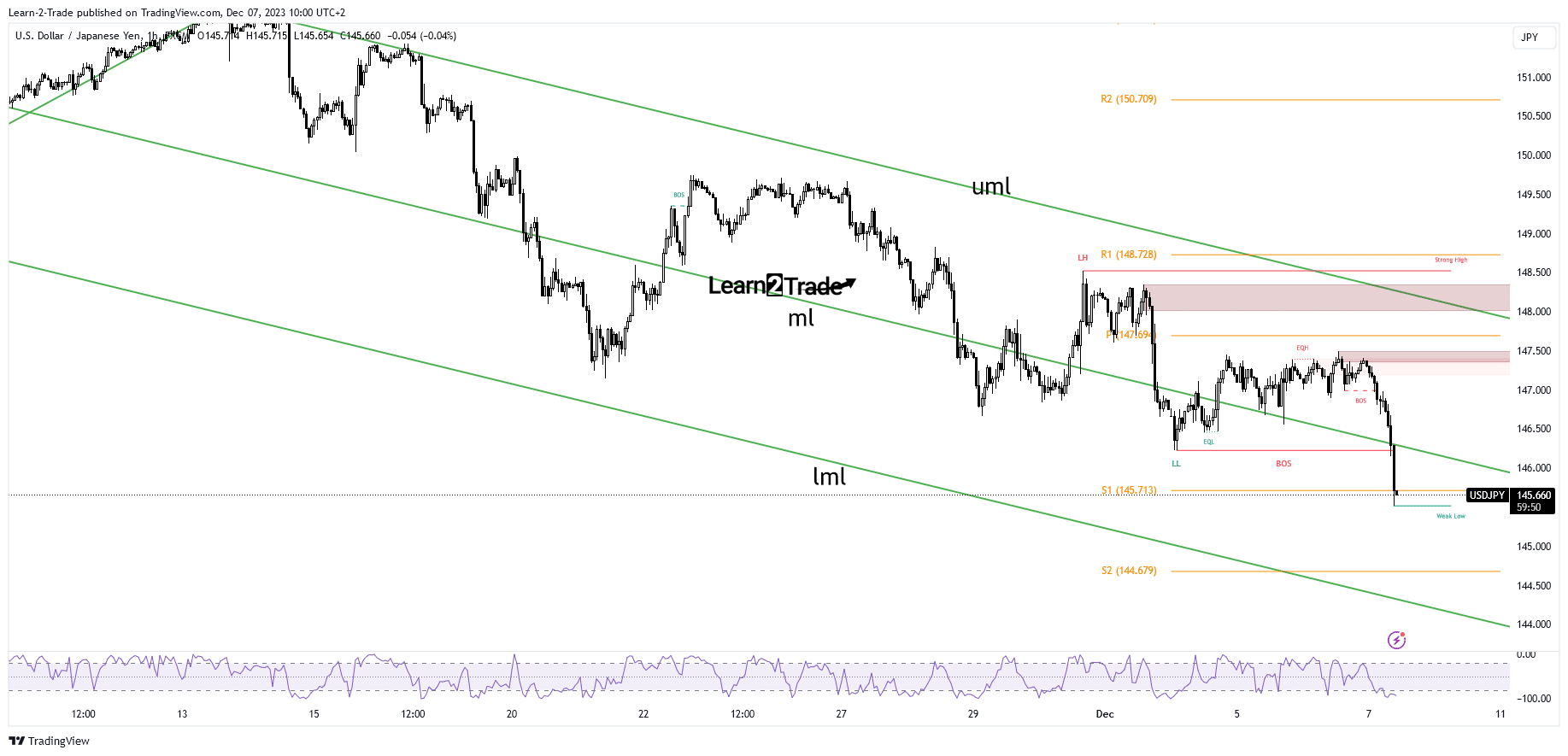

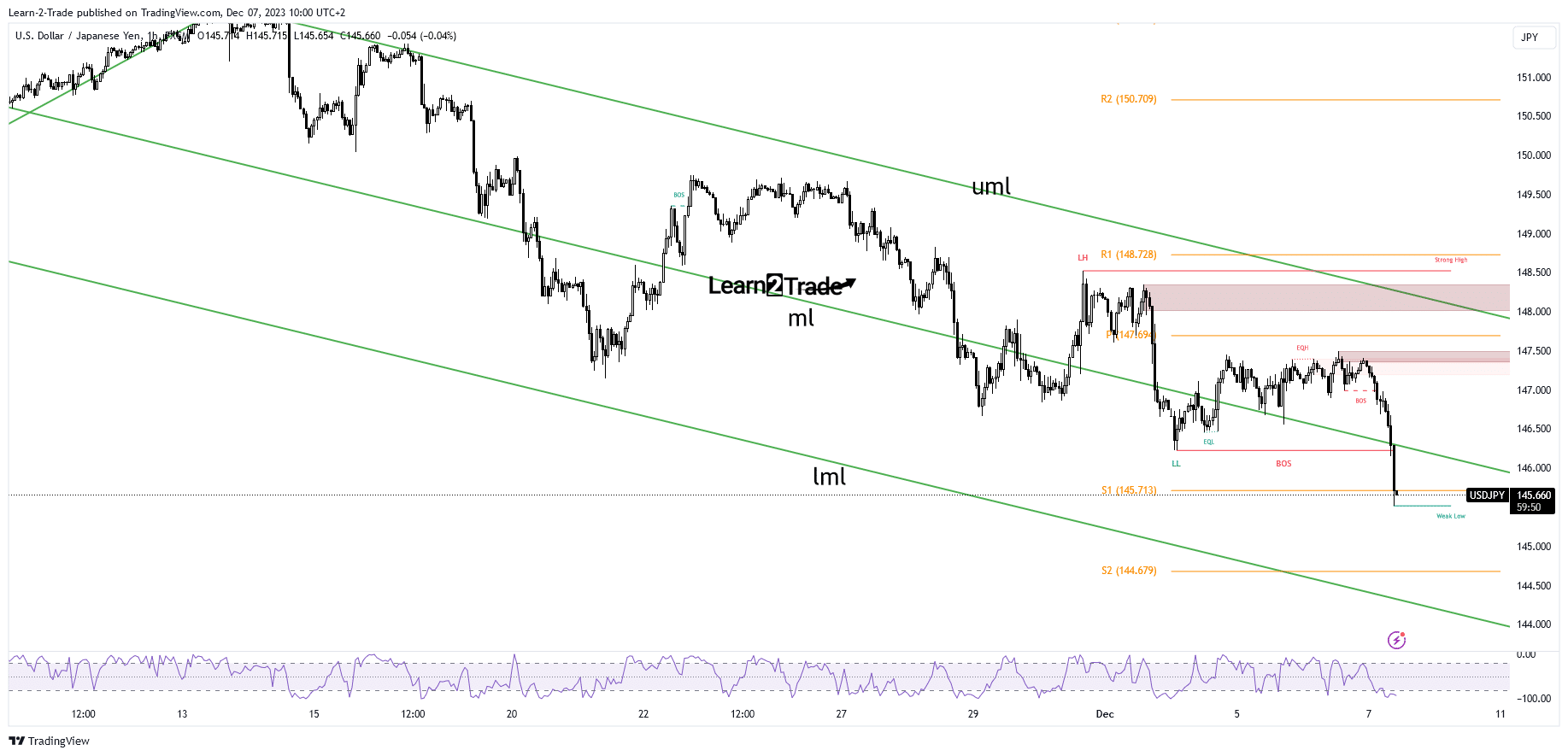

- The bias is bearish as long as it is below the median line.

- Data from the US and Japan should be decisive tomorrow.

- S2 stands as static support.

The price of USD/JPI fell well below yesterday’s low of 146.89. Basically, the depreciation of the US dollar was expected after the change in employment in the US non-farm sector reached 103 thousand in November against the expected 131 thousand, compared to 106 thousand in October.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

In addition, the trade balance, revised non-agricultural productivity and revised unit labor costs also reported poor data in the last session.

Today, the JPI got a helping hand from Japan’s leading indicator, which hit 108.7%, above expectations of 108.2%.

Later, US data could move the markets. Jobless claims could jump from 218,000 to 221,000 last week. Data on Challenger job cuts, consumer credit and wholesale ending inventories will also be released.

Fundamentals will be key to watch as the US releases NFP, unemployment rate and average hourly earnings tomorrow. At the same time, Japan publishes data on the sentiment of economic observers, final GDP, current account, household consumption and average cash earnings.

USD/JPI Price Technical Analysis: Breakout of a Key Level

From a technical point of view, the price of USD/JPI fell after failing to close the weekly pivot point of 147.69 or the upper middle line (uml). It is back below the midline (ml) and looks determined to make new lows.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

The psychological level of 145.00 stands as the first negative target. In addition, weekly S2 at 144.67 represents potential static support. As long as it is below the middle line (ml), the rate could approach and reach the lower middle line (LML).

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.