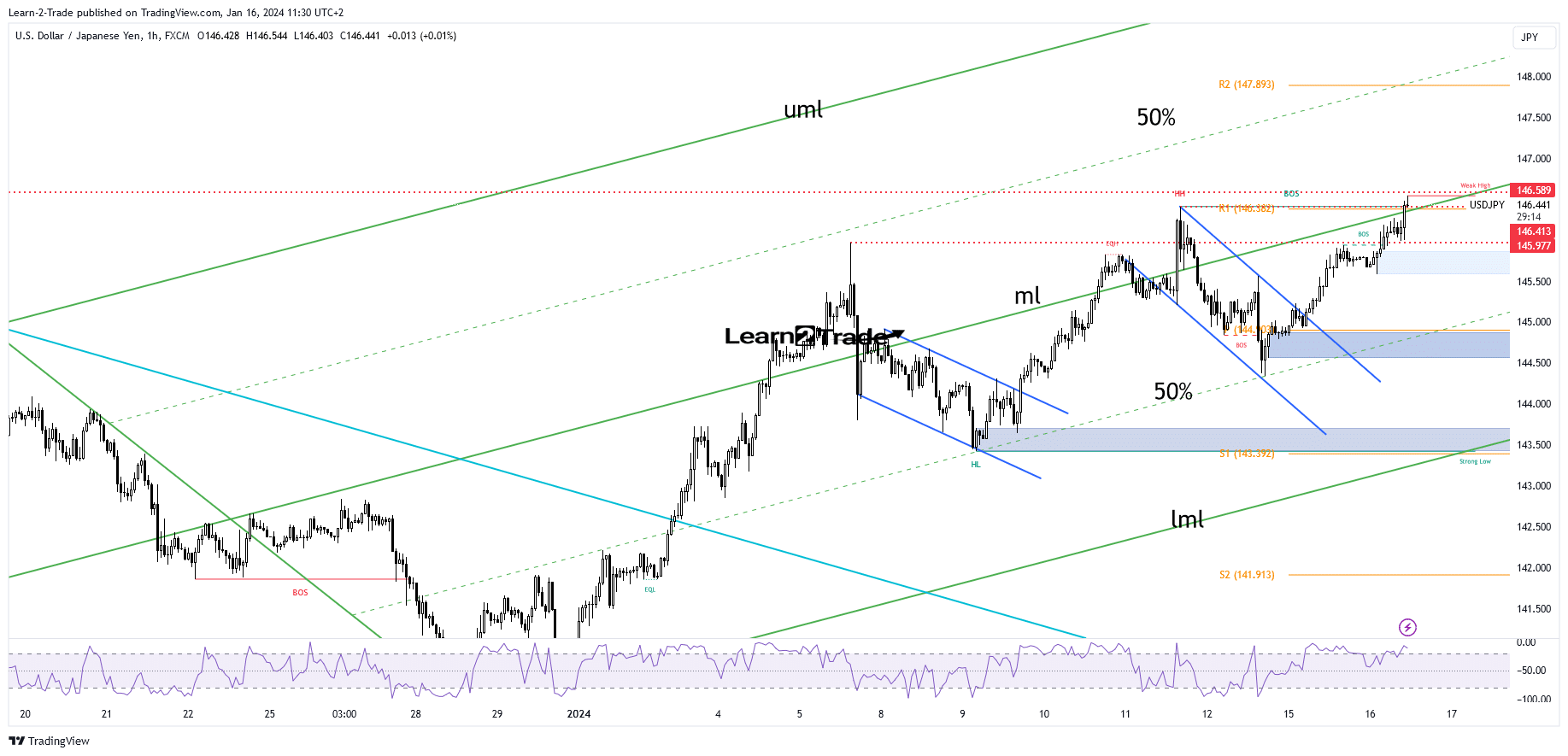

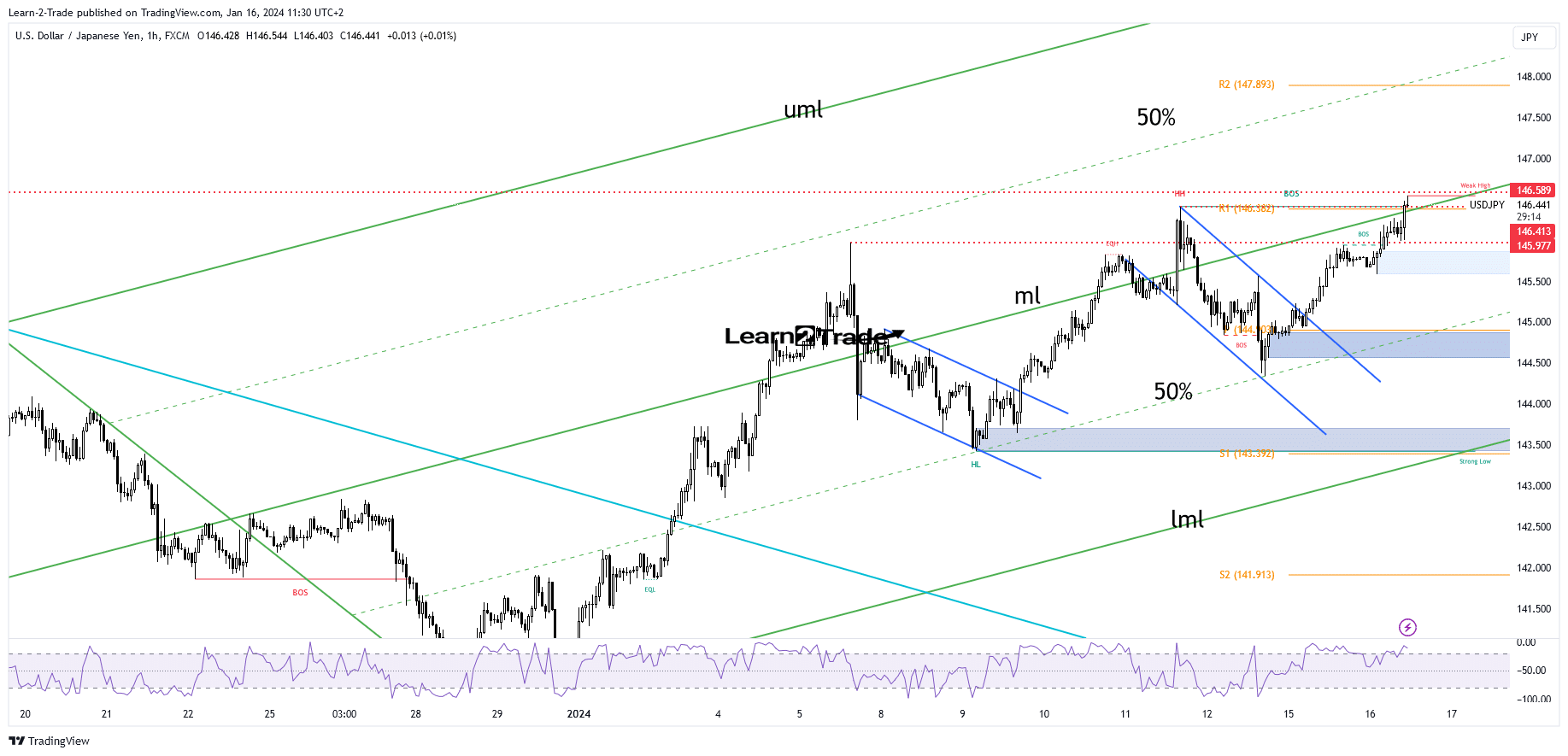

- A new higher high confirms further growth.

- US data should have a big impact during the week.

- The bias remains bullish as long as it is above the 50% Fibonacci line.

The price of USD/JPI rose in the short term, trading at 146.45 above the previous high of 146.41. The bias is bullish as the US dollar surged amid poor risk appetite.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

The yen depreciated slightly even as Japan’s PPI rose 0.0% compared to an estimated 0.3% decline. Later, US and Canadian data should have a big impact on all markets.

The Empire State Manufacturing Index is expected at -4.9 points compared to -14.5 points in the previous reporting period.

Furthermore, Canadian CPI m/m may announce a decline of 0.3% after a rise of 0.1% in the previous reporting period. Positive US data helps the dollar dominate the currency market.

Tomorrow, the US will release its retail sales indicator, which is expected to report a 0.4% rise, and core retail sales data. The US figures should move the rate, so the fundamentals could be decisive during the week.

USD/JPI price technical analysis: Strongly bullish

Technically, the price of USD/JPI rose after breaking out of the flag pattern. You knew from my previous analysis that the bias is bullish as long as it is above the lower 50% Fibonacci line of the ascending fork.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Now the pair has once again crossed above the midline (ml) and is challenging the previous high of 146.41. This represents static resistance, so it remains to be seen if the price confirms its breakout, confirming a potential continuation to the upside.

The historical level of 146.58 also represents a static obstacle to the upside. So, removing this resistance, making a new higher high confirms a bigger gain going forward.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.