- On Tuesday, the Bank of Japan raised interest rates for the first time in 17 years.

- BoJ Governor Kazuo Ueda has vowed to maintain ultra-easy monetary conditions.

- The dollar weakened after Powell maintained his dovish stance.

Today’s USD/JPI outlook is bullish, with the yen weakening in response to BoJ Governor Ueda’s promise to stimulate the economy, meaning continued ultra-easy monetary conditions. Moreover, despite the recent policy shift, markets expect the BoJ to slow further rate hikes.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

On Tuesday, the Bank of Japan raised interest rates for the first time in 17 years. This was a monumental shift from years of negative interest rates and dovishness. However, investors have already weighed in on such a move. Accordingly, the yen fell after the policy meeting and weakened.

Moreover, despite Tuesday’s rate hike, BoJ Governor Kazuo Ueda vowed to maintain ultra-easy monetary conditions to support the economy. However, he noted that inflation is rising and that the central bank will increase again if necessary.

In addition, markets are now seeing a slower-than-expected BoJ hike cycle. A more aggressive move would support the Japanese currency. However, the yen weakened despite the dollar’s recent weakness. The weakness has raised concerns in Japan, with the finance minister warning that the government is closely monitoring foreign exchange markets.

On the other hand, the dollar weakened after Powell maintained his dovish stance. In particular, the Fed kept rates on hold at the meeting and forecast a resilient economic performance in 2024. Moreover, Powell claimed that the central bank will cut three times this year. Initially, the dollar weakened, allowing the yen to recover. However, this was only temporary.

USD/JPI Key Events Today

- First jobless claims in the US

- US manufacturing PMI

- US flash services PMI

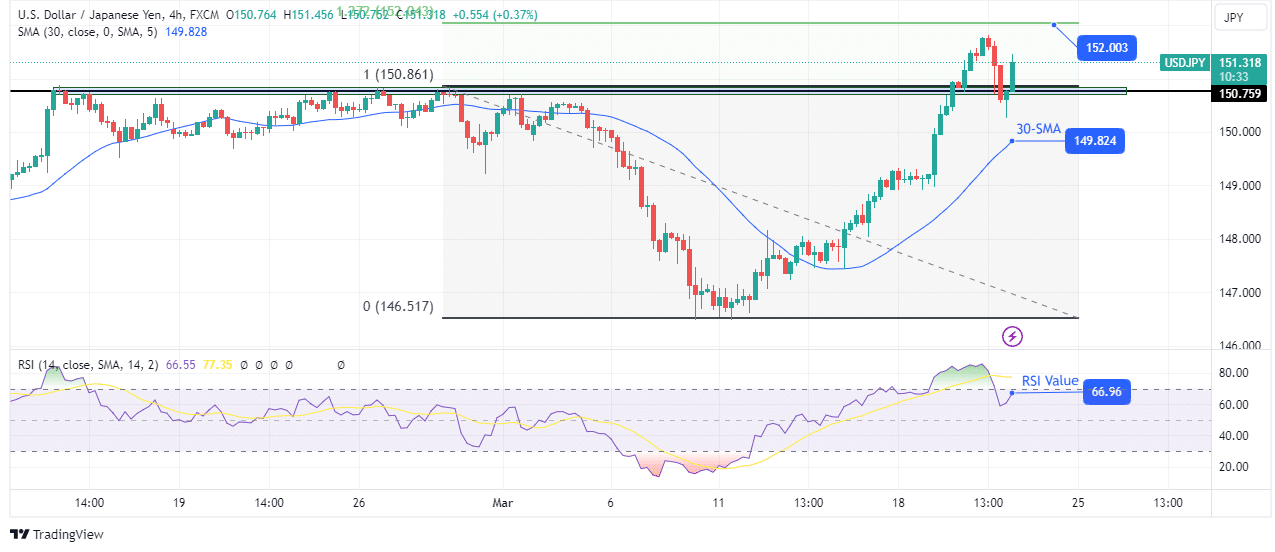

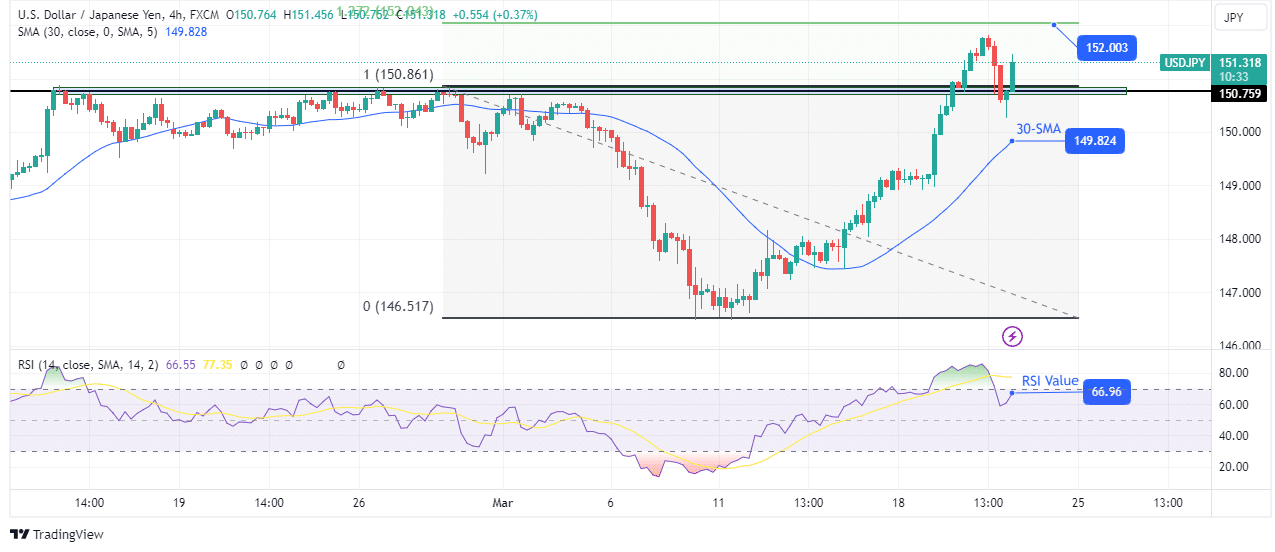

USD/JPI Technical Outlook: Buyers emerge after retest at 150.75.

On the technical side, USD/JPI is in a strong bullish trend, with the price remaining above the 30-SMA. Meanwhile, the RSI has been rising continuously since breaking above 50, reaching the overbought region. The price recently broke above the strong resistance level at 150.75 and pulled back to retest the level.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

At the moment, the price is jumping higher after retesting the key level of 150.75. Therefore, he could make a higher maximum. The next strong resistance is at the 1,272 Fib extension and 152.00 key levels. The price could pause or break above this level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.