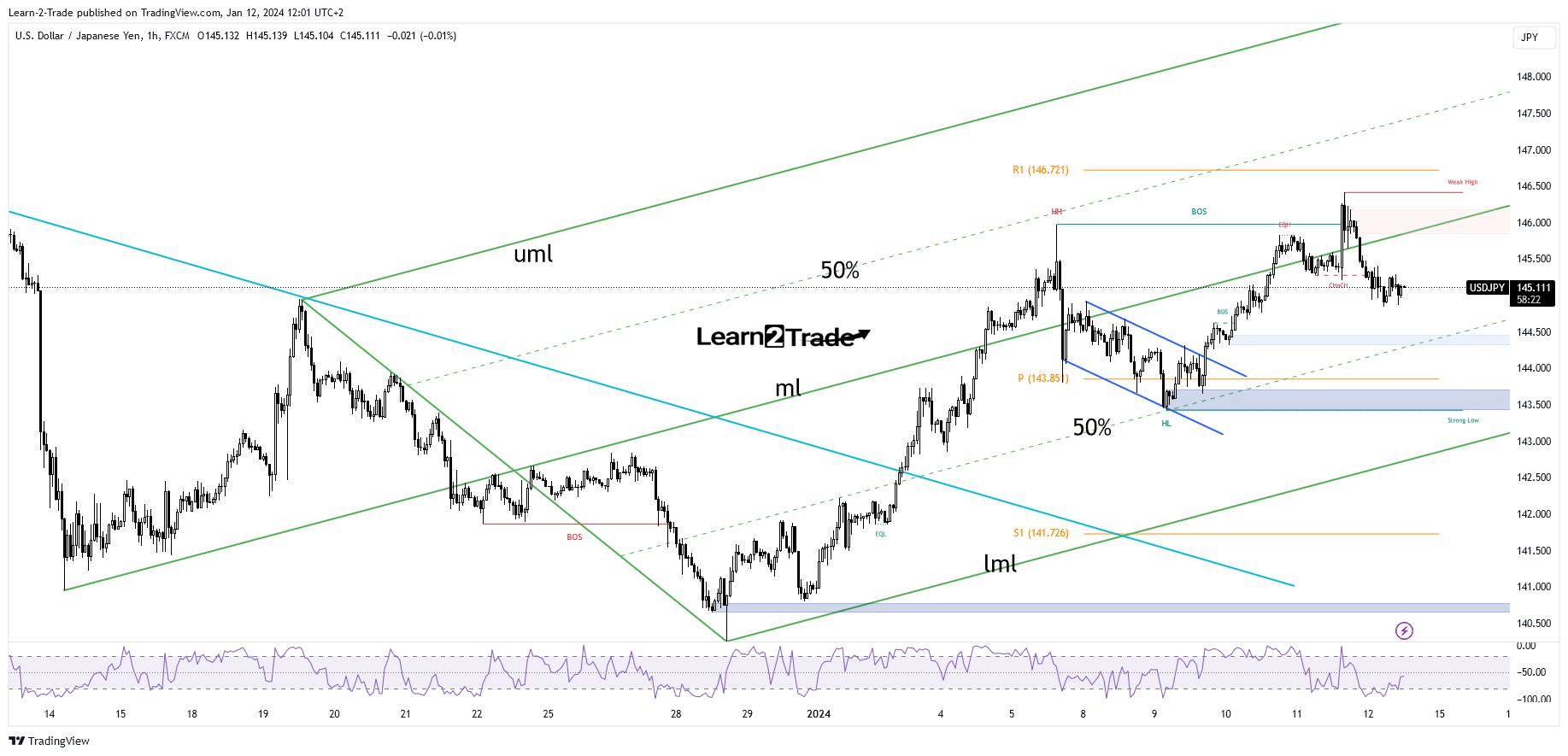

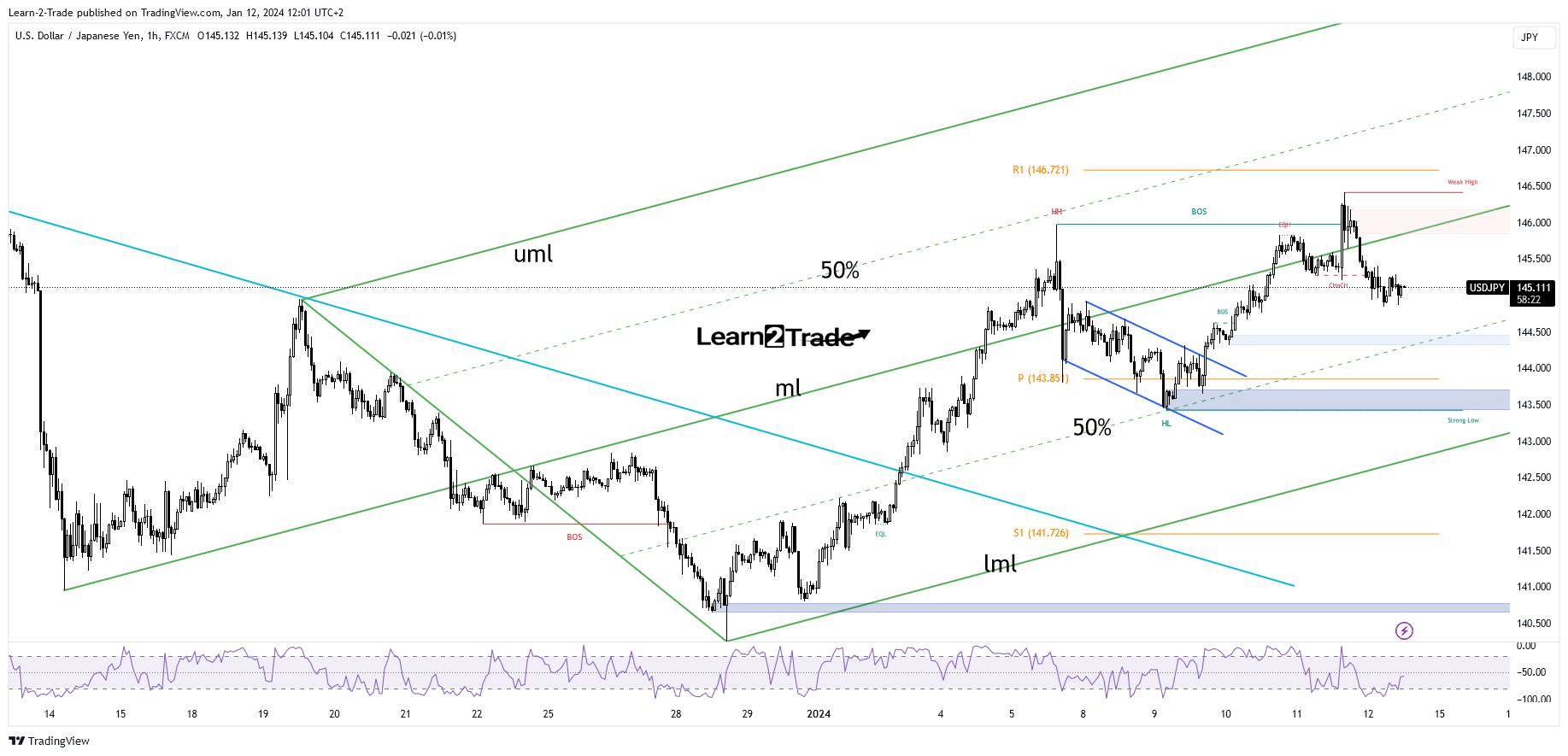

- The bias remains bullish as long as it is above the 50% Fibonacci line.

- PPI and Core PPI should move rate today.

- After the last rally, the retreat was natural.

USD/JPI is trading at 145.21 at the time of writing, well below yesterday’s high of 146.41. The bias remains bullish. Surprisingly or not, the dollar depreciated against its rivals, even though the US reported higher inflation in December.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

The consumer price index announced a 0.3% increase, beating the expected 0.2% increase and the 0.1% increase in the previous reporting period. By comparison, the CPI rose 3.4% year-on-year, beating forecasts of 3.2% growth and November’s 3.1% rise.

In addition, core CPI was in line with expectations, while jobless claims fell to 202k from 203k, even as experts expected a potential rise to 209k.

Today Japan’s economic watchers Sentiment and Bank Lending were better than expected, while the current account disappointed.

Later, US data should move the markets. The PPI could post a 0.1% increase compared to a 0.0% increase in the previous reporting period, while the Core PPI is expected to register a 0.2% increase.

USD/JPI price technical analysis: Corrective downside

As you can see on the hourly chart, the price failed to stay above the midline (ml) of the ascending fork, signaling exhausted buyers. However, the correction could only be temporary.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

Price can only test current support levels or demand zones before developing new bullish momentum. 144.50 and the lower 50% Fibonacci retracement represent key downside barriers. The bias remains bullish if it remains above the 50% line.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money