- Core inflation in Japan marked the second consecutive month of slowing trend.

- The Bank of Japan is likely to keep interest rates ultra-low at next week’s meeting.

- The dollar is poised for its second consecutive weekly gain.

Friday reveals bullish outlook for USD/JPY as yen softens amid weaker inflation. Despite holding Japan’s core inflation above the central bank’s 2% target in December, it was the second straight month of a slowing trend. This further supports the expectation that the Bank of Japan will maintain its extensive monetary stimulus.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Moreover, the data increases the likelihood that the Bank of Japan will keep interest rates ultra-low at next week’s meeting.

Rabobank strategist Jane Foley noted: “The market’s realization that a rate hike is unlikely for the BOJ in the coming months and a re-evaluation of the Fed’s rate cuts is already evident in USD/JPY’s upside.”

However, analysts suggest that there is still steady growth in service prices. Moreover, there is an increasing likelihood of significant wage increases. Therefore, this is likely to maintain market expectations of a move to hike interest rates for the BoJ.

Meanwhile, the dollar braced for its second straight weekly gain. This is due to signs of US economic resilience and a cautious stance on rate cuts. Traders have cut expectations of quick and big rate cuts in the US. Notably, the dollar index rose by 0.9% during the week. This made the yen the biggest loser, down 5% for the year. The data and a deadly earthquake in Japan dented confidence in the likelihood of the Bank of Japan raising rates.

USD/JPI Key Events Today

- Preliminary attitude of UoM consumers in the US

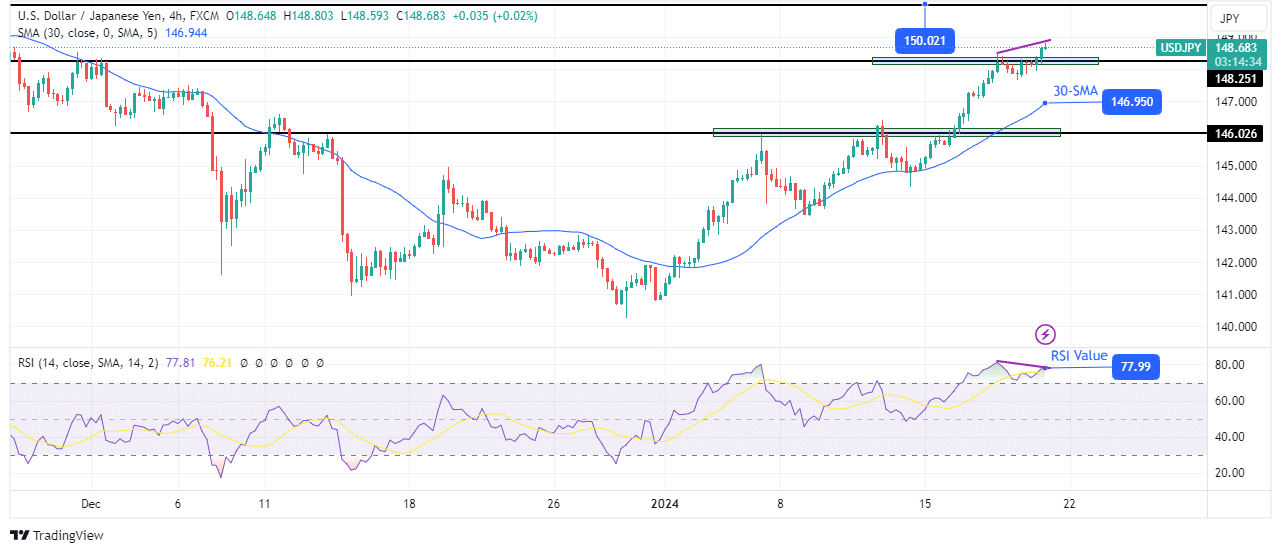

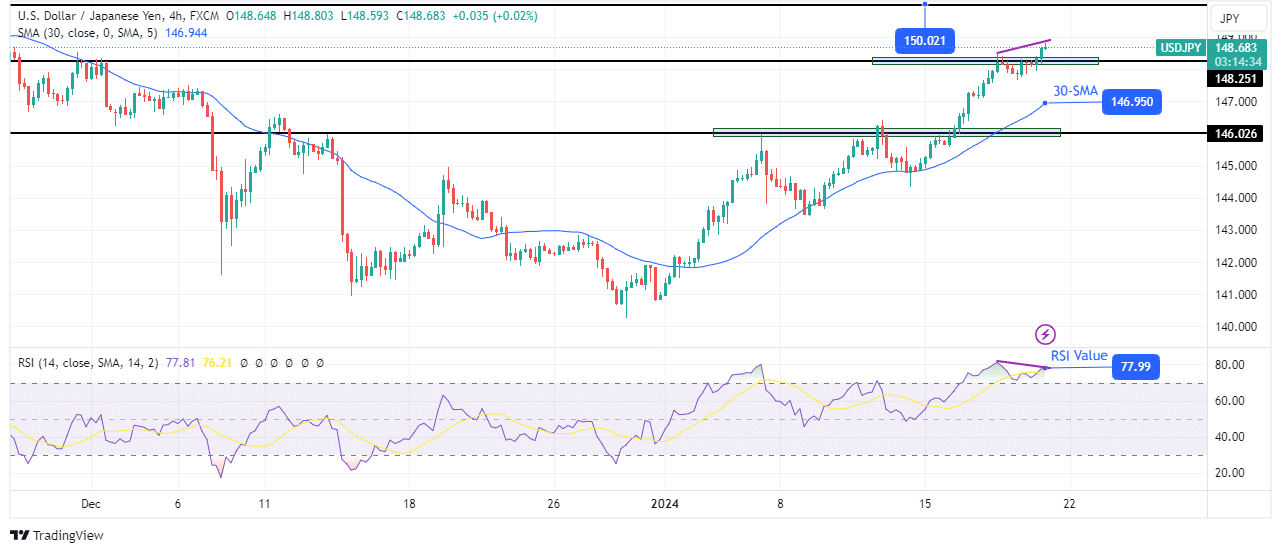

USD/JPI Technical Outlook: Bullish strength fading with bearish divergence above 148.25

On the technical side, the USD/JPI price has broken above the key resistance level of 148.25 and is on track to make a new high. However, the RSI is above 70, indicating an overbought market. Further upside may therefore be limited. Furthermore, the RSI is already showing signs that the bulls are weaker, above 148.25, as it made a slight bearish divergence.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

If, indeed, the bulls are weaker, then the price will struggle to reach the next resistance level at 150.02. At the same time, it could pull back to retest the 30-SMA before reaching the 150.02 resistance. However, the bullish trend will continue if the price remains above the 30-SMA.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.