- The Bank of Japan maintained ultra-loose monetary policy on Tuesday.

- Some investors were waiting for signs of a potential move away from negative interest rates.

- Some Fed officials are balking at market expectations of an imminent rate cut.

USD/JPI price analysis turned bullish on Tuesday after the Bank of Japan maintained its ultra-loose monetary policy at the end of a two-day meeting. Moreover, the central bank maintained its forward-looking guidance, maintaining its dovish stance.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Consequently, the yen fell over 0.6% against the US dollar following the decision. Notably, this outcome was in line with market expectations. However, some investors were waiting for signs of a potential departure from negative interest rates by the dovish central bank.

SMBC’s chief foreign exchange strategist, Hirofumi Suzuki, noted that there had been expectations for policy changes, including changes to the wording of the statement. Moreover, he noted that the likelihood of a sustained yen weakening trend is low. This is due to ongoing expectations for a policy review between January and March next year.

Meanwhile, the BoJ said it was ready to implement additional easing measures if needed, citing extremely high economic uncertainty.

Elsewhere, the US dollar was largely unchanged at 102.53. Some Fed officials are bucking market expectations of an imminent rate cut by the Fed. However, such comments had minimal impact on market prices and did not stop the dollar from falling.

Chicago Fed President Austin Goolsby stressed Monday that the Fed is not making a pre-commitment to an imminent rate cut. Moreover, the rise in market expectations is inconsistent with the usual functioning of the US central bank.

USD/JPI Key Events Today

Traders will continue to absorb the results of the BoJ policy meeting as there will be no more major events.

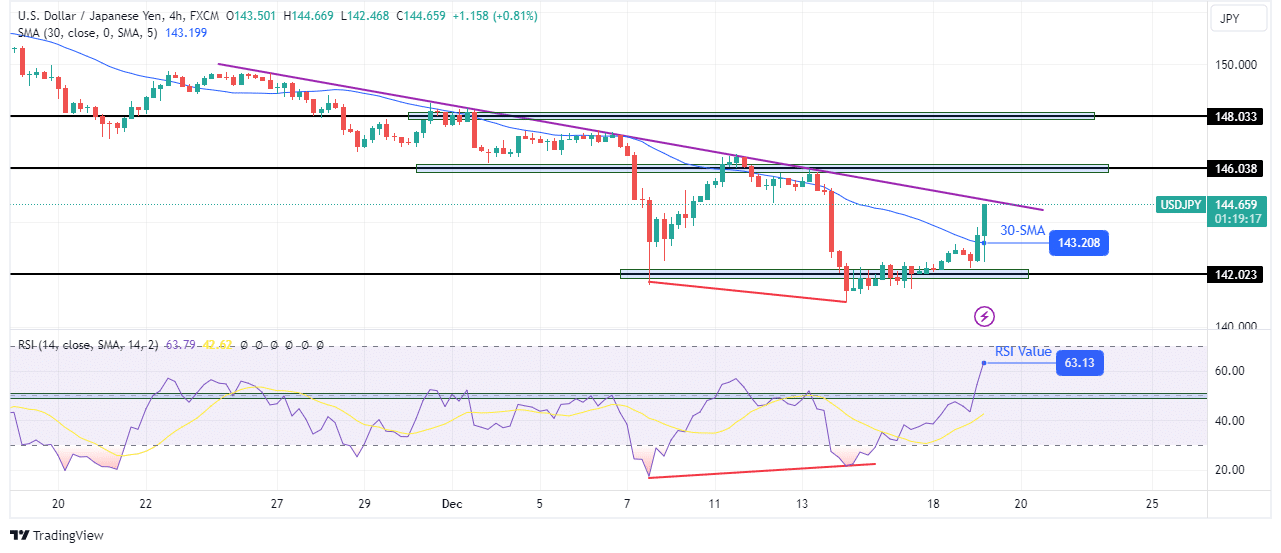

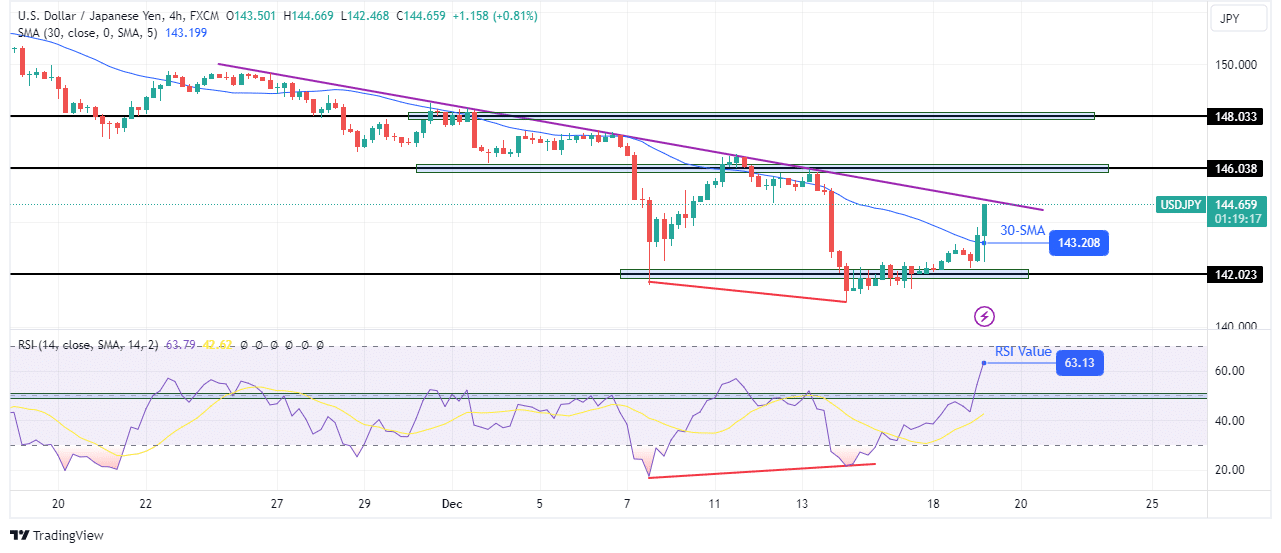

USD/JPI Price Technical Analysis: Bullish sentiment emerges as price crosses 30-SMA barrier

On the technical side, sentiment changed from bearish to bullish as USD/JPI broke above the 30-SMA. In addition, the change can be seen in the RSI, which has crossed well above the key 50 mark.

–Are you interested in learning more about forex tools? Check out our detailed guide-

Significantly, the reversal comes after a bullish divergence in the RSI. The sellers weakened when the price reached the 142.02 support level, allowing buyers to push the price above the SMA. However, buyers must break above the resistance trend line for the downtrend to confirm a trend reversal. Furthermore, they must make a higher high above the key resistance level of 146.03. Otherwise, the sellers could come back.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.