- The US inflation scenario is now leaning towards lower levels.

- The dollar index is poised for a weekly loss of approximately 0.73%.

- The data revealed a 2.5% year-on-year increase in Japan’s core consumer prices for November.

The USD/JPI price analysis was bearish on Friday, with the dollar weak and investors on edge as they eagerly awaited US inflation data. According to Chris Weston, head of research at Pepperstone, the US inflation scenario is now unbalanced and leaning towards lower levels.

Moreover, the dollar index is poised for a weekly loss of approximately 0.73%, extending the previous week’s 1.3% decline.

Meanwhile, the yen remained steady, unaffected by Friday’s data which revealed a 2.5% year-on-year increase in core consumer prices in Japan for November. It recorded the slowest growth in the last year. Moreover, this eases pressure on the Bank of Japan to reduce its significant stimulus. Notably, the core consumer price index slowed from a gain of 2.9% in October.

Furthermore, the Japanese currency looks poised to close out the week. Earlier this week, the BoJ maintained its ultra-loose policy setting and provided few indications of when it might move away from negative interest rates.

Elsewhere, minutes from the Bank of Japan’s October meeting revealed ongoing divisions among board members over the timeframe for Japan to meet exit conditions. Meanwhile, a Reuters poll conducted in November found that over 80% of economists expect the BoJ to end its negative rate policy next year.

USD/JPI Key Events Today

- Core price index US PCE m/m

- US UoM Consumer Sentiment Revised

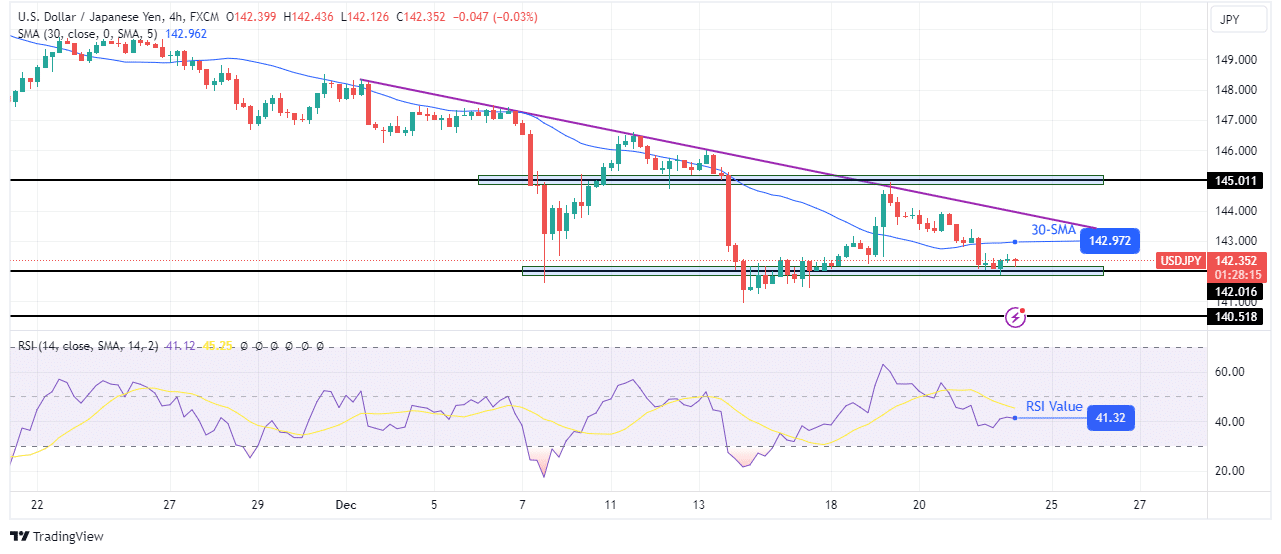

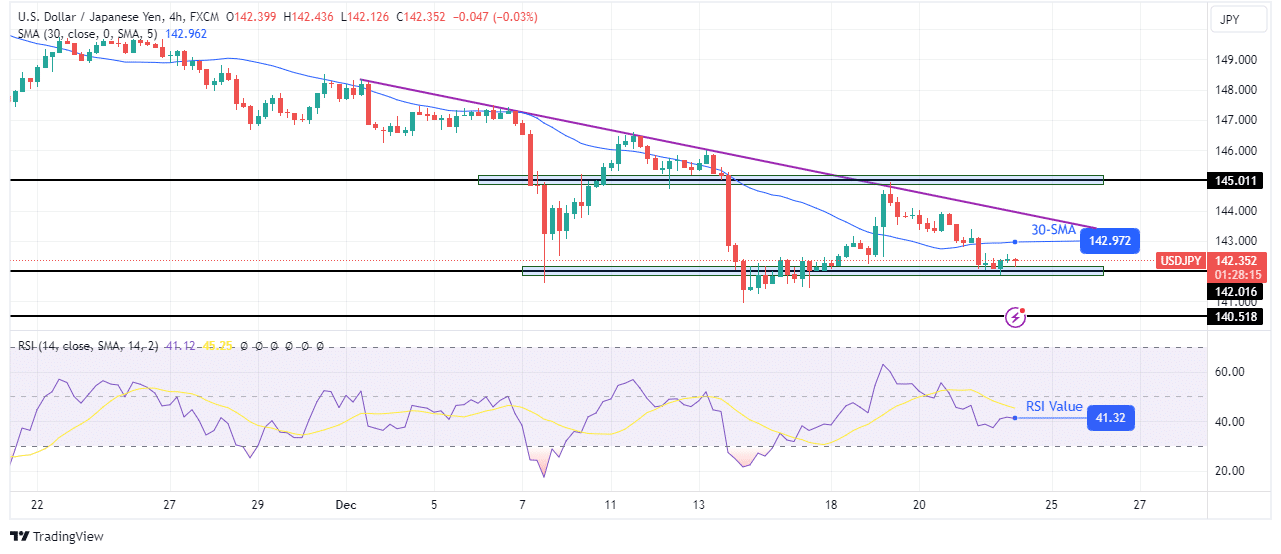

USD/JPI technical price analysis: Price is returning to the key support level of 142.01

On the charts, USD/JPI has returned to the 142.01 support level. This comes after a failed attempt to reverse the trend. Initially, buyers threatened to take control when sellers challenged the 142.01 level for a second time and failed to break below. However, the price stopped at the resistance trend line and the key level of 145.01.

–Are you interested in learning more about forex tools? Check out our detailed guide-

Therefore, the sellers reversed the bullish move and pushed the price back below the 30-SMA. Sellers are challenging the 142.01 support level for the third time. If they are strong enough, the price will break below and fall to the 140.51 level and below. However, if the support is firm, the bulls could re-emerge.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.