- The dollar was weak as US markets remained closed for the holiday.

- The yen fell by about 6% in 2024 on falling expectations of a US rate cut.

- Some experts believe the Fed will fail to achieve a soft landing.

The USD/JPY outlook is slightly tilted on Monday, with the Yen showing modest recovery from recent lows. At the same time, the dollar showed weakness, considering the closure of US markets for the holidays.

–Are you interested in learning more about automated Forex trading? Check out our detailed guide-

However, the pair remains close to $150.00, keeping investors wary of the possibility of intervention by Japanese authorities. Officials from the Ministry of Finance of Japan have repeatedly warned of a fall in the currency.

Notably, the yen fell by around 6% in 2024 due to falling expectations of a US rate cut. Data from the US in recent months have shown a resilient economy. Moreover, last week’s inflation data was higher than expected, underscoring the need for high interest rates in the US. As a result, the likely timing for the Fed’s first rate cut is in June. In addition, markets expect a smaller interest rate cut in 2024.

However, although inflation remains high in the US, some data points to a slowing economy. It is noticeable that there has been a sharp decline in retail sales, and unemployment claims are on the rise. Therefore, some experts believe that the Fed will fail to achieve a soft landing, which means a possible recession.

Meanwhile, in Japan, even as markets expect a policy shift, the BoJ has played down hopes of an aggressive rate hike. Moreover, interest rate differentials between Japan and the US remained wide, leading to a decline in the yen.

USD/JPI Key Events Today

Investors are not expecting any major economic announcement from Japan on the US.

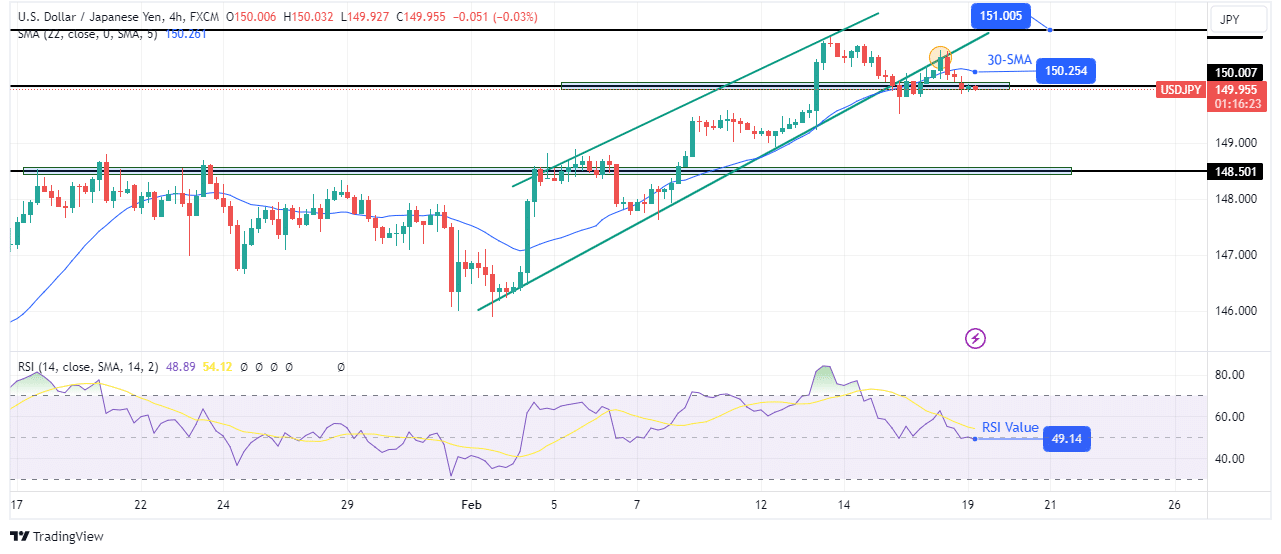

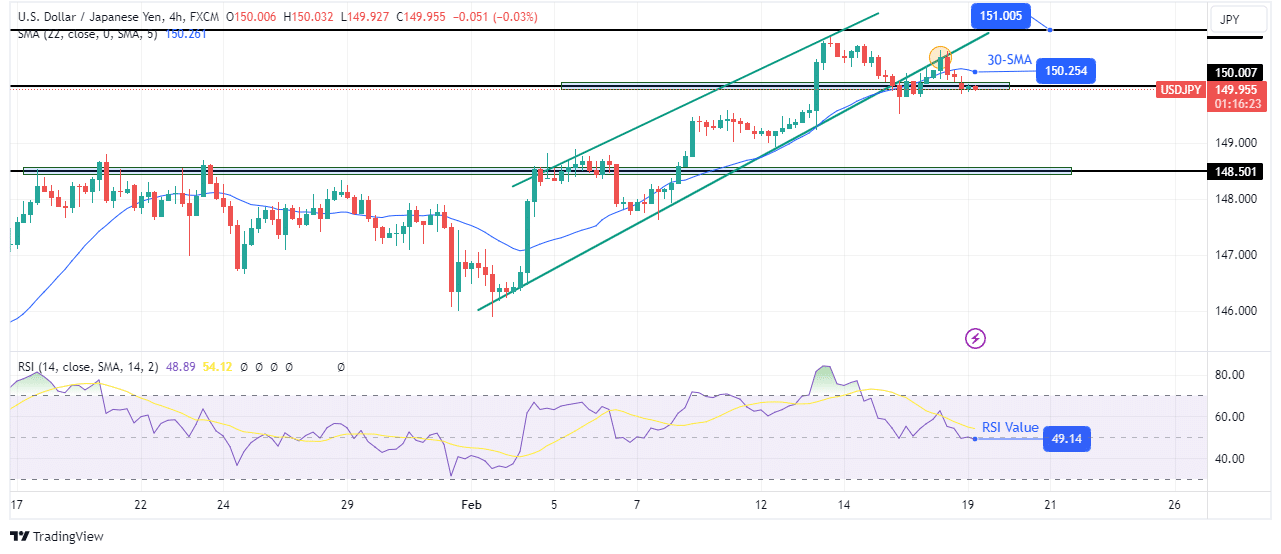

USD/JPI Technical Outlook: Bears are looking for a reversal of the 150.00 support

On the technical side, the USD/JPI price is falling after pulling back to retest the recently broken channel support. For a long time, the price traded in a bullish channel, staying above the 30-SMA with RSI above 50.

–Are you interested in learning more about forex signals? Check out our detailed guide-

However, the bears triggered a bullish trend when the price broke below the channel support. Moreover, the price retested the level that remained firm as resistance. The final step to confirm a downside reversal would be a break below the 150 support level to make a lower low. If that happens, the bears will target the 148.50 support level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.