- The yen weakened as markets cut expectations for an aggressive rate hike by the BoJ.

- The dollar held on to Thursday’s gains.

- The probability of a Fed rate cut in March fell to 16.5%.

The USD/JPI outlook was bullish as the currency pair climbed to a 10-week high, boosted by a resilient dollar and a weakening yen. The yen weakened as markets lowered expectations of an aggressive rate hike by the Bank of Japan starting in March. On the other hand, the dollar held on to Thursday’s gains after an upbeat jobs report.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

Yen weakness returned as the market overestimated the pace and size of rate hikes following the BoJ’s policy shift. BoJ policymakers recently scaled back these expectations, saying the turnaround could be slower than previously thought.

BoJ Deputy Governor Uchida on Thursday dismissed expectations that the central bank will aggressively raise interest rates. Moreover, on Friday BoJ Governor Ueda said monetary conditions are likely to remain easy even as the bank moves to raise interest rates.

As the yen falls, $152 becomes a target again. Therefore, the Japanese authorities may begin to warn of a possible intervention. Namely, Japanese Finance Minister Suzuki said on Friday morning that he is closely monitoring the movement of the currency.

Meanwhile, the dollar was on course for a fourth week of gains as US data continued to point to a strong economy. Initial U.S. jobless claims fell more than expected last week, indicating strength in the labor market.

By Friday, the probability of a Fed rate cut in March had fallen to 16.5%, down from 65.9% a month ago.

USD/JPI Key Events Today

There will be no high-impact economic reports from the US or Japan today. Therefore, it can lead to weak trading for the pair.

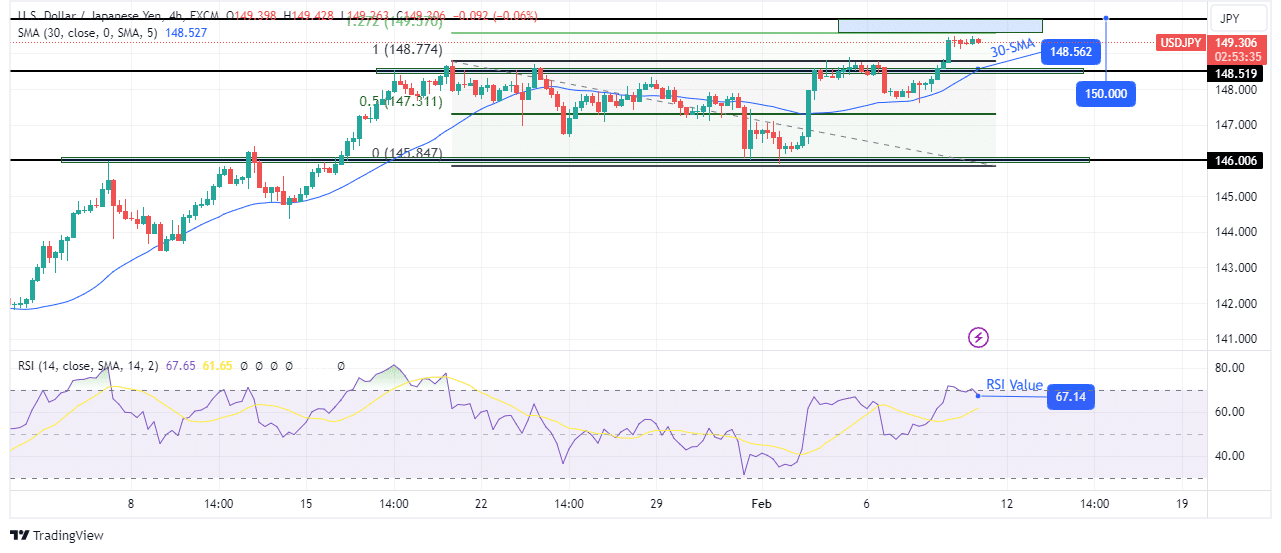

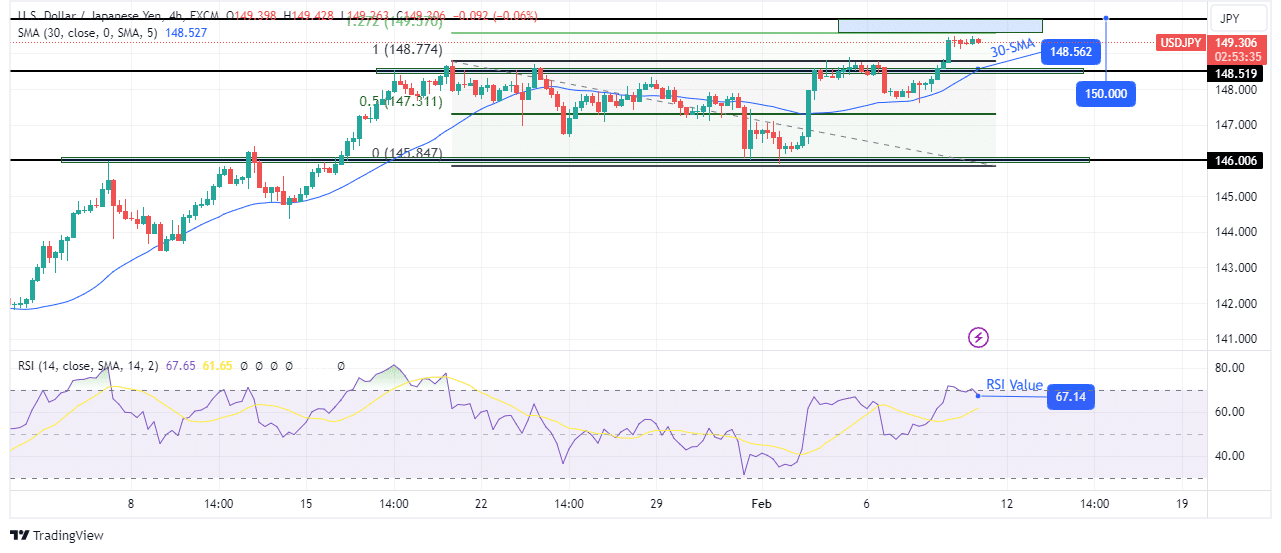

USD/JPI Technical Outlook: Bullish momentum breaks the 148.51 resistance level

On the technical side, USD/JPI has breached the 148.51 resistance level, indicating an increase in bullish momentum. This matched the conditions for a bullish trend. First, price made a higher low and high. Second, it respected the 30-SMA as support. Finally, the RSI is trading near overbought levels, showing solid bullish momentum.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

However, the price could soon pull back as it nears a solid resistance zone. Just above the current price level is the 1.27 fib extension and key 150.00 levels. This resistance zone could temporarily pause the rally.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money