- Fed policymakers have emphasized the need for evidence of a steady decline in inflation.

- Falling inflation in the US would lead to increased expectations of interest rate cuts.

- Markets are pricing in an almost 33% chance that the BoJ will raise rates by 10 basis points next month.

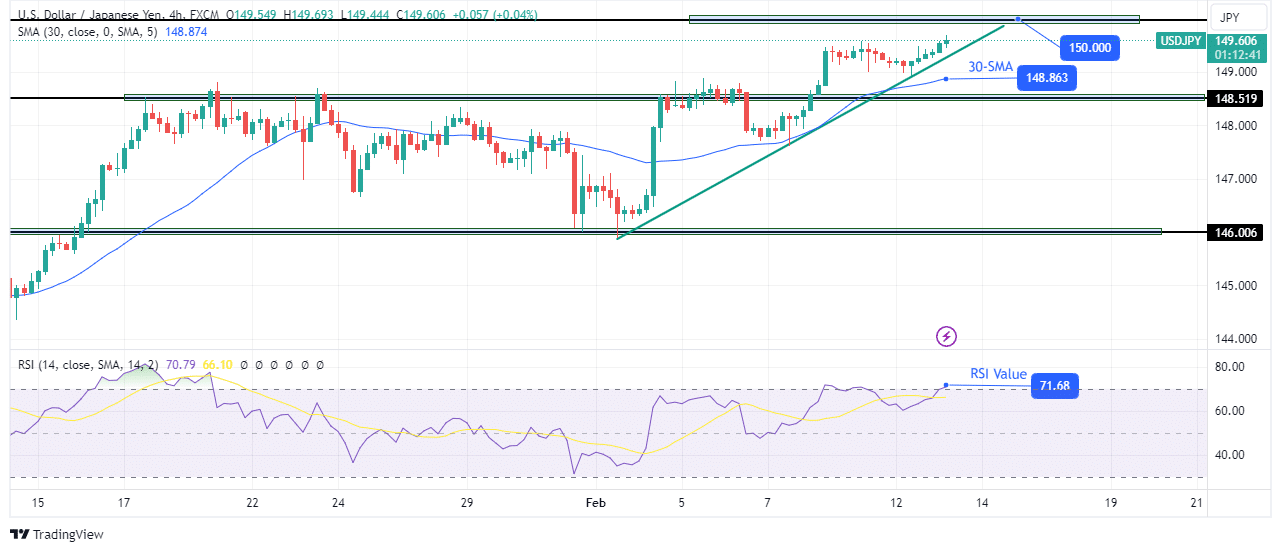

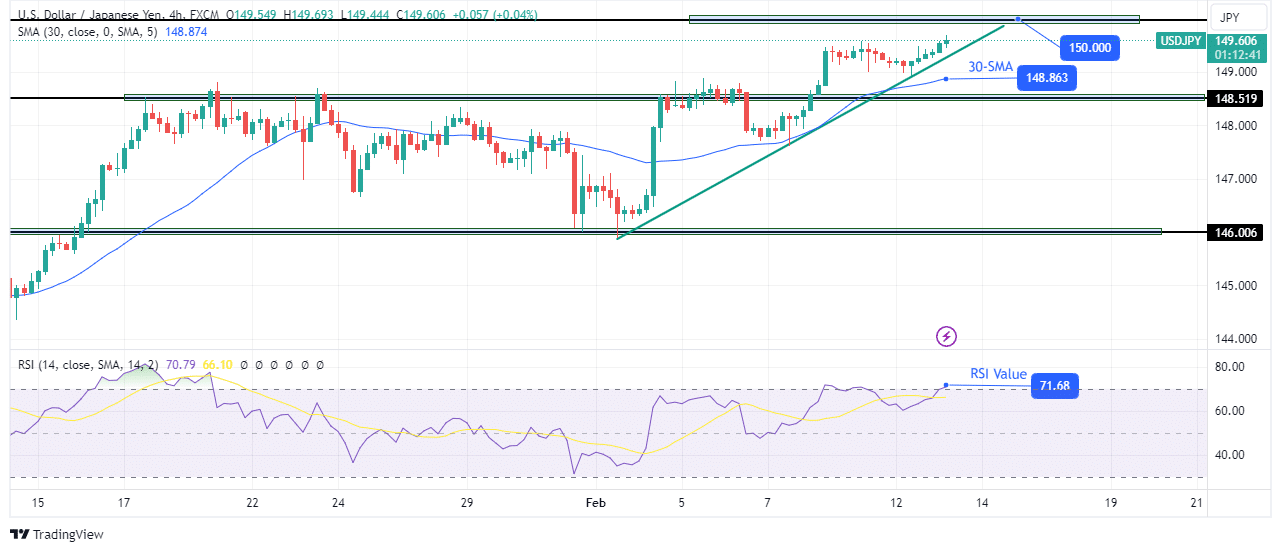

USD/JPI price analysis showed a bullish landscape on Tuesday as the dollar rose ahead of the US inflation report. Meanwhile, the yen continued to fall after BoJ policymakers played down expectations of an aggressive policy shift. As a result, the pair is quickly approaching $150.

–Are you interested in learning more about copy trading platforms? Check out our detailed guide-

The inflation report will show whether high interest rates are dampening price growth. Recently, Fed policymakers have emphasized the need for evidence of a steady decline in inflation. A sustained downward trend would mean that once inflation reaches the 2% target, it will remain at that level. The Fed would then be confident enough to cut rates.

Therefore, if the report shows a drop in inflation, it would lead to a rise in rate cut expectations. On the other hand, if inflation is higher than expected, the Fed would be more reluctant to cut rates. Therefore, the dollar would rise, pushing USD/JPI above the 150 level.

Meanwhile, the yen weakened as investors speculated about an upcoming BoJ policy change. Policy makers recently dismissed market expectations that the central bank would implement a rapid rate hike. Furthermore, there is a chance that monetary conditions will remain easy. However, the Japanese economy is growing, and demand is pushing up inflation. Accordingly, markets are pricing in an almost 33% chance that the BoJ will raise rates by 10 basis points next month.

USD/JPI Key Events Today

- US Consumer Price Index (CPI) report.

USD/JPI Technical Price Analysis: Bulls are headed for 150.00 resistance

On the technical side, the USD/JPY pair is in a solid bullish trend, with the price constantly making new highs. Furthermore, the price held above the 30-SMA with RSI above 50, supporting the bullish trend. The price recently broke above the 148.51 resistance level and made a new high before pulling back to retest its support trend line.

–Are you interested in learning more about forex broker scalping? Check out our detailed guide-

Currently, the bulls are making a new leg with targets at the 150.00 resistance level. However, the price action shows that the bulls have weakened. The current momentum has much less candles compared to the previous bullish momentum. This indicates that the bulls are less enthusiastic about pushing the price higher. Therefore, the price could pause at the 150.00 resistance.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.