- Investors shifted their focus to upcoming consumer inflation numbers.

- Economists expect softer US inflation numbers this month.

- Sentiment in Japan’s service sector fell in May.

USD/JPI price analysis shows strong bullish sentiment as dollar strengthens ahead of key inflation data. Investors are also gearing up for the Fed’s policy meeting, where there will be an indication of the outlook for interest rate cuts. Meanwhile, the yen remained vulnerable as data revealed weak spending in Japan due to a weak currency.

–Are you interested in learning more about Ethereum price prediction? Check out our detailed guide-

After Friday’s upbeat US jobs report, investors shifted their focus to the upcoming consumer inflation numbers. However, sentiment ahead of the numbers suggests the Fed may delay tapering until November, given the strength of the US labor market. Therefore, the CPI report will either reinforce this view or revive bets for a September cut.

Economists expect softer numbers this month after inflation fell the previous month. However, the report may surprise. Policymakers will then conclude their policy meeting, during which they are likely to hold rates. Traders will be looking for clues on the future path of policy, which will be guided by inflation figures.

On the other hand, the yen remained fragile after falling on Friday amid rising US Treasury yields. Furthermore, Monday’s data revealed that sentiment in Japan’s services sector fell in May as a weak yen pushed up the cost of living. This indicates that consumption is fragile, complicating the outlook for a BoJ rate hike.

However, a separate report found that Japan’s economy was contracting at a softer rate than previously reported, easing the BoJ. Japan’s GDP fell 1.8% compared to estimates of a 2.0% decline. Still, the weak yen continues to cloud the economy’s outlook.

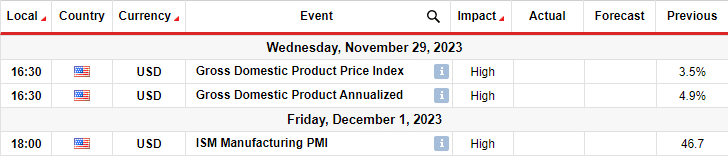

USD/JPI Key Events Today

Neither Japan nor the US will release high-impact reports. As a result, the pair could consolidate.

USD/JPI Technical Price Analysis: Bulls approaching 157.50

From the technical side, USD/JPY the price is approaching the 157.50 resistance level after finding support near the 155.00 level. Moreover, it has made a series of higher highs and lows that confirm the bullish trend.

–Are you interested in learning more about Crypto Signals Telegram Groups? Check out our detailed guide-

Bullish momentum recently picked up, allowing the price to break above the 30-SMA and RSI above 50. Given the solid bullish bias, the price could soon break above 157.50 to make a new high and retest the bullish channel resistance.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.