- US Treasury yields rose as expectations for interest rate cuts fell.

- The probability of a Fed rate cut in June has dropped to around 54%.

- Japanese Finance Minister Shunichi Suzuki reiterated his warning against sharp currency movements.

In a firm move, the USD/JPI price analysis was leaning bullish as the yen weakened on rising US Treasury yields. However, warnings of a possible intervention prevented the USD/JPI pair from breaching the $152 level. Meanwhile, the dollar was steady ahead of the US inflation report.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

U.S. Treasury yields rose on Tuesday as interest rate cut expectations fell. The likelihood of a Fed rate cut in June fell to about 54 percent after Friday’s jobs report. An unexpected increase in employment in March led to a market reversal on US interest rates.

Currently, investors expect a cut of 60 basis points in 2024, which is less than the Fed’s forecast of 75 basis points. Accordingly, short-term yields, which reflect rate cut expectations, have risen. Ideally, rising yields would push the USD/JPI pair higher. However, the Japanese authorities, with their repeated warnings about a possible intervention, kept the price rise.

Japanese Finance Minister Shunichi Suzuki repeated his usual statement on Tuesday that authorities will do whatever it takes to deal with excessive currency movements. At the same time, Bank of Japan Governor Kazuo Ueda hinted at a possible reduction in economic stimulus if inflation continues to rise. However, a catalyst for the dollar would likely bring sharp moves.

In particular, investors are waiting for the US inflation report. Worse-than-expected figures could push USD/JPI above $152, prompting an intervention.

USD/JPI Key Events Today

Traders are likely to stay on the sidelines with no high-impact reports coming out of the US or Japan.

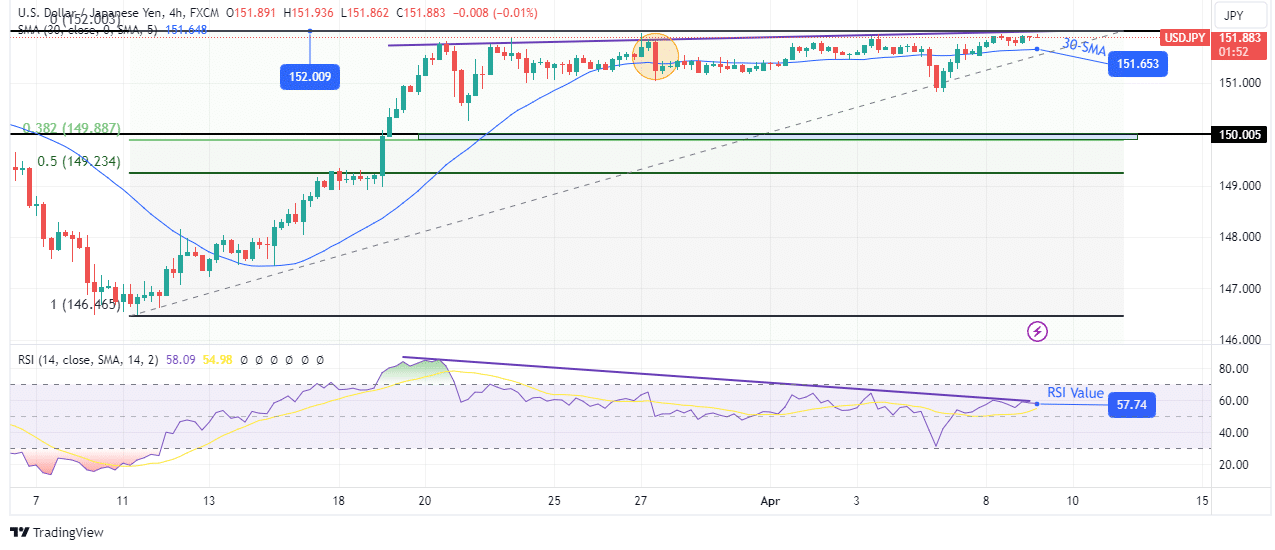

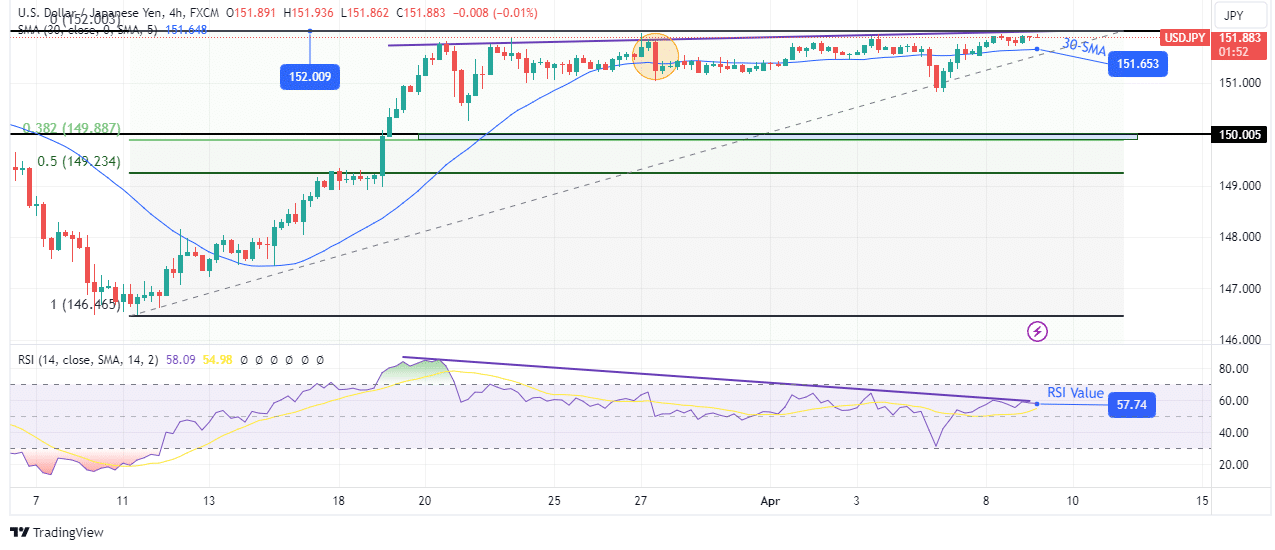

USD/JPI technical price analysis: Bullish momentum is declining near a solid barrier

On the technical side, the USD/JPI price is above the 30-SMA, indicating that the bulls are once again in the lead. The previous sharp bearish move has reversed, and now the price is approaching the key resistance level of 152.00.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

Although the RSI is above 50, the bullish momentum has gradually faded. As a result, there is a bearish RSI divergence that could allow the bears to take control. If the bulls fail to regain enough momentum to break the 152 level, the bears could break below the 30-SMA to target 150.00. Such a move would allow the price to return by 38.2% of the previous trend.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.