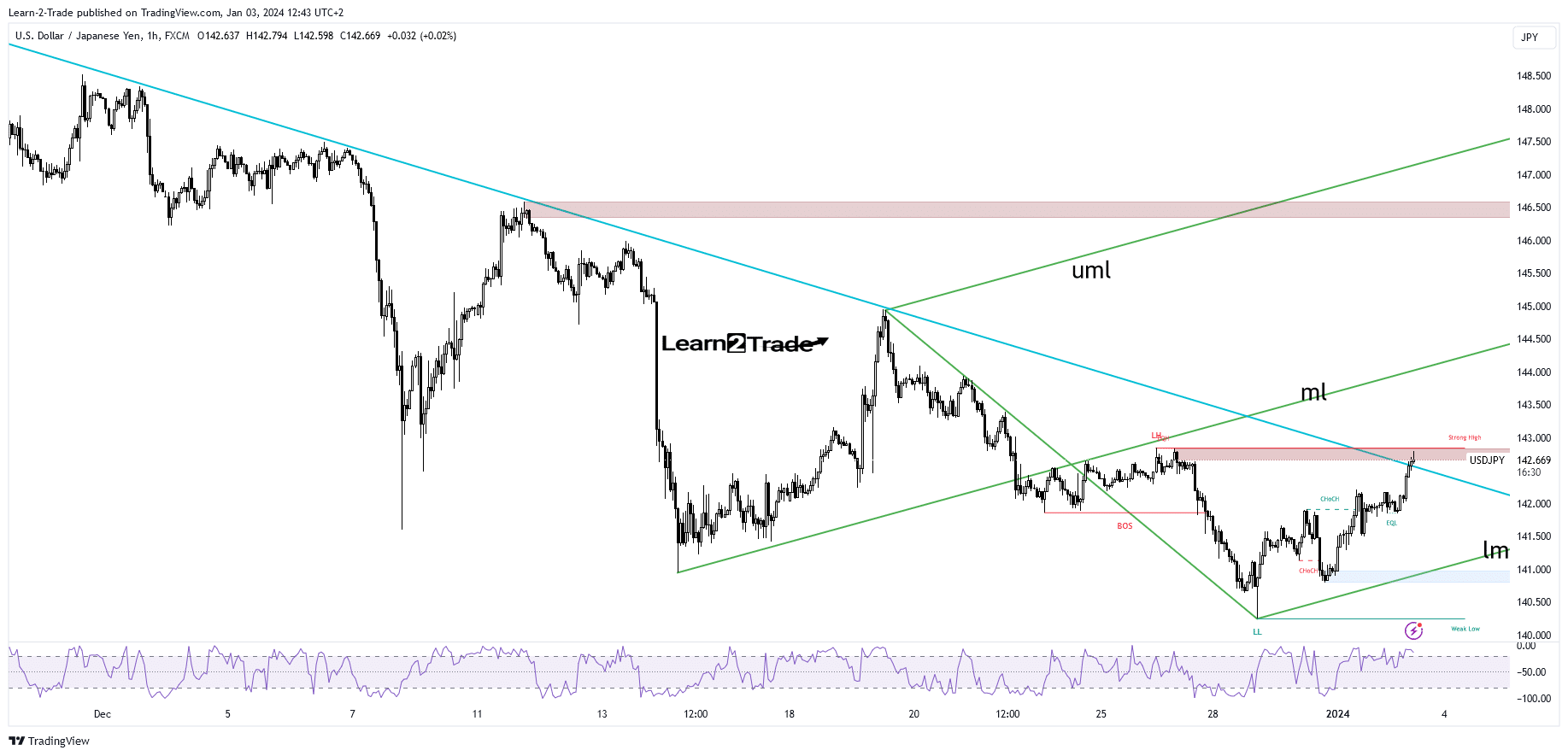

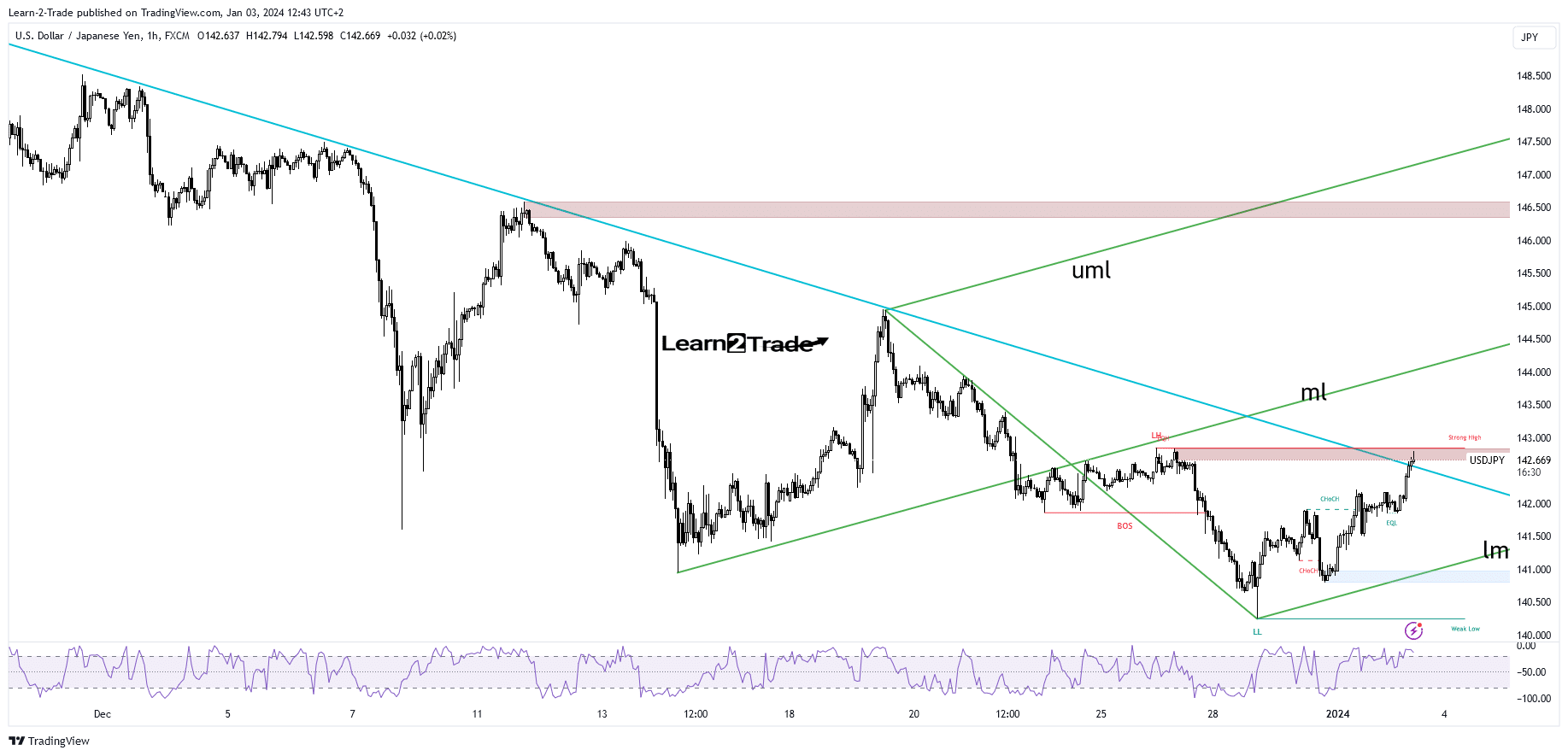

- Confirmation of its breakout activates an upward continuation.

- Removing the middle line (ml) confirms higher growth.

- The minutes of the FOMC meeting today should be decisive.

USD/JPI is trading at 142.64 at the time of writing and is struggling to regain its position. Japanese banks are also closed today for a 4-day holiday.

If you are interested in automated Forex trading, check out our detailed guide-

The dollar took the lead even though US final manufacturing PMI and construction spending were worse than expected in the latest trade.

Today, US economic numbers should trigger big stocks. JOLTS job openings could be reported at 8.84 million versus 8.73 million in the previous reporting period, ISM Manufacturing PMI could jump to 47.2 points from 46.7, while ISM manufacturing prices could fall to 49.5 points with 49.9 points. In addition, data on the department’s total vehicle sales should also be published.

Still, traders are focused on the minutes from the FOMC meeting. The report is a high-impact event, so volatility should be huge. Dovish talk could punish the dollar again, and sentiment could change.

USD/JPI Price Technical Analysis: Breakout Attempt

From a technical point of view, the price of USD/JPI has bounced above the downtrend line, and is now challenging the supply zone from just below the 142.83, which was the previous high. Confirmation of its breakout through the downtrend line and creation of a new higher high activates further growth towards the middle line (ml) of the ascending fork.

If you are interested in guaranteed stop loss forex brokers, check out our detailed guide-

However, a higher momentum should be triggered after a valid breakout through the middle line (ml) is made. On the contrary, a reversal of its breakout may herald a new sell-off towards the psychological level of 141.00.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.