- Japanese authorities were concerned when the yen fell to a 34-year low on Wednesday.

- Suzuki reiterated his warning that he would react to any excessive currency swings.

- The dollar was on the back foot on Monday as bets on a Fed rate cut rose.

The outlook for USD/JPI is slightly bearish as the yen shows modest recovery amid persistent pounding from Japanese warnings to curb currency depreciation. At the same time, the yen found some relief as the dollar lost ground as bets on a Fed rate cut increased.

–Are you interested in learning more about low spread forex brokers? Check out our detailed guide-

Investors were cautious while trading USD/JPI, fearing a possible intervention from last week. Japanese authorities were concerned when the yen fell to a 34-year low on Wednesday. As a result, they made it clear that they would take the necessary measures to contain the yen’s further decline.

The most recent intervention occurred in 2022, when the pair reached the $152 mark, which sent USD/JPI down. The currency retreated on Monday as Finance Minister Shunichi Suzuki reiterated his warning that he would react to any excessive currency swings.

Meanwhile, the dollar was on the back foot on Monday as bets on a Fed rate cut rose after Friday’s inflation report. The core PCE price index revealed a drop in inflation from 0.5% to 0.3%. Powell noted that the reading supports their view that inflation is on the decline. Accordingly, traders increased the likelihood that the central bank will cut interest rates in June to 68.5%. The next big report is this month’s non-farm payrolls.

USD/JPI Key Events Today

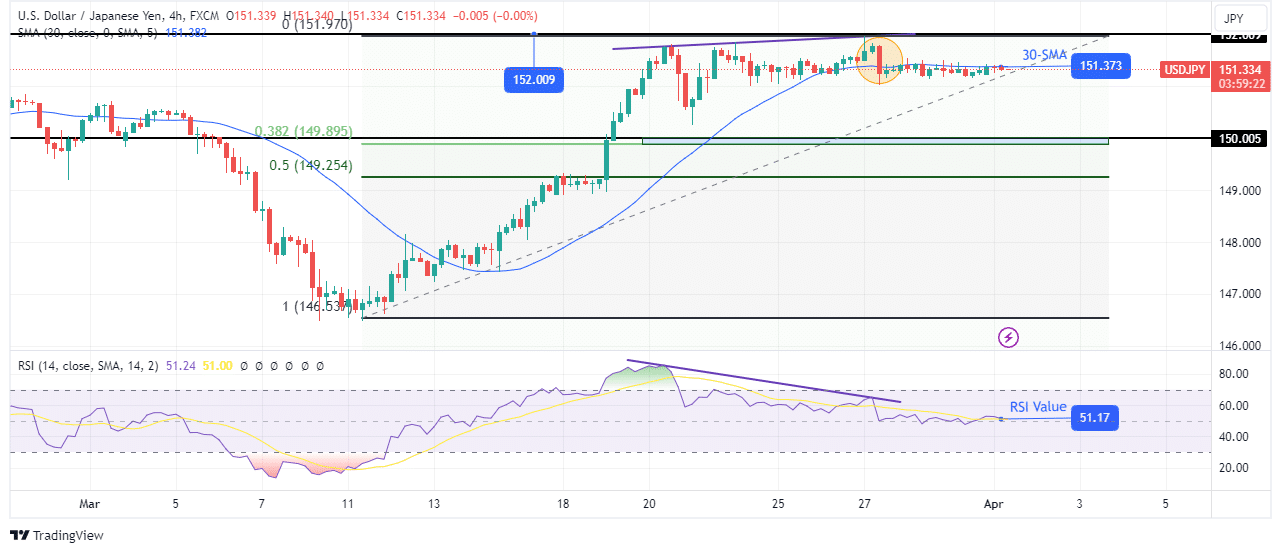

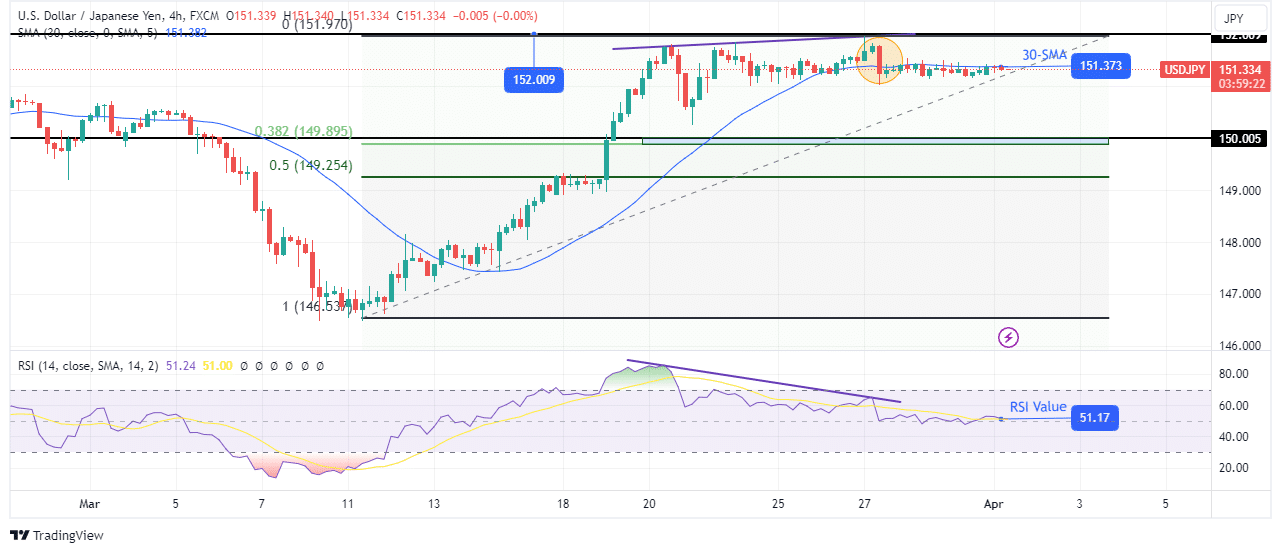

USD/JPI Technical Outlook: Bears struggle for control below 30-SMA

On the charts, the USD/JPI price is trading in a tight range, just below the 30-SMA. Meanwhile, the RSI is consolidating just above the central level of 50. This is a sign that bears and bulls are fighting for control at this level. This comes after the previous bullish trend paused at the 152.00 resistance level.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

Notably, the break revealed the weakness of the bulls, as they could no longer make large swings above the SMA. At the same time, the RSI made a bearish divergence, highlighting the weakening of the bullish momentum. Moreover, the price made a bearish, engulfing candle.

Consequently, there is a greater chance that the bears will win the current battle. If this happens, the price is likely to fall to retest the key 150.00 level and the 0.382 Fib retracement level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.