- Recent remarks by the Bank of Japan have shown the increasing urgency to strengthen the weak yen.

- The BoJ’s Ueda said the central bank would focus on incoming data ahead of its December meeting.

- The dollar weakened as market participants awaited new developments in the US.

The USD/JPI outlook points to growing enthusiasm among yen bulls following recent hawkish remarks from BoJ policymakers. Meanwhile, the dollar weakened from recent peaks as traders awaited new US policy and monetary policy developments.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

Recent remarks by the Bank of Japan have shown the increasing urgency to strengthen the weak yen. BoJ Governor Kazuo Ueda noted that rising wages would fuel inflation, allowing the central bank to continue raising interest rates. He said on Thursday that the central bank would focus on incoming data ahead of its December meeting to decide whether to raise interest rates.

Furthermore, policymakers will focus on the effects of a weak yen on the Japanese economy. The comments boosted the yen as markets see an increasing likelihood that interest rates in Japan will rise in December.

Ahead of the US election, a Reuters poll showed most economists expect the Bank of Japan to pause in December and hike next March. However, Trump’s victory changed the outlook for US monetary policy. Markets expect fewer interest rate cuts by the Fed, which will keep the dollar strong. Consequently, further yen weakness puts more pressure on Japan to raise interest rates.

Meanwhile, after a solid Trump rally, the dollar weakened as market participants awaited further developments in the US. On the other hand, Fed policymakers took a more hawkish tone, lowering expectations of a rate cut. However, economists still believe the central bank will cut rates in December.

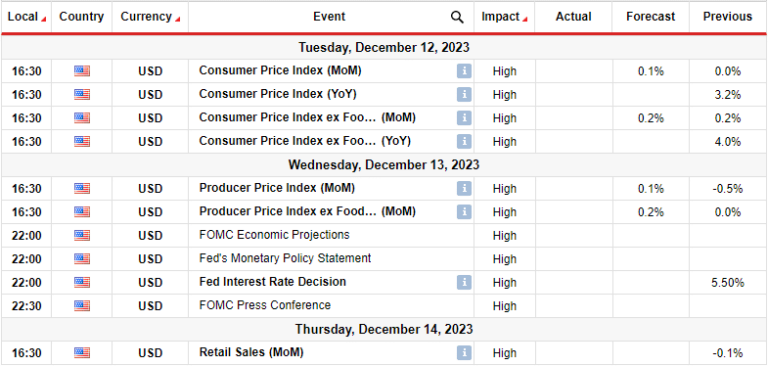

USD/JPI Key Events Today

USD/JPI Technical Outlook: Lower highs revive bears

From the technical side, USD/JPY price broke well below the 30-SMA, indicating that control has shifted from the bulls to the bears. At the same time, the price broke the support level of 154.51. Meanwhile, the RSI has fallen into sub-50 territory.

–Are you interested in learning more about leveraged brokers? Check out our detailed guide-

Initially, the price broke below its bullish trend line after the bearish momentum built up. However, the bulls managed to regain control. Unfortunately, they only hit a lower high, indicating weaker momentum. Accordingly, the bears are back and ready to break below 154.51. Such an outcome would allow USD/JPI to revisit the 151.74 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money