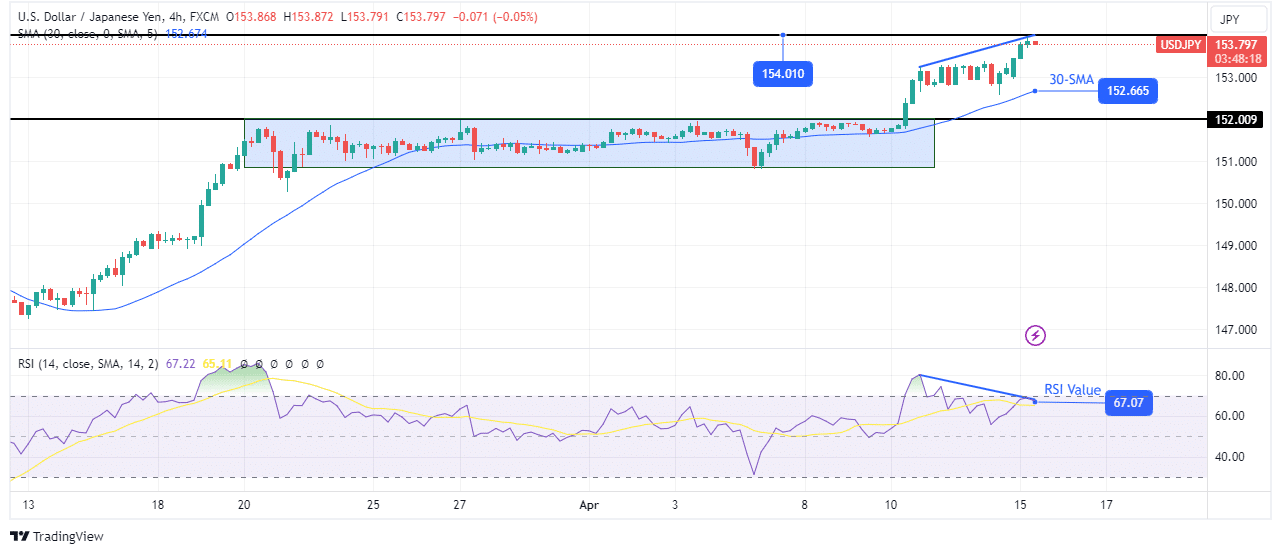

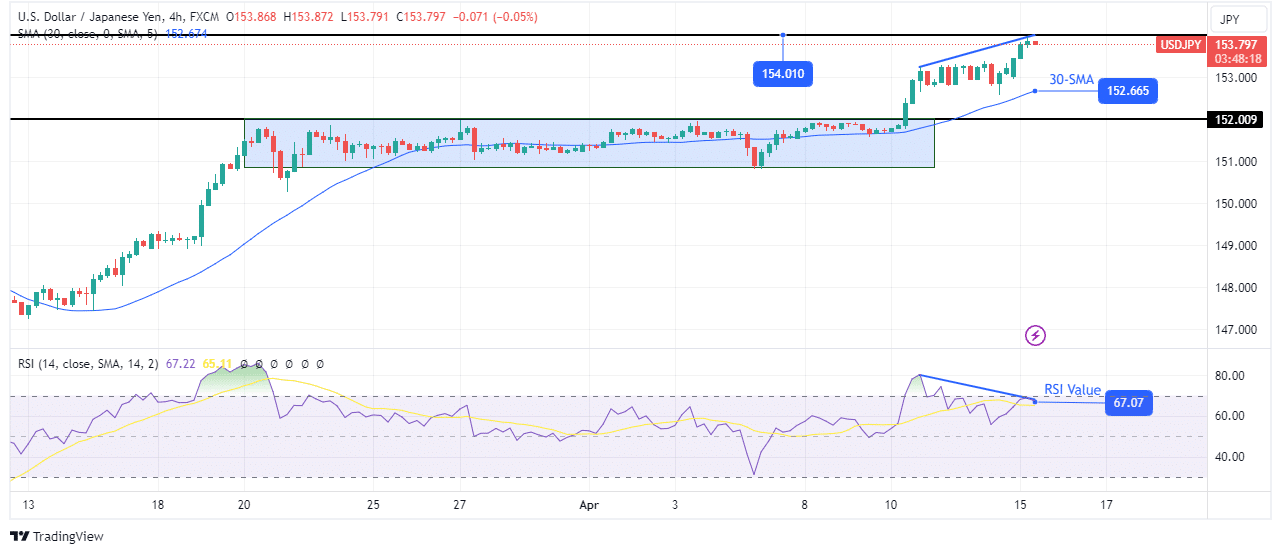

USD/JPI technical outlook: RSI divergence

On the charts, the USD/JPY price has broken out of its tight consolidation, signaling a continuation of the previous bullish trend. The price is now well above the 30-SMA and the RSI is almost overbought. Bulls are likely to reach the resistance level of 154.01 soon.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

However, the recent bounce shows weaker momentum as the RSI made a bearish divergence. If it plays out, the price will retest or break below the 30-SMA to retest the key 152.00 level. A retest of the SMA could allow the bulls to make another high. However, a break below the SMA would signal a change in sentiment. Therefore, it would probably lead to lower prices.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.